International Economics - Exchange Rate | 12th Economics : Chapter 7 : International Economics

Chapter: 12th Economics : Chapter 7 : International Economics

Exchange Rate

Exchange Rate

1. Meaning of Foreign Exchange (FOREX)

FOREX refers to foreign currencies. The mechanism through which

payments are effected between two countries having different currency systems

is called FOREX system . It covers methods of payment, rules and regulations of

payment and the institutions facilitating such payments.

2. Definition of FOREX

“FOREX is the system or process of converting one national

currency into another, and of transferring money from one country to another”.

3. Rate of Exchange

The transactions in the exchange market are carried out at

exchange rates. It is the external value of domestic currency. Thus, exchange

rate may be defined as the price paid in the home currency (say ₹ 75) for a

unit of foreign currency (say 1 US $). It can be quoted in two ways:

1. One unit of foreign money (1 USD) to so many units of the

domestic currency (₹); or

2. A certain number of units of foreign currency (USD)to one unit

of domestic money (₹ 1)

For instance:

1 U.S Dollar = ₹ 70 , or

₹ 1 = U.S.1.42 cents

4. Definition of Equilibrium Exchange Rate

“The equilibrium exchange rate is that rate, which over a certain

period of time, keeps the balance of payments in equilibrium”.

- Ragner Nurkse

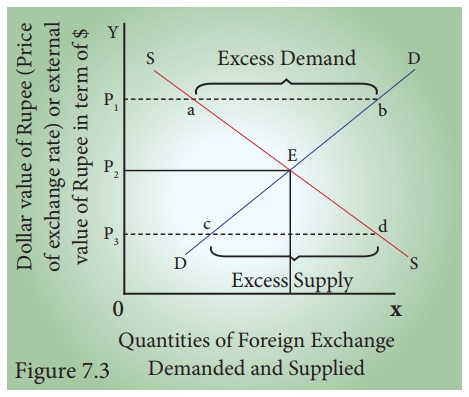

5. Determination of Equilibrium Exchange Rate

The equilibrium rate of exchange is determined in the foreign

exchange market in accordance with the general theory of value, i.e., by the

interaction of the forces of demand and supply. Thus, the rate of exchange is

determined at the point where demand for forex is equal to the supply of forex.

In the above diagram, Y axis represents exchange rate, that is,

value of rupee in terms of dollars. X axis represents demand and supply of

forex. E is the point of equilibrium where DD intersects SS. The exchange rate

is P2.

6. Types of Exchange Rate Systems

Broadly, there are two major exchange rate systems, namely, (1)

fixed (or pegged) exchange rate system and flexible (or floating) exchange rate

system. Managed Floating Exchange Rate system also prevails in some countries

(like India).

1. Fixed Exchange Rates

Countries following the fixed exchange rate (also known as stable

exchange rate and pegged exchange rate) system agree to keep their currencies

at a fixed rate as determined by the Government. Under the gold standard, the

value of currencies was fixed in terms of gold.

2. Flexible Exchange Rates

Under the flexible exchange rate (also known as floating exchange

rate) system, exchange rates are freely determined in an open market by market

forces of demand and supply.

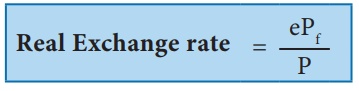

7. Types of Exchange Rates

Exchange rates are also in the form of (a) Nominal exchange rate

(b) Real exchange rate (c) Nominal Effective Exchange Rate (NEER) and (d) Real

Effective Exchange Rate (REER)

If 1 US Dollar = ₹ 75,

Nominal exchange rate = 75/1 = 75.

This is the bilateral nominal exchange rate.

Real Exchange rate = ePf/P

P = Price levels in India

Pf = Price levels in abroad (say US)

e = nominal exchange rate.

If a pen costs ₹ 50 in India and it costs 5 USD in the US,

Real Exchange Rate = 75x5 / 50 = 7.5

If real exchange rate is equal to 1, the currencies are at

purchasing power parity.

It the price of the pen in US is 0.66 USD then the real exchange

rate = 66x75 / 50 € then it could be said that the USD and Indian rupee

are at purchasing power parity.

NEER and REER are not explained here.

Interested students and teachers can search for them.

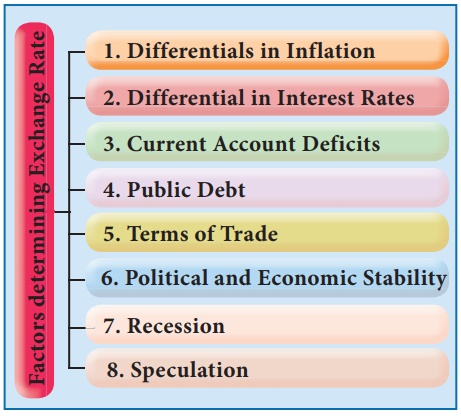

8. Determinants of Exchange Rates

Exchange rates are determined by numerous factors and they are

related to the trading relationship between two countries.

1. Differentials in Inflation

Inflation and exchange rates are inversely related. A country with

a consistently lower inflation rate exhibits a rising currency value, as its

purchasing power increases relative to other currencies.

2. Differentials in Interest Rates

There is a high degree of correlation between interest rates,

inflation and exchange rates. Central banks can influence over both inflation

and exchange rates by manipulating interest rates. Higher interest rates

attract foreign capital and cause the exchange rate to rise and vice versa.

3. Current Account Deficits

A deficit in the current account implies excess of payments over

receipts. The country resorts to borrowing capital from foreign sources to make

up the deficit. Excess demand for foreign currency lowers a country’s exchange

rate.

4. Public Debt

Large public debts are driving out foreign investors, because it

leads to inflation. As a result, exchange rate will be lower.

5. Terms of Trade

A country’s terms of trade also determines the exchange rate. If

the price of a country’s exports rises by a greater rate than that of its

imports, its terms of trade will improve. Favorable terms of trade imply

greater demand for the country’s exports and thus BoP becomes favorable.

6. Political and Economic Stability

If a nation’s political climate is stable and economic performance

is good, its currency value will be appreciated by attracting more foreign

capital.

7. Recession

Interest rates are low during the recession phase. This will

decrease inflow of foreign capital. As a result, a currency will be depreciated

against other currencies, thereby lowering the exchange rate.

8. Speculation

If a country’s currency value is expected to rise, investors will

demand more of that currency in order to make a profit in the near future. This

results in appreciation of the exchange rate. Beside the above determinants,

relative dominance in the global politics and the power to announce economic sanctions

over other countries also determine exchange rates.

Related Topics