Retirement and Death of a Partner | Accountancy - Adjustment for goodwill | 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Chapter: 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Adjustment for goodwill

Adjustment

for goodwill

Reputation built up by a

firm has an impact on the present and future profit to be earned by the firm.

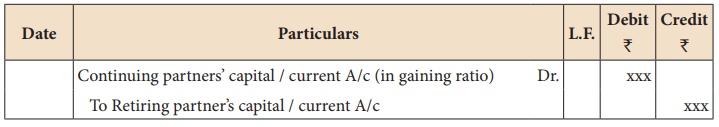

At the time of retirement of a partner, the continuing partners gain part of

retiring partner’s share of profit. Hence, the retiring partner’s share of

goodwill is to be valued and adjusted through the capital accounts of the

gaining partners. The following journal entry is passed.

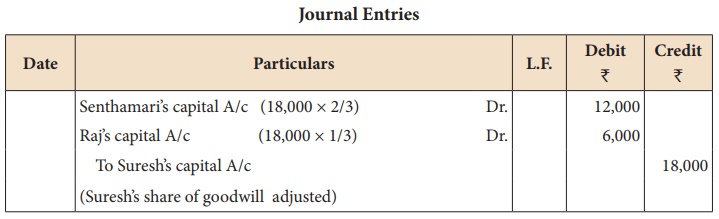

Illustration 12

Suresh, Senthamarai and

Raj were partners in a firm sharing profits and losses in the ratio of 3:2:1.

Suresh retired from partnership. The goodwill of the firm on the date of

retirement was valued at â‚ą

36,000. Pass necessary journal entries for goodwill on the assumption that the

fluctuating capital system is followed.

Solution

As the new profit sharing ratio and gain made by the continuing partners is not mentioned, it is assumed that they gain in their old profit sharing ratio of 2:1. Therefore, gaining ratio is 2:1.

Suresh’s share of

goodwill = 36, 000 x 3/6 = â‚ą 18,000

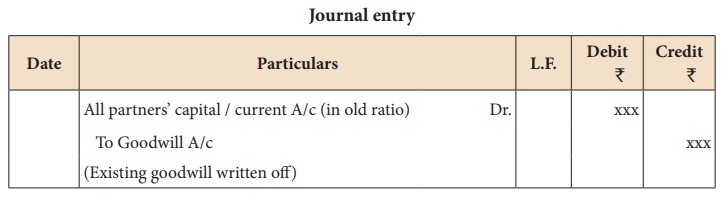

Existing goodwill

If goodwill already

appears in the balance sheet, at the time of retirement if the partners decide,

it can be written off by transferring it to all the partners’ capital account /

current account in the old profit sharing ratio. The following journal entry is

to be passed:

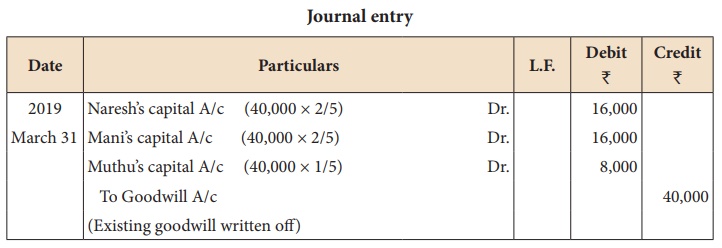

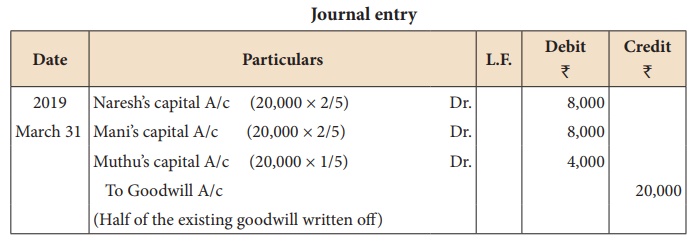

Illustration 13

Naresh, Mani and Muthu

are partners in a firm sharing profits and losses in the ratio of 2:2:1. On

31st March 2019, Muthu retires from the firm. On the date of Muthu’s

retirement, goodwill appeared in the books of the firm at â‚ą 40,000. By assuming

fluctuating capital method, pass the necessary journal entry if the partners

decide to

a)

write off the entire amount of existing goodwill

b) write off half of the amount of existing goodwill.

Solution

(a) Write off the entire amount of existing goodwill

Related Topics