Retirement and Death of a Partner | Accountancy - Adjustments required on the death of a partner | 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Chapter: 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Adjustments required on the death of a partner

Adjustments

required on the death of a partner

When a partner dies,

there is dissolution or reconstitution of partnership. The following

adjustments are made on the death of a partner:

1.

Distribution of accumulated profits, reserves and losses

2.

Revaluation of assets and liabilities

3.

Determination of new profit sharing ratio and gaining ratio

4.

Adjustment for goodwill

5.

Adjustment for current year’s profit or loss upto the date of

death

6.

Settlement of the amount due to the deceased partner

The adjustments to be

done in the accounts incase of death of a partner is the same as in the case of

retirement of a partner except settlement of the amount due to the deceased

partner.

Incase of retirement,

the amount due from the firm is paid to the partner himself. But, when a

partner dies the amount due from the firm is paid to the executor or legal

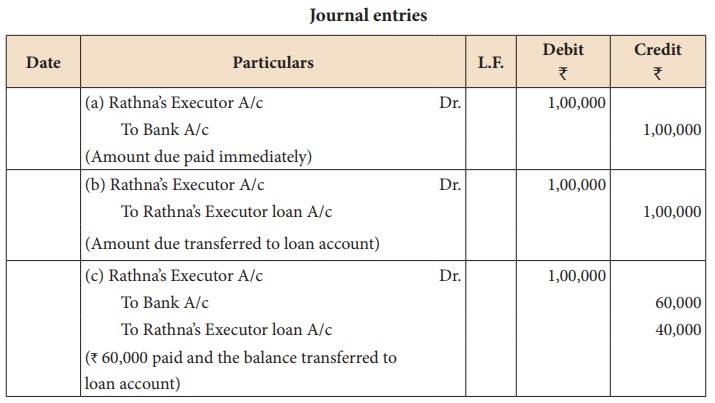

representative of the deceased partner. The following journal entries are

passed for settlement of the amount due to the deceased partner:

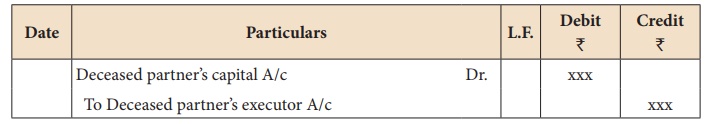

(i) To transfer the amount due to the deceased partner to the executor or legal representative of the deceased partner.

(ii) For payment made

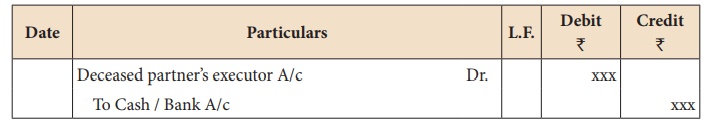

a. When the amount due is paid in cash immediately

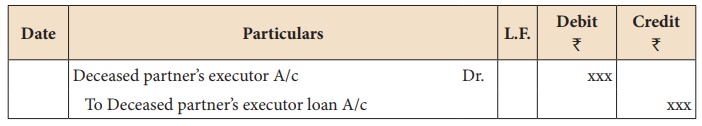

b. When the amount due is not paid immediately in cash

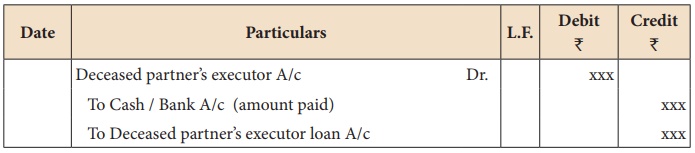

c. When the amount due is partly paid in cash immediately

Illustration: 20

Rathna, Baskar and

Ibrahim are partners sharing profits and losses in the ratio of 2:3:4

respectively. Rathna died on 31st December, 2018. Final amount due to her

showed a credit balance of â‚ą

1,00,000. Pass journal entries if,

b.

The amount due is paid off immediately by cheque.

c.

The amount due is not paid immediately.

d.

60,000 is paid immediately by cheque.

Solution

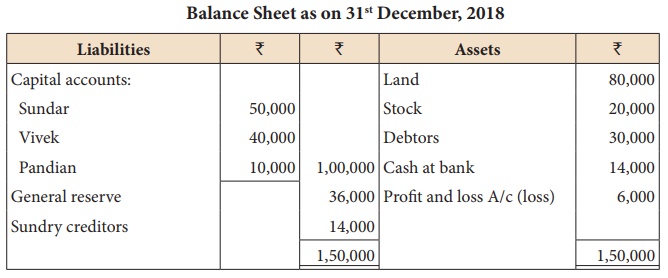

Illustration: 21

Sundar, Vivek and

Pandian are partners, sharing profits in the ratio of 3:2:1. Their balance

sheet as on 31st December, 2018 is as under:

On 1.1.2019, Pandian

died and on his death the following arrangements are made:

i.

Stock to be depreciated by 10%

ii.

Land is to be appreciated by â‚ą

11,000

iii.

Reduce the value of debtors by â‚ą

3,000

iv.

The final amount due to Pandian was not paid

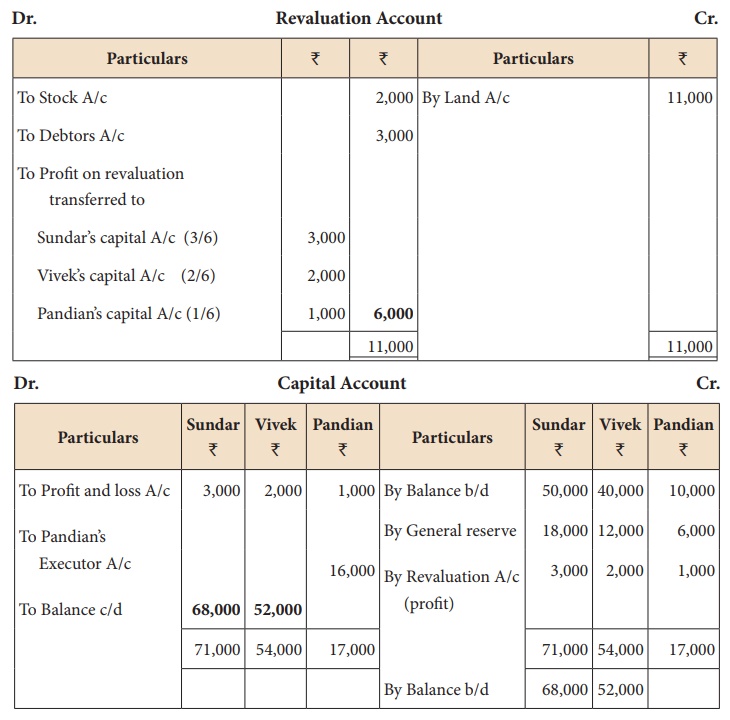

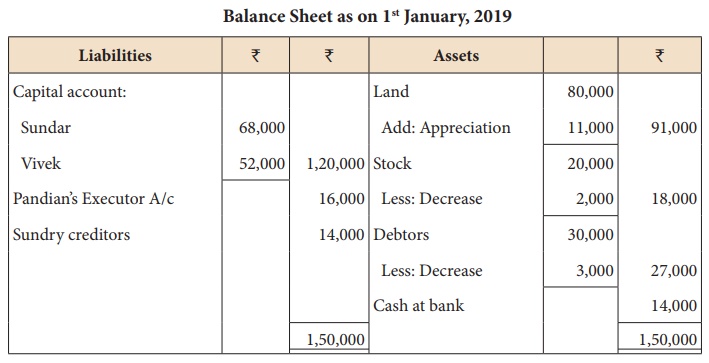

Prepare revaluation

account, partners’ capital account and the balance sheet of the firm after

death.

Solution

Illustration 22

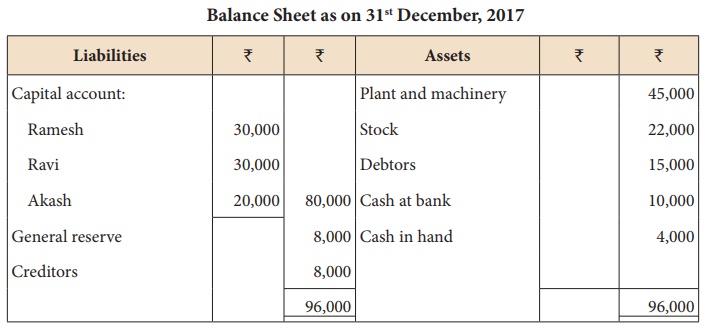

Ramesh, Ravi and Akash

are partners who share profits and losses in their capital ratio. Their balance

sheet as on 31.12.2017 is as follows:

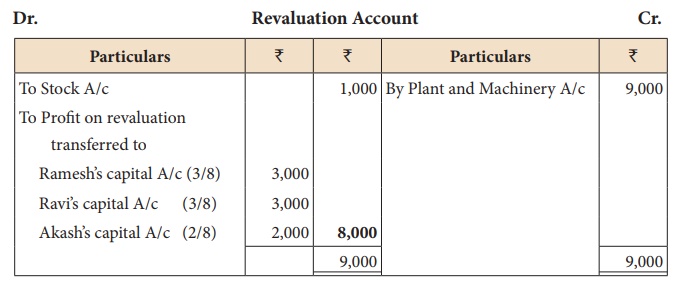

Akash died on 31.3.2018.

On the death of Akash, the following adjustments are made:

i.

Plant and machinery is to be valued at â‚ą 54,000

ii.

Stock is to be depreciated by â‚ą

1,000

iii.

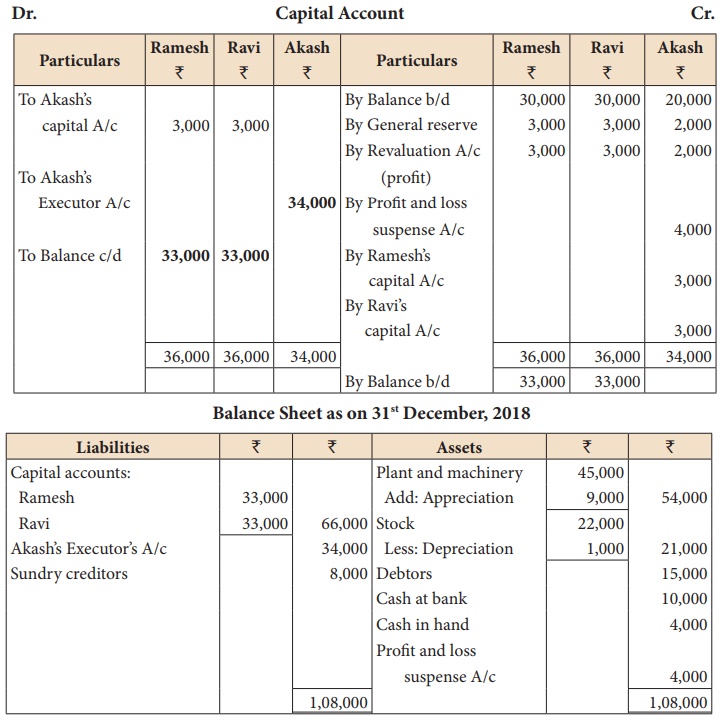

Goodwill of the firm is valued at â‚ą 24,000

iv.

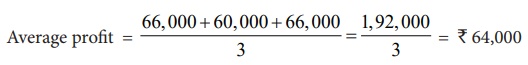

Share of profit of Akash is to be calculated from the closing of

the last financial year to the date of death on the basis of the average of the

three completed years’ profit before death. Profit for 2015, 2016 and 2017 were

â‚ą 66,000, â‚ą 60,000 and â‚ą 66,000 respectively.

Prepare the necessary

ledger accounts and the balance sheet immediately after the death of Akash.

Solution

Working notes:

(i) Profit sharing ratio

Profit sharing ratio = Capital ratio = 30,000: 30,000: 20,000

that is, 3:3:2

Gaining ratio between

Ramesh and Ravi = Old profit sharing ratio = 3:3 that is 1:1

(ii) Calculation of

Akash’s share of current year’s profit

Current year’s profit

upto the date of death = 64,000 Ă— 3/12 = â‚ą

16,000

Akash’s share of current

year’s profit = 16,000 × 2/8 = ₹

4,000

(iii) Akash’s share of

goodwill =

24,000 Ă— 2/8 = â‚ą 6,000

It is to be borne by

Ramesh and Ravi in the gaining ratio of 1:1

Related Topics