Introduction, Definition, Features, Specimen, Important terms | Accountancy - Bills of exchange | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

Bills of exchange

Bills of exchange

Introduction

To increase

the sales, a seller sells the goods on credit to his customers. If sale is made

on credit, cash will not be received immediately. The seller may draw a bill on

the customer for the amount due from him. If the customer accepts it, the

seller can get the same discounted with the bank and get cash immediately.

Definition of bill of exchange

According to

the Negotiable Instruments Act, 1881, “Bill of exchange is an instrument in

writing containing an unconditional order, signed by the maker, directing a

certain person to pay a certain sum of money only to, or to the order of a

certain person or to the bearer of the instrument”.

Features of bills of exchange

An analysis

of the definition given above, highlights the following important features of a

bill of exchange:

·

It is a

written document.

·

It is an

unconditional order.

·

It is an

order to pay a certain sum of money.

·

It is

signed by the drawer.

·

It bears

stamp or it is drafted on a stamp paper.

·

It is to

be accepted by the acceptor.

·

The

amount of the bill is paid to the drawer or the endorsee.

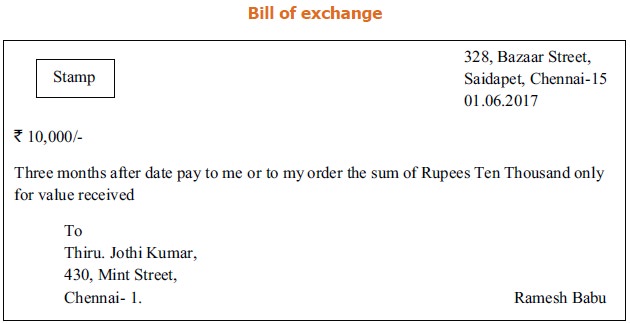

Specimen of bill of exchange

Bill of exchange

Important terms

Explanation of some terms connected with bill of

exchange is given below:

(i) Drawing of a bill

The seller (creditor) prepares the bill in the form

presented above. The act of preparing the bill by the seller or creditor in its

complete form with the signature is known as ‘drawing’ a bill.

(ii) Parties

There are three parties to a bill of exchange as

under:

Drawer: The person

who prepares the bill is called the drawer, i.e., a creditor

Drawee: The person

who has to make the payment or who accepts to make the payment is called the

drawee, i.e., a debtor

Payee: The person

who receives the payment is payee. He may be a third party or the drawer

of the bill.

In the above

specimen, drawer and payee is Ramesh Babu. Jothi Kumar is the drawee.

(iii) Acceptance

In a bill,

drawee gives his/her acceptance by writing the word ‘accepted’ and signs the

same with the date. Now the bill becomes a legal document enforceable in the

court of law.

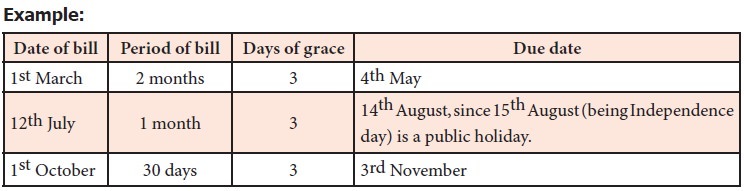

(iv) Due date and days of grace

When a bill

is drawn payable after a specified period, the date on which the payment should

be made is called ‘Due date’. In the

calculation of the due date, three extra days are added to the specified period

of the bills called ‘Days of grace’.

If the date of maturity falls on a holiday, the bill will be due for payment on

the preceding day.

Example:

(v) Endorsement

Endorsement

means signing on the face or back of a bill for the purpose of transferring the

title of the bill to another person. The person who endorses is called the

“Endorser”. The person to whom a bill is endorsed is called the “Endorsee”. The

endorsee is entitled to collect the money.

(vi) Discounting

When the

holder of a bill is in need of money before the due date of a bill, cash can be

received by discounting the bill with the banker. This process is referred to

as the discounting of bill. The banker deducts a small amount of the bill which

is called discount and pays the balance in cash immediately to the holder of

the bill.

(vii) Retiring of bill

An acceptor

may make the payment of a bill before its due date and may discharge the

liability on the bill. It is called as retirement of a bill. Usually, the

holder of the bill allows a concession called rebate to the drawee for the

unexpired period of the bill.

(viii) Renewal

When the

acceptor of a bill knows in advance that he/she will not be able to meet the

bill on its due date, he/she may request the drawer for extension of time for

payment. The drawer of the bill may agree to cancel the original bill and draw

a new bill for the amount due with interest thereon. This is referred to as

renewal.

(ix) Dishonour

Dishonour of

the bill means the non payment of the amount of the bill, when it is presented

for payment.

Related Topics