Format, Example Illustration, Solution | Accountancy - Sales returns book | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

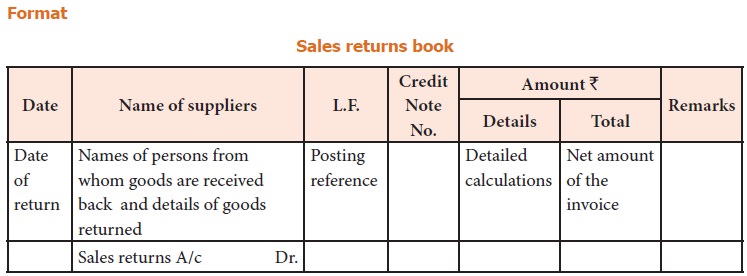

Sales returns book

Sales returns book

Sales returns

book is a subsidiary book, in which, details of return of goods sold for which

cash is not immediately paid are recorded. Just as goods may be returned to

suppliers, goods may be returned by customers for the following reasons:

·

Defect in

the goods

·

Delay in

the dispatch of goods to the customers

·

Over-supply

of goods

·

Goods not

being in accordance with the samples and specifications

·

Violation

of the terms of the contract, etc.

Goods returned by the customers is known as

‘returns inwards’.

This book is not concerned with the return of

assets or return of goods for which cash is paid.![]()

This book is prepared just like the other day

books.

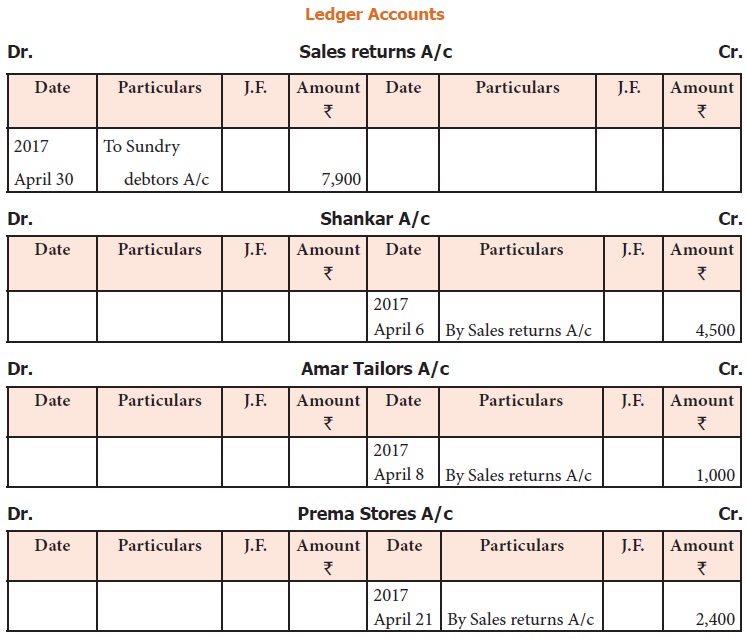

1. Posting from sales returns book

After the

transactions are recorded in the sales returns book, posting them to ledger

involves two steps:

Step 1: Posting to personal accounts of debtors: Each entry in the sales

returns book is posted to the credit side of the respective personal account

of the debtor on daily basis by writing the words ‘By Sales returns account’.

Step 2: Posting to Sales returns account: At the end of the month,

the aggregate of the sales returns is posted to the debit side

of sales returns account by writing the words ‘To Sundry debtors A/c’.

2. Credit note – Source document for returns inward

A credit note

is prepared by the seller and sent to the buyer when goods are returned

indicating that the buyer’s account is credited in respect of goods returned.

Credit note is a statement prepared by a trader who receives back from his

customer the goods sold. It contains details such as the description of goods

returned by the buyer, quantity returned and also their value.

Format

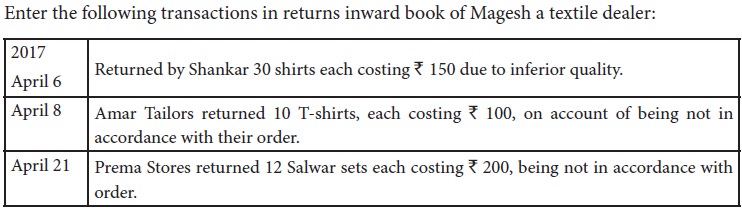

Illustration 6

Enter the following transactions in returns inward

book of Magesh a textile dealer:

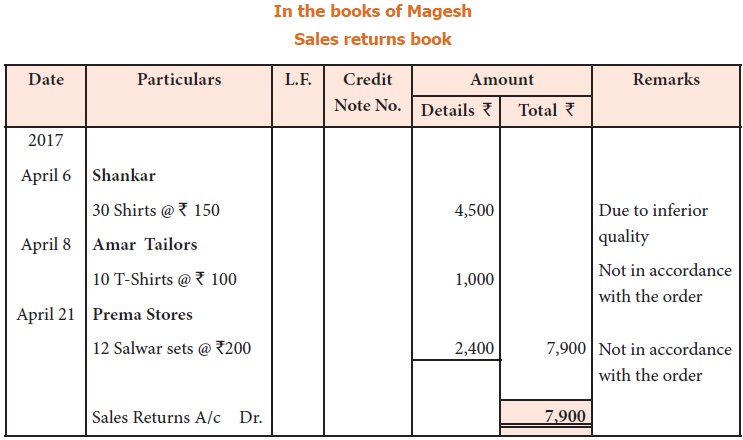

Solution

Related Topics