Accountancy - Journal proper | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

Journal proper

Journal proper

Journal

proper is a residuary book which contains record of transactions, which do not

find a place in the subsidiary books such as cash book, purchases book, sales

book, purchases returns book, sales returns book, bills receivable book and

bills payable book. Thus, journal proper or general journal is a book in which

the residual transactions which cannot be entered in any of the sub divisions

of journal are entered. The usual entries that are passed through this journal

are given below:

i.

Opening journal entry

ii.

Closing journal entry

iii.

Adjusting entries

iv.

Transfer entries

v.

Rectifying entries

vi.

Miscellaneous entries

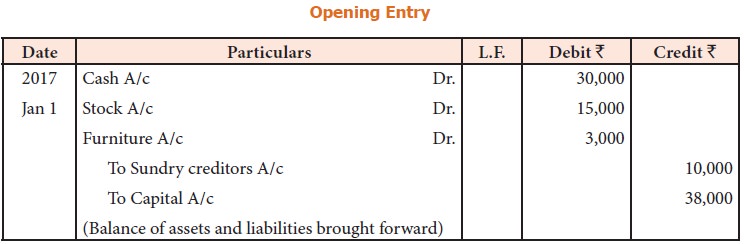

(i) Opening journal entry

At the end of

the accounting year, all nominal accounts are closed but the business has to be

carried on with previous year’s assets and liabilities. Hence, these accounts

are to be brought into the accounts of the current year. Journal entry made in

the beginning of the current year with the balances of assets and liabilities

of the previous year is opening journal entry. In this entry, asset accounts

are debited, liabilities and capital accounts are credited.

Example

Ramnath carried forward the following items. Make

the opening entry in journal proper as on 1st January, 2017.

Cash 30,000 Stock Rs.

15,000

Furniture Rs. 3,000 Sundry Creditors Rs. 10,000

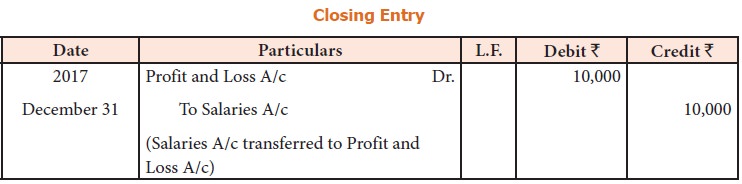

(ii) Closing journal entry

At the end of

the accounting period, all the ledger accounts relating to purchases, sales,

purchases returns, sales returns, stock and other accounts concerning expenses,

losses, incomes and gains are closed by transfer to trading and profit and loss

account so that financial statements can be prepared. It should be noted that

closing entries are made for nominal accounts only.

Example: Salaries account Rs. 10,000. The closing entry as on 31st December, 2017

is:

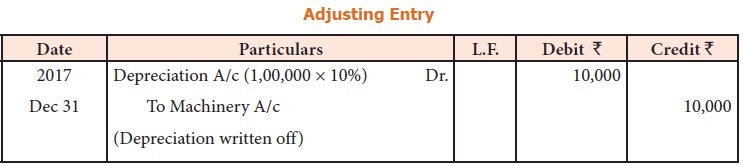

iii) Adjusting entries

After

preparing the trial balance, but before preparing the final accounts, if any

adjustment is required in the accounts for items or transactions left out,

adjusting entries are made.

Example

Book value of the machinery as on 1st January, 2017

Rs. 1,00,000. Rate of depreciation is 10% p.a.

Adjusting entry as on 31st December, 2017 is:

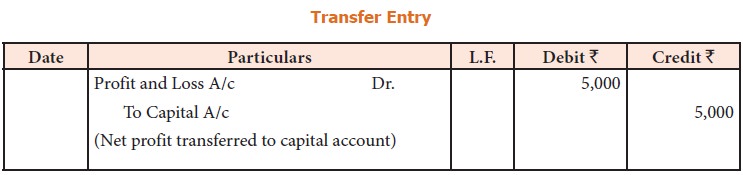

(iv) Transfer entries

Transfer

entries are passed in the journal proper for transferring an item entered in

one account to another account. For example, transferring net profit of Rs. 5,000 to capital

account, the following entry is passed:

Transfer Entry

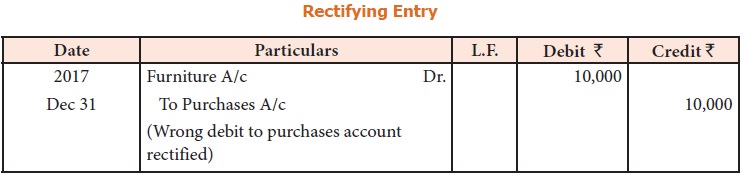

(v) Rectifying entries

Rectifying

entries are passed for rectifying errors which are committed in the books of

accounts. Example

Purchase of furniture by a stationery dealer for Rs. 10,000 was debited to purchases account.

Pass rectifying entry on December 31, 2017.

(vi) Miscellaneous entries

These are

entries which do not occur frequently such as:

·

Credit

purchases and credit sale of assets which cannot be recorded through purchases

or sales book.

·

Endorsement,

renewal and dishonor of bill of exchange which cannot be recorded through bills

book.

·

Other

adjustments like interest on capital, bad debts, reserves, etc.

·

Goods

withdrawn by the owner for personal use.

·

Goods

distributed as samples for sales promotion.

·

Loss of

goods by fire, theft and spoilage.

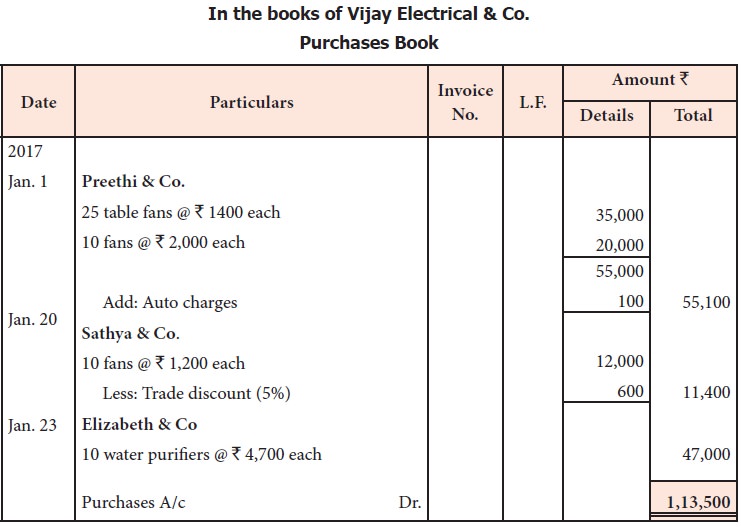

Illustration 7

Record the

following transactions of Vijay Electrical & Co., in the purchases book,

purchases returns book, sales book and sales returns book.

2017

Jan 1

Purchased on credit from Preethi & Co.,

25 table fans @ Rs. 1,400

each

10 fans @ Rs. 2,000

each

Add: Auto charges @ Rs. 100

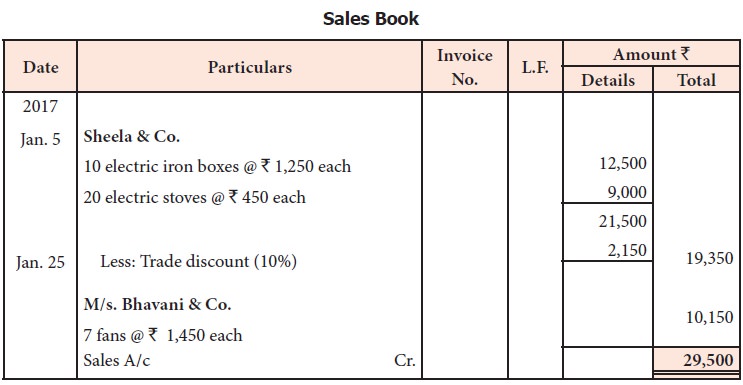

Jan 5

Sold on credit to Sheela & co.,

10 electric iron box @ Rs. 1,250 each

20 electric stoves @ Rs. 450 each

Less: 10% Trade discount

Jan 10

Purchased for cash from Brinda & Co.,

10 electric stoves @ Rs. 1,300

each

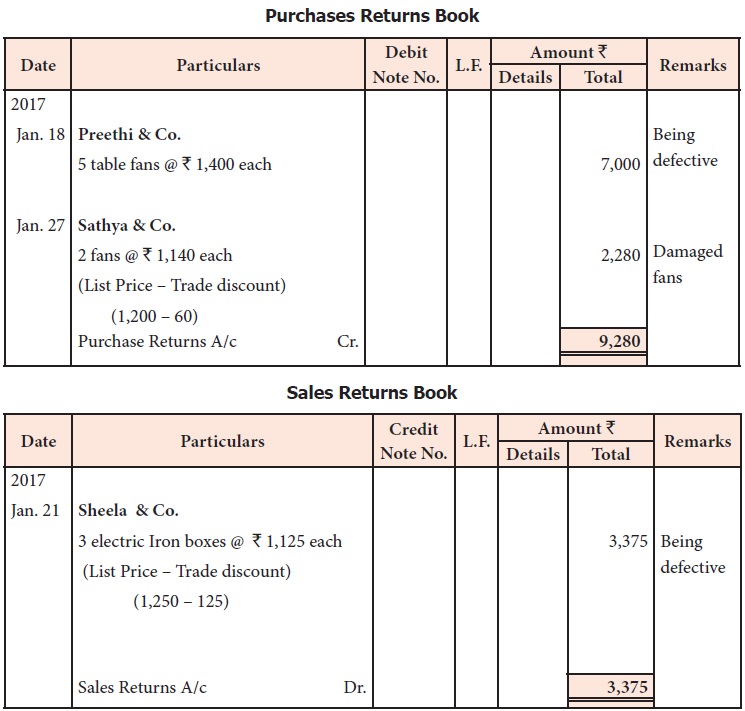

Jan 18

Returned to Preethi & Co.,

5 table fans being defective for which cash is not

received Jan 20 Purchased from Sathya & Co.,

10 fans @ Rs. 1,200

each

Less: Trade discount 5%

Jan 21

Sheela & Co., returned 3 electric iron boxes as

defective for which cash is not paid

Jan 23

Purchased from Elizabeth & Co., 10 water

purifiers @ Rs. 4,700 each on credit

Jan 25

Sold on credit to M/s. Bhavani & Co., 7 fans @ Rs. 1,450 each

Jan 27

Returned to Sathya & Co., 2 damaged fans for

which cash is not received

Solution

Related Topics