Accountancy - Types of subsidiary books | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

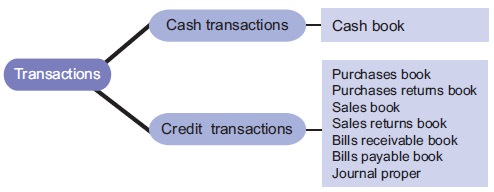

Types of subsidiary books

Types of subsidiary books

The number of subsidiary books may vary according

to the requirements of each business. Based on the nature of business and the

volume of transactions, the following subsidiary books are maintained:

i. Subsidiary book for entering cash transactions -

Cash book

ii. Subsidiary books (special journal) for entering

non-cash transactions:

·

Purchases

book or purchases journal – for recording only credit purchase of goods in

which the trader deals.

·

Sales

book or sales journal–for recording only credit sale of goods dealt in by the

trader.

·

Purchases

returns or returns outward book – for recording return of goods purchased by

the trader, for which no cash is immediately received.

·

Sales

returns or returns inward book – for recording the goods returned (out of

previous sale) by customers for which no cash is immediately paid.

·

Bills

receivable book – to record bills drawn or promissory notes received.

·

Bills

payable book – to record bills accepted or promissory notes given.

iii. Journal proper – The general journal or all

purpose journal to record transactions which do not find a place in the above

seven subsidiary books.

Related Topics