Retirement and Death of a Partner | Accountancy - Settlement of the amount due to the retiring partner | 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Chapter: 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Settlement of the amount due to the retiring partner

Settlement

of the amount due to the retiring partner

The amount due to the

retiring partner from the partnership firm is the balance of his capital

account after making adjustments for goodwill, accumulated profits and losses,

profit or loss on revaluation, remuneration due, etc. The settlement is to be

done in the manner prescribed in the partnership deed. The amount due to the

retiring partner may be settled in one of the following ways:

i.

Paying the entire amount due immediately in cash

ii.

Transfer the entire amount due, to the loan account of the partner

iii.

Paying part of the amount immediately in cash and transferring the

balance to the loan account of the partner

The journal entries to

be made are as follows:

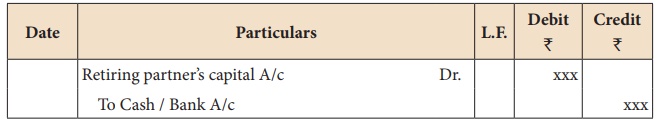

a. When the amount due is paid in cash immediately

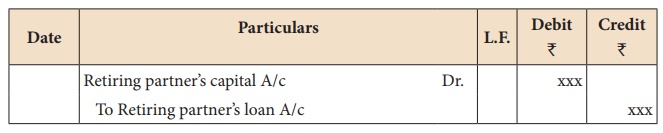

b. When the amount due is not paid immediately in cash

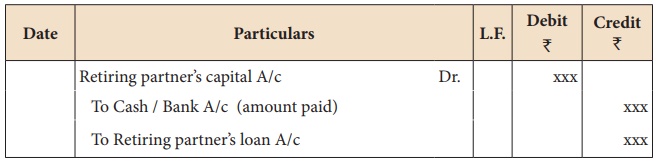

c. When the amount due is partly paid in cash immediately

Retiring partner’s loan

account will appear on the liabilities side of the balance sheet prepared after

retirement till it is completely settled.

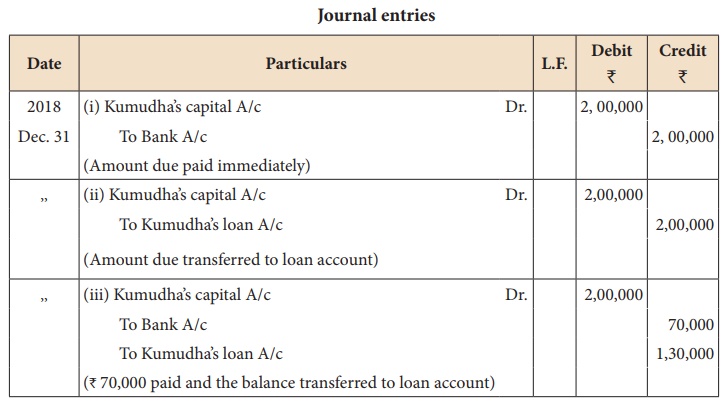

Illustration 15

Kavitha, Kumudha and

Lalitha are partners sharing profits and losses in the ratio of 5:3:3

respectively. Kumudha retires from the firm on 31st December, 2018. On the date

of retirement, her capital account shows a credit balance of â‚ą 2,00,000. Pass journal

entries if:

i.

The amount due is paid off immediately by cheque.

ii.

The amount due is not paid immediately.

iii.

70,000 is paid immediately by cheque.

Solution

Illustration 16

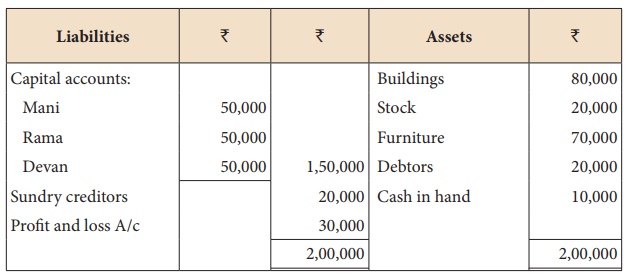

Mani, Rama and Devan are

partners in a firm sharing profits and losses in the ratio of 4:3:3.

Their balance sheet as

on 31st March, 2019 is as follows:

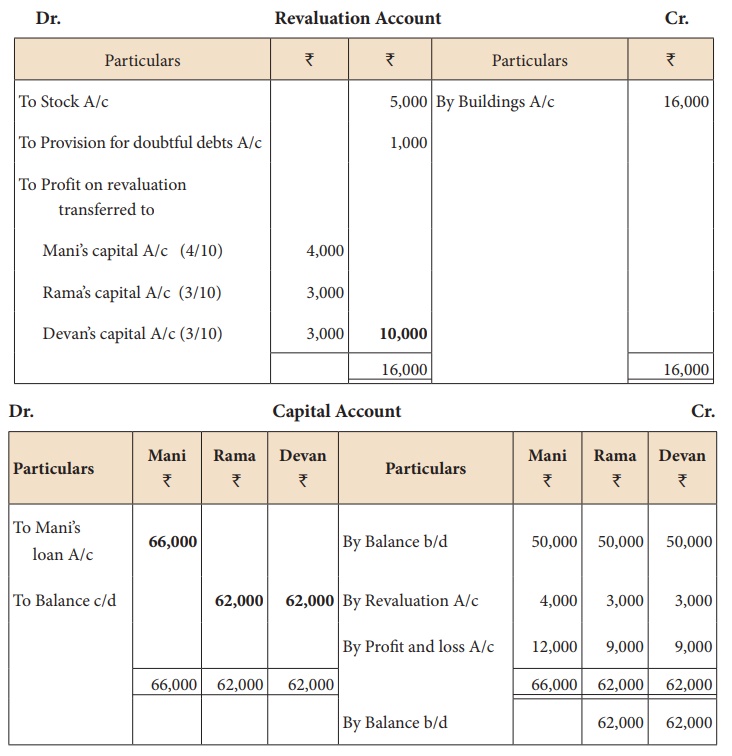

Solution

Mani retired from the partnership

firm on 31.03.2019 subject to the following adjustments:

i.

Stock

to be depreciated by â‚ą 5,000

ii.

Provision

for doubtful debts to be created for â‚ą 1,000.

iii.

Buildings

to be appreciated by â‚ą 16,000

iv.

The

final amount due to Mani is not paid immediately

Prepare revaluation account and

capital account of partners after retirement.

Comprehensive problems

Illustration 17

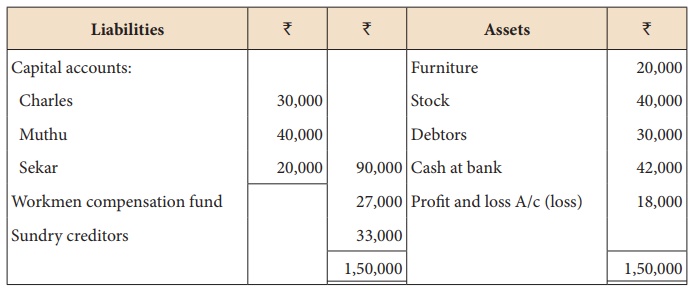

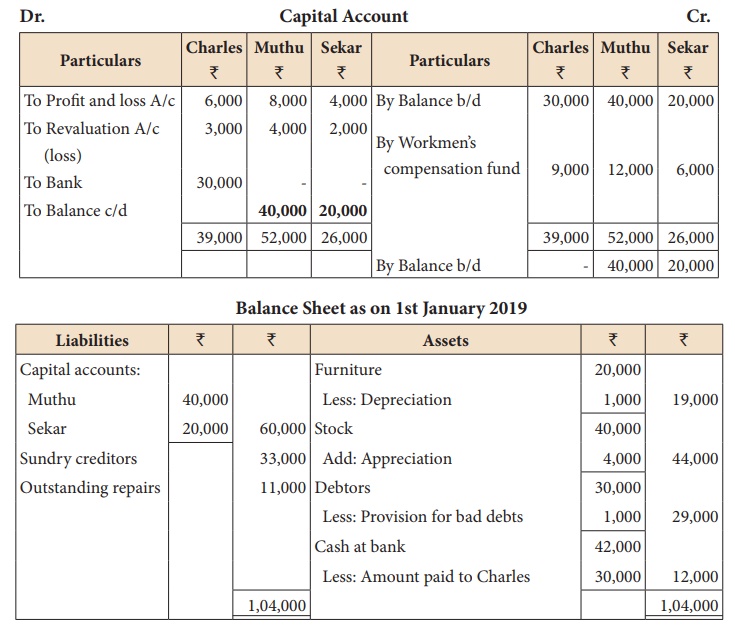

Charles, Muthu and Sekar

are partners, sharing profits in the ratio of 3:4:2. Their balance sheet as on

31st December, 2018 is as under:

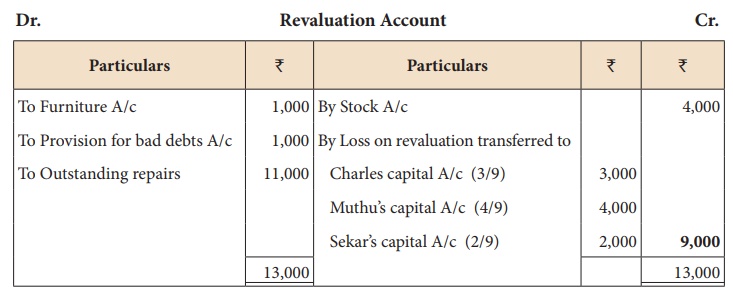

On 1.1.2019, Charles

retired from the partnership firm on the following arrangements.

(i) Stock to be

appreciated by 10%

(ii) Furniture to be

depreciated by 5%

(iii) To provide â‚ą 1,000 for bad debts

(iv) There is an

outstanding repairs of â‚ą

11,000 not yet recorded

(v) The final

amount due to Charles was paid by cheque

Prepare revaluation

account, partners’ capital account and the balance sheet of the firm after

retirement.

Solution

Illustration 18

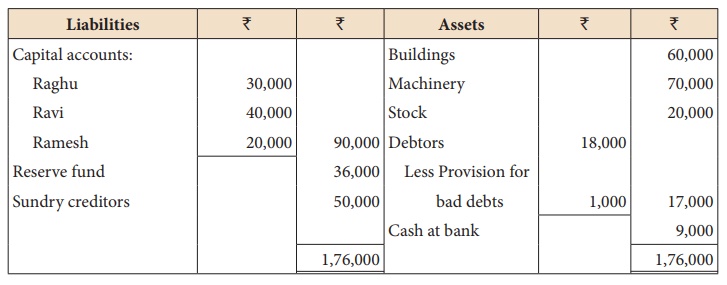

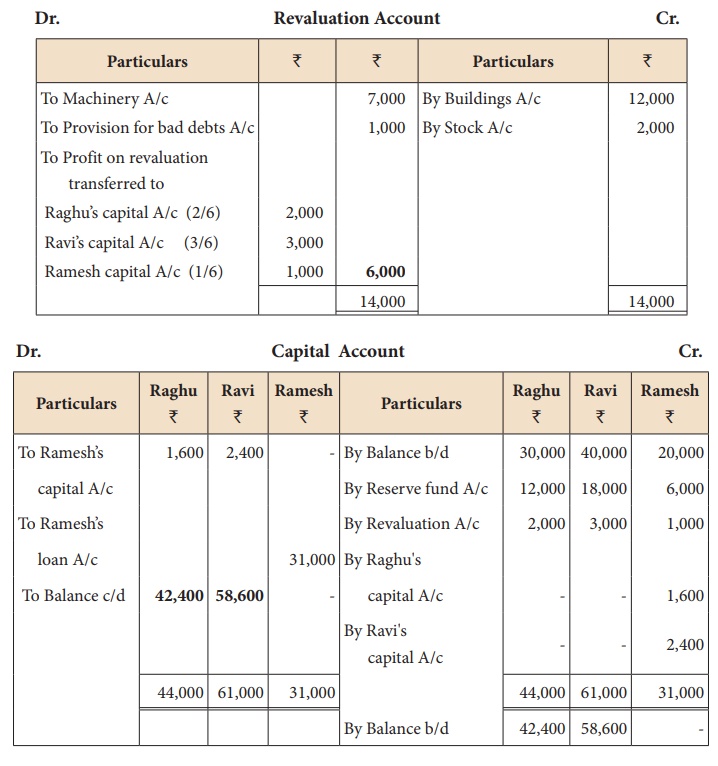

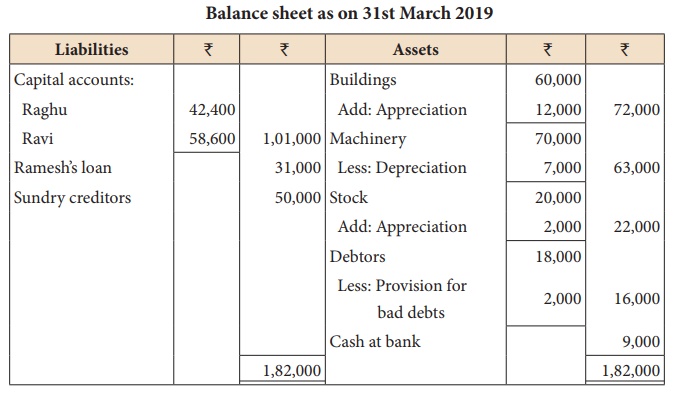

Raghu, Ravi and Ramesh

are partners in a firm sharing profits and losses in the ratio of 2:3:1.

Their balance sheet as

on 31st March, 2019 was as follows:

Ramesh retires on

31.3.2019 subject to the following conditions:

i.

Goodwill of the firm is valued at â‚ą 24,000

ii.

Machinery to be depreciated by 10%

iii.

Buildings to be appreciated by 20%

iv.

Stock to be appreciated by â‚ą

2,000

v.

Provision for bad debts to be raised by â‚ą 1,000

vi.

Final amount due to Ramesh is not paid immediately

Prepare the necessary

ledger accounts and show the balance sheet of the firm after retirement.

Solution

Tutorial note

1. As new profit sharing

ratio and proportion of gain is not given, it is assumed that the continuing

partners gain in their old profit sharing ratio of 2:3.

2. Ramesh share of

goodwill = 24, 000 Ă—

1/6 = â‚ą 4,000

Goodwill of Ramesh to be

borne by

Raghu: 4,000 Ă— 2/5 = â‚ą 1,600

Ravi : 4,000 Ă— 3/5

= â‚ą 2,400

Illustration 19

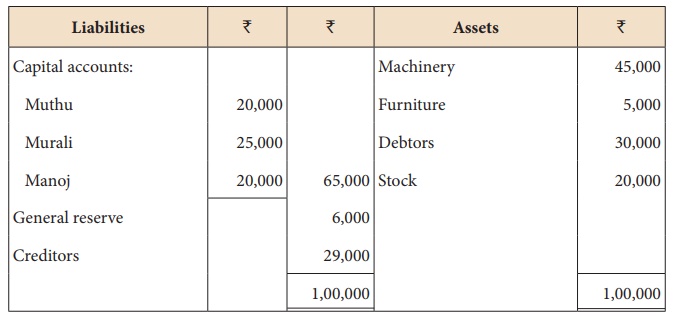

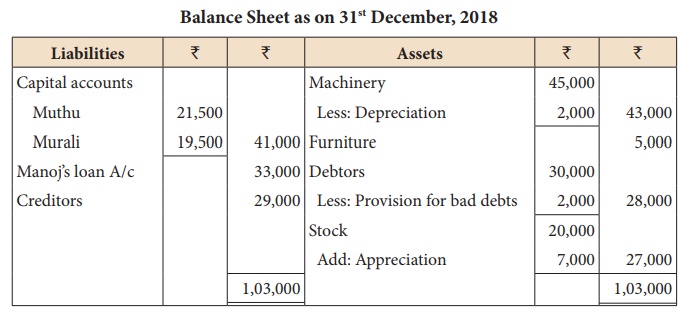

Muthu, Murali and Manoj

are partners in a firm and sharing profits and losses in the ratio 3:1:2. Their

balance sheet as on 31st December, 2018 is given below:

Manoj retires on 31st

December, 2018 subject to the following conditions:

(i) Muthu and Murali

will share profits and losses in the ratio of 3:2

(ii) Assets are to be

revalued as follows:

Machinery â‚ą 43,000, stock â‚ą 27,000, debtors â‚ą 28,000.

(iii) Goodwill of the

firm is valued at â‚ą

30,000

(iv) The final amount

due to Manoj is not paid immediately

Prepare necessary ledger

accounts and the balance sheet immediately after the retirement of Manoj.

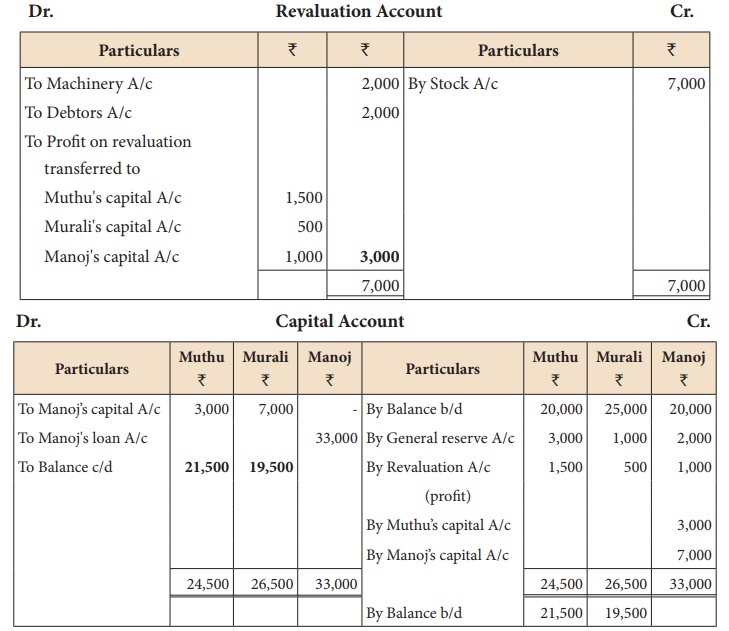

Solution

Note:

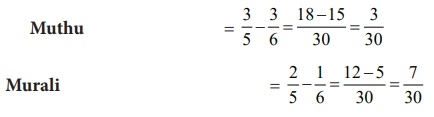

(i) Computation of gaining ratio

Share gained = New share – old share

Therefore, the gaining ratio of

Muthu and Murali is 3:7

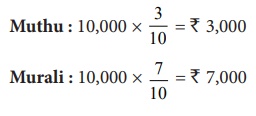

(ii) Adjustment for goodwill

Goodwill of the firm = â‚ą 30,000

Share of goodwill to Manoj = 30,000

Ă— 2/6 = â‚ą 10,000

It is to be adjusted in the capital

accounts of Muthu and Murali in the gaining ratio of 3:7

That is,

Related Topics