International Economics - Theories of International Trade | 12th Economics : Chapter 7 : International Economics

Chapter: 12th Economics : Chapter 7 : International Economics

Theories of International Trade

Theories of International Trade

1. The Classical Theory of International Trade

Introduction

Adam Smith (1776) developed the theory of absolute cost advantage.

But it was David Ricardo who formulated as an explicit and precise theory,

namely, the theory of comparative cost advantage, which was later improved and

refined by the economists like J.S Mill, Cairnes, Bastable,Taussig and

Haberler. We shall first discuss the Adam Smith’s theory of absolute cost

advantage.

Classical Trade Theories

Mercantilism (pre - 16th century)

Takes an us-versus - them view of trade

Other country's gain is our country's loss

Free Trade theories

Absolute Advantage (Adam Smith,1776)

Comparative Advantage

(David Ricardo, 1817)

Specialization of production and free flow of goods benefit all

trading partner's economies

Free Trade refined

Factor - proporations (Heckscher - Ohlin, 1919)

International Product life (Ray Vernon, 1966)

2. Adam Smith’s Theory of Absolute Cost Advantage

Adam Smith argued that all nations can be benefitted when there is

free trade and specialisation in terms of their absolute cost advantage.

The Theory

According to Adam Smith, the basis of international trade was

absolute cost advantage. Trade between two countries would be mutually beneficial

when one country produces a commodity at an absolute cost advantage over the

other country which in turn produces another commodity at an absolute cost

advantage over the first country.

Assumptions

1. There are two countries and two commodities (2 x 2 model).

2. Labour is the only factor of production.

3. Labour units are homogeneous.

4. The cost or price of a commodity is measured by the amount of

labour required to produce it.

5. There is no transport cost.

Illustration

Absolute cost advantage theory can be illustrated with the help of

the following example.

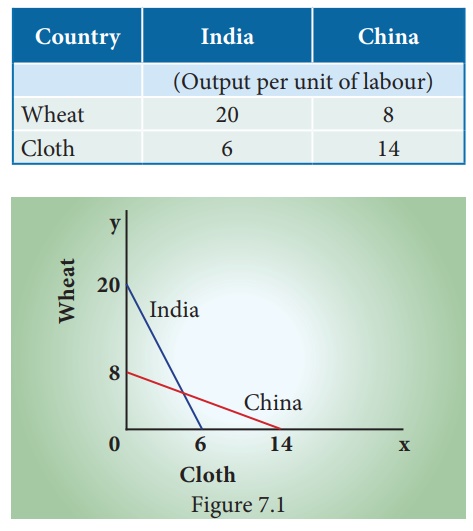

Absolute Cost Advantage

From the illustration, it is clear that India has an absolute

advantage in the production of wheat over China and China has an absolute

advantage in the production of cloth over India. Therefore, India should

specialize in the production of wheat and import cloth from China. China should

specialize in the production of cloth and import wheat from India. This kind of

trade would be mutually beneficial to both India and China.

3. Ricardo’s Theory of Comparative Cost Advantage

David Ricardo , the British economist in his ‘Principles of

Political Economy and Taxation’ published in 1817, formulated a systematic

theory called ‘Comparative Cost Theory’. Later it was refined by J.S Mill,

Marshall, Taussig and others.

Ricardo demonstrates that the basis of trade is the comparative

cost difference. In other words, trade can take place even if the absolute cost

difference is absent but there is comparative cost difference.

According to Ricardo, a country can gain from trade when it

produces at relatively lower costs. Even when a country enjoys absolute

advantage in both goods, the country would specialize in the production and

export of those goods which are relatively more advantageous. Similarly, even

when a country has absolute disadvantage in production of both goods, the

country would specialize in production and export of the commodity in which it

is relatively less disadvantageous.

Assumptions

1.

There are only two nations and two commodities (2x2 model)

2.

Labour is the only element of cost of production.

3.

All labourers are of equal efficiency.

4.

Labour is perfectly mobile within the country but perfectly

immobile between countries.

5.

Production is subject to the law of constant returns.

6.

Foreign trade is free from all barriers.

7.

No change in technology.

8.

No transport cost.

9.

Perfect competition.

10. Full employment.

11. No government

intervention.

Illustration

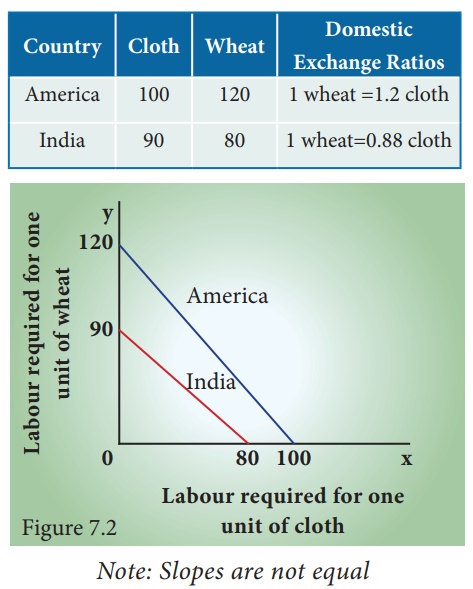

Ricardo’s theory of comparative cost can be explained with a

hypothetical example of production costs of cloth and wheat in America and

India.

Comparative Cost Advantage

(Units of labour required to produce one unit)

It is evident from the example that India has an absolute

advantage in production of both cloth and wheat. However, India should

concentrate on the production of wheat in which she enjoys a comparative cost

advantage. (80/120 < 90/100). For America the comparative cost disadvantage

is lesser in cloth production. Hence America will specialize in the production

of cloth and export it to India in exchange for wheat. (Any exchange ratio

between 0.88 units and 1.2 units of cloth against one unit of wheat represents

gain for both the nations). With trade, India can get 1 unit of cloth and 1

unit of wheat by using its 160 labour units. In the absence of trade, for

getting this benefit, India will have to use 170 units of labour. America also

gains from this trade. With trade, America can get 1 unit of cloth and one unit

of wheat by using its 200 units of labour. Otherwise, America will have to use

220 units of labour for getting 1 unit of cloth and 1 unit of wheat.

Criticisms

1. Labour cost is a small portion of the total cost. Hence, theory

based on labour cost is unrealistic.

2. Labourers in different countries are not equal in efficiency.

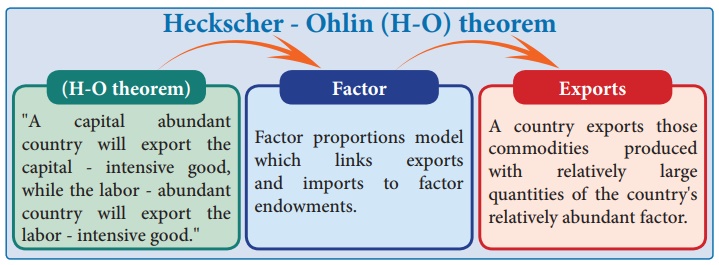

4. Modern Theory of International Trade

Introduction

The modern theory of international trade was developed by Swedish

economist Eli Heckscher and his student Bertil Ohlin in 1919. This model was

based on the Ricardian theory of international trade. This theory says that the

basis for international trade is the difference in factor endowments. It is

otherwise called as ‘Factor Endowment Theory’.

Factor endowment model

Developed by Heckscher and Ohlin

Countries with

a relative factor abundance

can specialise and trade

Abundance of skilled labour

→ specialisation →

export → exchange for goods are

services produced by countries with

abundance of unskilled labour

Exports embody the abundant factor

Imports embody the scarce factor

Assumes a high degree of factor mobility

The Theory

The classical theory argued that the basis for foreign trade was

comparative cost difference and it considered only labour factor. But the

modern theory of international trade explains the causes for such comparative

cost difference. This theory attributes international differences in

comparative costs to:

i) difference in the endowments of factors of production between

countries, and

ii) differences in the factor proportions required in production.

Assumptions

1. There are two countries, two commodities and two factors.

(2x2x2 model)

2. Countries differ in factor endowments.

3. Commodities are categorized in terms of factor intensity.

4. Countries use same production technology.

5. Countries have identical demand conditions.

6. There is perfect competition in both product and factor

markets in both the countries.

Explanation

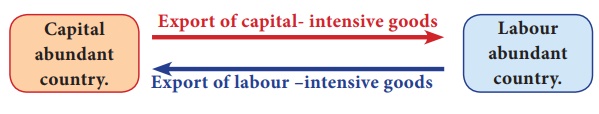

According to Heckscher - Ohlin, “a capital-abundant country will

export the capital –intensive goods, while the labour-abundant country will

export the labour-intensive goods”. A factor is regarded abundant or scare in

relation to the quantum of other factors. A country can be regarded as richly

endowed with capital only if the ratio of capital to other factors is higher than

other countries.

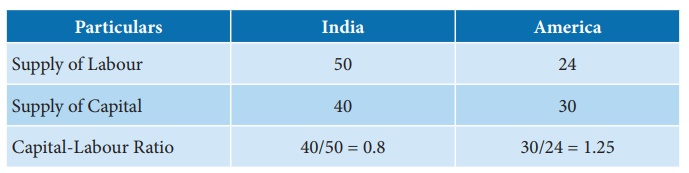

Illustration

In the above example, even though India has more capital in

absolute terms, America is more richly endowed with capital because the ratio

of capital in India is 0.8 which is less than that in America where it is 1.25.

The following diagram illustrates the pattern of word trade.

Limitations

1. Factor endowment of a country may change over time.

2. The efficiency of the same factor (say labour) may differ in

the two countries. For example, America may be labour scarce in terms of number

of workers. But in terms of efficiency, the total labour may be larger.

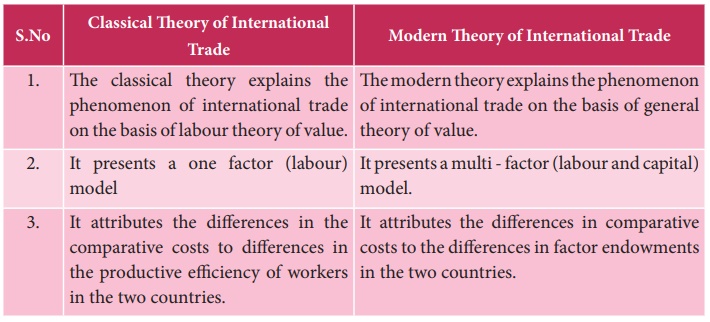

5. Comparison of Classical Theory and Modern Theory

Classical Theory of International Trade

1. The classical theory explains the phenomenon of international

trade on the basis of labour theory of value.

2. It presents a one factor (labour) model

3. It attributes the differences in the comparative costs to

differences in the productive efficiency of workers in the two countries.

Modern Theory of International Trade

1. The modern theory explains the phenomenon of international

trade on the basis of general theory of value.

2. It presents a multi - factor (labour and capital) model.

3. It attributes the differences in comparative costs to the

differences in factor endowments in the two countries.

Related Topics