International Economics - Balance of Trade Vs Balance of Payments | 12th Economics : Chapter 7 : International Economics

Chapter: 12th Economics : Chapter 7 : International Economics

Balance of Trade Vs Balance of Payments

Balance of Trade Vs Balance of Payments

Balance of Trade and Balance of Payments are two different

concepts in the subject of international trade.

1. Balance of Trade (BOT)

Balance of Trade (BOT) refers to the total value of a country’s

exports of commodities and total value of imports of commodities. Only export

and import of commodities are included in the statement of Balance of Trade of

a country. Movements of goods (export and imports of commodities) are also

known as ‘visible trade’, because the movement of commodities between

countries can be seen by eyes and felt by hands and can be verified physically

by custom authorities of a country.

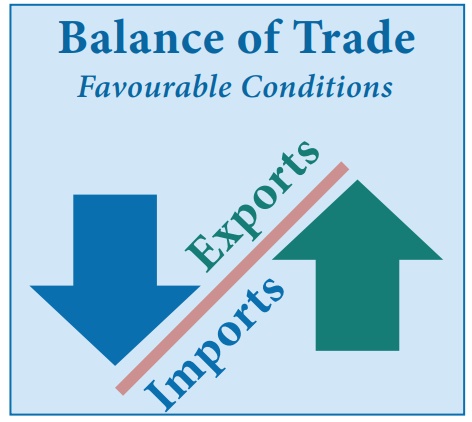

Favourable BOT

When the total value of commodity exports of a country exceeds the

total value of commodity imports of that country, it is said that the country

has a ‘favourable’ balance of trade.

Unfavourable BOT

If total value of commodity exports of a country is less than the

total value of commodity imports of that country, that country is said to have

an ‘unfavourable’ balance of trade.

2. Balance of Payments (BOP)

BoP is a systematic record of a country’s economic and financial

transactions with the rest of the world over a period of time.

When a payment is received from a foreign country, it is a credit

transaction while a payment to a foreign country is a debit transaction. The

principal items shown on the credit side are exports of goods and

services, transfer receipts in the form of gift etc., from foreigners,

borrowing from abroad, foreign direct investment and official sale of reserve

assets including gold to foreign countries and international agencies.

The principal items on the debit side include imports of

goods and services, transfer payments to foreigners, lending to foreign countries,

investments by residents in foreign countries and official purchase of reserve

assets or gold from foreign countries and international agencies.

3. Components of BOPs

The credit and debit items are shown vertically in the BOP account

of a country. Horizontally, they are divided into three categories, i.e.

a) The current account,

b) The capital account and

c) The official settlements account or official reserve assets

account.

a) The Current Account: It includes all international trade

transactions of goods and services, international service transactions (i.e.

tourism, transportation and royalty fees) and international unilateral

transfers (i.e. gifts and foreign aid).

b) The Capital Account: Financial transactions consisting of

direct investment and purchases of interest-bearing financial instruments,

non-interest bearing demand deposits and gold fall under the capital account.

c) The Official Reserve Assets Account: Official reserve

transactions consist of movements of international reserves by governments and

official agencies to accommodate imbalances arising from the current and

capital accounts.

The official reserve assets of a country include its gold stock,

holdings of its convertible foreign currencies and Special Drawing Rights

(SDRs) and it1s net position in the International Monetary Fund (IMF).

Balance of Payment (BOP) Account Chart

Credit (Receipts) – Debit (Payments) = Balance [Deficit

(-) , Surplus (+)]

Deficit if Debit > Credit

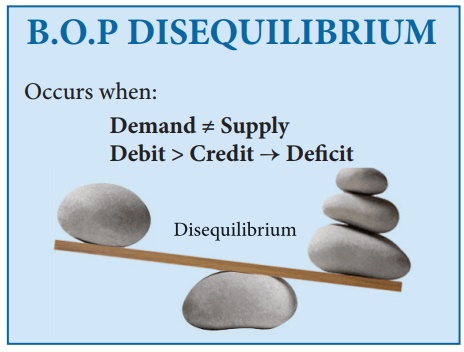

4. Balance of Payments Disequilibrium

The BoP is said to be balanced when the receipts (R) and payments (P) are just equal, i.e,

R / P =1.

Favourable BoP

When receipts exceed payments, the BoP is said to be favourable.

That is,

R / P > 1.

Unfavourable BOP

When receipts are less than payments, the BoP is said to be

unfavourable or adverse.That is

R / P < 1.

5. Types BOP Disequilibrium:

There are three main types of BOP Disequilibrium, which are

discussed below.

(a) Cyclical Disequilibrium,

(b) Secular Disequilibrium,

(c) Structural Disequilibrium.

a) Cyclical Disequilibrium: Cyclical disequilibrium occurs because of

two reasons. First, two countries may be passing through different phases of

business cycle. Secondly, the elasticities of demand may differ between

countries.

b) Secular Disequilibrium: The secular or long-run disequilibrium in

BOP occurs because of long-run and deep seated changes in an economy as it

advances from one stage of growth to another. In the initial stages of

development, domestic investment exceeds domestic savings and imports exceed

exports, as it happens in India since 1951.

c) Structural Disequilibrium: Structural changes in the economy may

also cause balance of payments disequilibrium. Such structural changes include

development of alternative sources of supply, development of better

substitutes, exhaustion of productive resources or changes in transport routes

and costs.

6. Causes for BoP Disequilibrium

The following are the major causes producing disequilibrium in the

balance of payments of a country.

1. Cyclical Fluctuation: Cyclical disequilibrium in different countries

is caused by their cyclical fluctuations, their phases and

magnitude. World trade shrinks

during depression while trade flourishes during prosperity

2. Structural Changes: Structural disequilibrium is caused by the

structural changes brought by huge development and investment programmes in the

developing economies.Such economies may have high propensity to import for want

of capital for rapid industrialization, while export may not be boosted up to

that extent.

3. Development Expenditure: Development disequilibrium is caused by rapid

economic development which results in

income and price

effects. The less developed countries in the early stage

of development are not self

sufficient. Income, savings

and investment are abysmally low. They depend upon developed countries for

import of commodities,

capital and technology. Export

potential is low and import intensity is high. So the LDCs suffer from adverse

BoP.

4. Consumerism: Balance of payments position of a country

is adversely affected by a huge increase in consumption. This increases the

need for imports and decreases the capacity to export.

5. Demonstration Effect: Deficit in the balance of

payments of developing countries is also caused by demonstration effect which

influences the people in UDCs to imitate western styled goods. This will raise

the propensity to import causing adverse balance of payments. This is good for

the developed countries.

6. Borrowing: International borrowing and investment may cause a deficit

in the balance of payments. When the international borrowing is heavy, a

country’s balance of payments will be adverse since it repays loans with

interest. Servicing of debt is a huge burden. That is why the UDCs are forced

to borrow more.

7. Technological Backwardness: Due to technological backwardness, the

people (Indians) are unable to use the energy (Solar) available with them. As a

result they import huge petroleum products from foreign countries, increasing

the trade deficit.

8. Global Politics: The rich countries (Eg. USA) need to sell

their weapons to promote their economy and generate employment. Hence, wars

between countries (for example Iran and Irag, Pakistan and India) are

stimulated In order to win the wars, the poor countries are forced to buy the

weapons from weapon – rich countries, using their export earnings and creating

trade deficit. Thus UDCs are trapped forever.

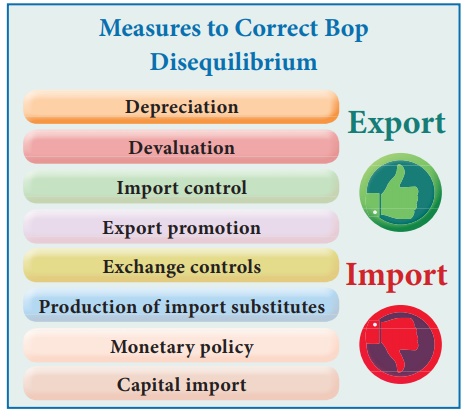

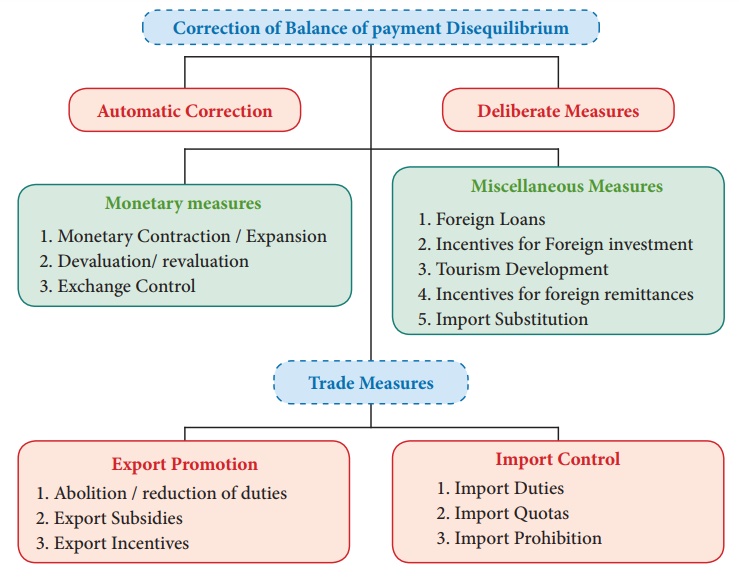

7. Measures to Correct BOP Disequilibrium

There are a number of measures available for correcting the

balance of payments disequilibrium. They are divided into two baord groups,

namely,automatic correction and (ii) deliberate measures.

I. Automatic Correction

If the market forces of demand and supply are allowed to play

freely, equilibrium will be automatically restored in course of time. Under the

free exchange rate system, the automatic adjustments of the balance of payments

can take place through changes in the variables like price, interest, income

and capital flows.

1. Price Adjustments

As a result of foreign exchange outflow from a deficit country to

a surplus country, there will be a fall in the money supply in the deficit

country and increase in the money supply in the surplus country. This will

result in rise in the price in the surplus country which will encourage imports

and discourage exports. Fall in prices in the deficit country will encourage

exports and discourage imports, leading to restoration of BoP equilibrium.

2. Interest Rate Adjustments

The contraction or expansion of money supply resulting from the

BoP deficit or surplus leads to a rise or fall in the interest rates. A rise in

interest rate in the deficit country will encourage investors to withdraw their

funds from abroad and invest in their home country. The opposite happens in the

surplus country.

3. Income Adjustments

A nation with payments surplus will experience rising income which

will increase imports and thereafter equilibrium is restored in Balance of

Payments.

4. Capital Flows

Changes in the interest rate consequent to the BoP disequilibrium

will encourage capital flows from the surplus nations to deficit nations

helping restoration of the BoP equilibrium.

II. Deliberate Measures

The deliberate measures may be broadly grouped into (a) monetary

measures (b) trade measures and (c) miscellaneous measures.

a. Monetary Measures

1. Monetary Contraction

High domestic price level is responsible for high imports and low

exports. In order to control inflation, the central monetary authority controls

credit. As a result, the prices come down and exports increase. This will help

to correct adverse BoP. However, if credit is controlled, investment will

decline, production will go down, prices will increase. This is the cause of

confusion between government and RBI in India in 2010s.

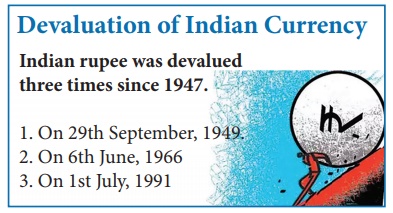

2. Devaluation

Devaluation means deliberate reduction of the official rate at

which domestic currency is exchanged for another currency. In other words,

devaluation refers to a reduction in the external value of a currency in the

terms of other currencies. For instance, instead of 70 ₹ per US$, making ₹ 80

per US$.

A country with fundamental disequilibrium in the balance of

payments may devalue its currency in order to stimulate its exports and

discourage imports to correct the disequilibrium. Devaluation makes exports

cheaper and imports dearer. That means making Indian good cheaper for

foreigners, and foreign goods costlier for Indians.

3. Exchange Control

Exchange control means the state intervention in the forex market.

It is a popular method employed to influence the balance of payments position

of a country. Under exchange control, the government or central bank assumes

complete control over the foreign exchange reserves and earning of the country.

The recipients of foreign exchange, like exporters, are required to surrender

foreign exchange to the government / central bank in exchange for domestic

currency. By virtue of its control over the use of foreign exchange, the

government can control imports. Does it happen in India? Too much of imports

control would invite more and more smuggled goods. Smuggling of gold into

Indian airports regularly happens, as per the reports in the media.

III. Trade Measures

Trade measures include measures to promote exports and to reduce

imports.

1. Export Promotion

Exports may be encouraged by i).reducing or abolishing export

duties, ii). providing export subsidy, iii).encouraging export production by

giving monetary, fiscal, physical and institutional incentives. (Then local

people and domestic industries would suffer)

2. Import Control

Imports may be controlled by i).imposing or enhancing import

duties, ii).restricting imports through import quotas, iii).licensing and even

prohibiting altogether the import of certain non essential items. But this

would encourage smuggling.

IV. Miscellaneous Measures

In addition to the measures mentioned above, there are a number of

other measures that can help make the balance of payments position more

favourable, like i). foreign loans, ii).encouraging foreign investment in the

home country, iii).development of tourism to attract foreign tourists,

iv).providing incentives to enhance inward remittances and v). import

substitution.

Related Topics