Format, Example | Accountancy - Bills receivable book | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

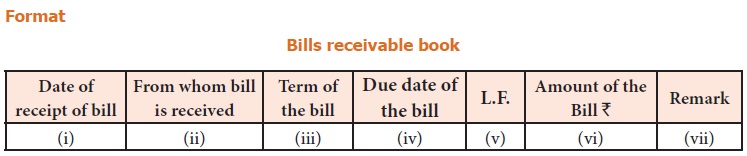

Bills receivable book

Bills receivable book

Bills

receivable refers to bills drawn, the payment for which has to be received. In

case of credit sales of goods, the entity may draw a bill on the buyer

(debtor), for a certain period. This is called bills receivable for the

business entity and bills payable for the debtor who has accepted the bill.

Where number of bills receivable is large, then a separate bills receivable

book may be maintained by a business entity to record the details of bills

receivable. Such bills are drawn on debtor for a specified amount payable at

sight on or after specified period. Bills receivable book contains the details of

bills drawn and its disposal. The format of the bills receivable book is given

below:![]()

Format

Bills receivable book

Date: In this column, the date of the acceptance of the

bill is recorded.

From whom received: In this column, the name

of the debtor, who has accepted the bill

and promised to make its payment, is recorded. The bill legally comes into

existence after its acceptance.

Term or period: The bill is drawn for a

specified period. This period may be one month, two months, three months, etc. or even 60 days, 90 days, 120 days,

etc. Period of the bill for which the bill has been drawn is mentioned here.

Due date:

Due date is the date on which the

payment of the bill is actually due. It is also known as date of maturity. In order to calculate the due date,

three days of grace is added to the term of the bill

Ledger Folio (L.F.): This column contains the

page number of the ledger in which the account

of the acceptor of the bill appears.

Amount of the bill: The actual amount of the

bill is recorded in this column.

Remark: This column contains the

details of disposal of the bill, whether the bill has been discounted or endorsed, honoured or dishonoured etc.

Related Topics