Admission of a Partner | Accountancy - Revaluation of assets and liabilities | 12th Accountancy : Chapter 5 : Admission of a Partner

Chapter: 12th Accountancy : Chapter 5 : Admission of a Partner

Revaluation of assets and liabilities

Revaluation

of assets and liabilities

When a partner is

admitted into the partnership, the assets and liabilities are revalued as the

current value may differ from the book value. Determination of current values

of assets and liabilities is called revaluation of assets and liabilities. The

reasons for revaluation of assets and liabilities are as follows:

i.

To give a true and fair view of the state of affairs of the firm

and

ii.

To share the gain arising from the revaluation of assets and

liabilities as it is due to the old partners.

There are two ways in

which the revaluation of assets and liabilities may be dealt with in the

accounts.

a) Revised value of assets

and liabilities are shown in the books

b) Revised value of assets

and liabilities are not shown in the books

1. When revised value of assets and liabilities are shown in the books

Under this method, the

assets and liabilities are shown at their revised values in the books and in

the balance sheet which is prepared immediately after the admission of a partner.

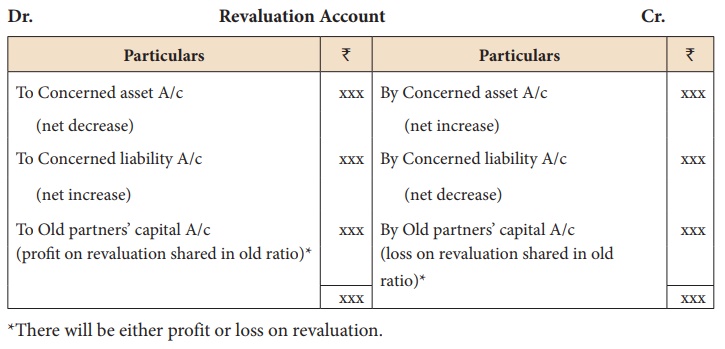

A Revaluation account is opened to record the increase or decrease in assets

and liabilities. Revaluation account is also called Profit and loss adjustment

account. It is a nominal account. Revaluation account is credited with increase

in value of assets and decrease in the value of liabilities. It is debited with

decrease in value of assets and increase in the value of liabilities.

Unrecorded assets if any are credited and unrecorded liabilities if any are

debited to the revaluation account. The profit or loss arising therefrom is

transferred to the capital accounts of the old partners in the old profit

sharing ratio. If the total of the credit side of the revaluation account

exceeds the total of the debit side, the difference is profit on revaluation.

If the total of the debit side of the revaluation account exceeds the total of

the credit side, the difference is loss on revaluation.

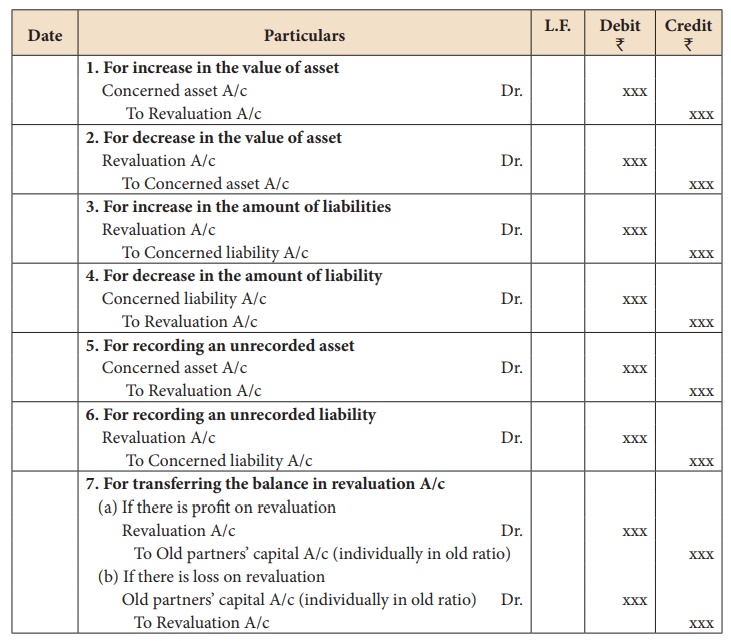

Following are the

journal entries to be passed to record the revaluation of assets and

liabilities:

Format

of Revaluation Account:

*There will be either profit or loss

on revaluation.

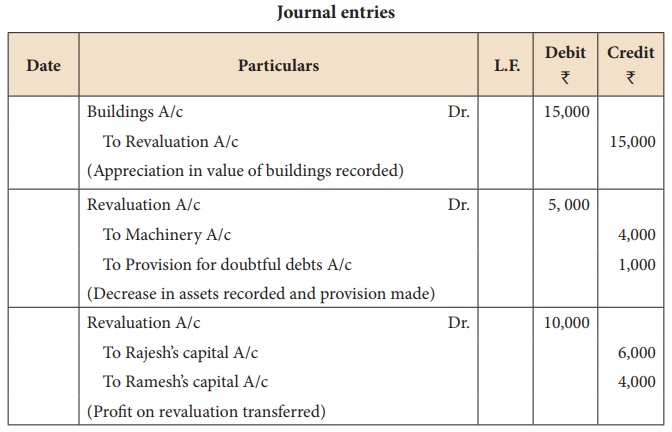

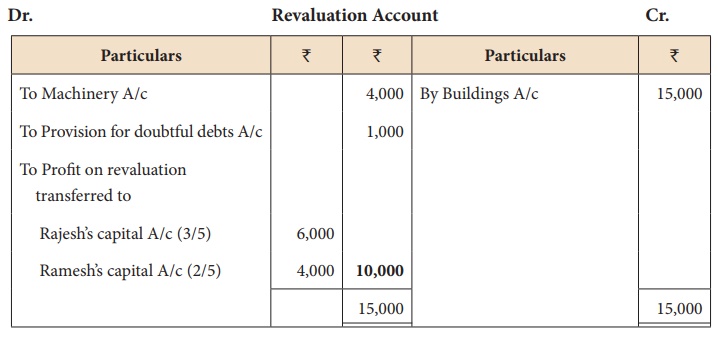

Illustration 4

Rajesh and Ramesh are

partners sharing profits in the ratio 3:2. Raman is admitted as a new partner

and the new profit sharing ratio is decided as 5:3:2. The following

revaluations are made. Pass journal entries and prepare revaluation account.

a) The value of building is

increased by ₹ 15,000.

b) The value of the

machinery is decreased by ₹

4,000.

c) Provision for doubtful

debt is made for ₹

1,000.

Solution

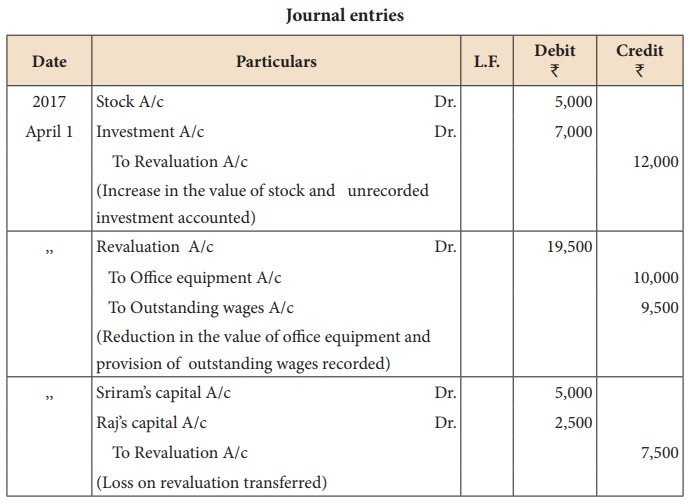

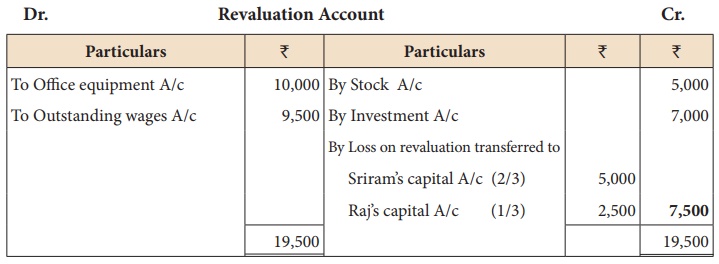

Illustration 5

Sriram and Raj are

partners sharing profits and losses in the ratio of 2:1. Nelson joins as a

partner on 1st April 2017. The following adjustments are to be made:

i.

Increase the value of stock by ₹

5,000

ii.

Bring into record investment of ₹ 7,000 which had not been recorded in the books

of the firm.

iii.

Reduce the value of office equipment by ₹ 10,000

iv.

A provision would also be made for outstanding wages for ₹ 9,500.

Give journal entries and

prepare revaluation account.

Solution

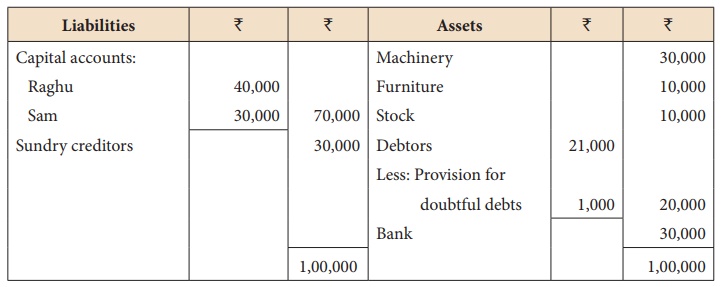

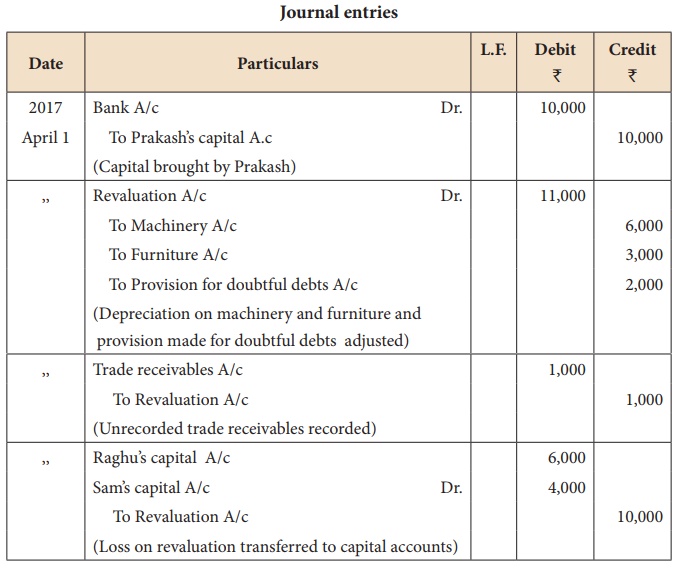

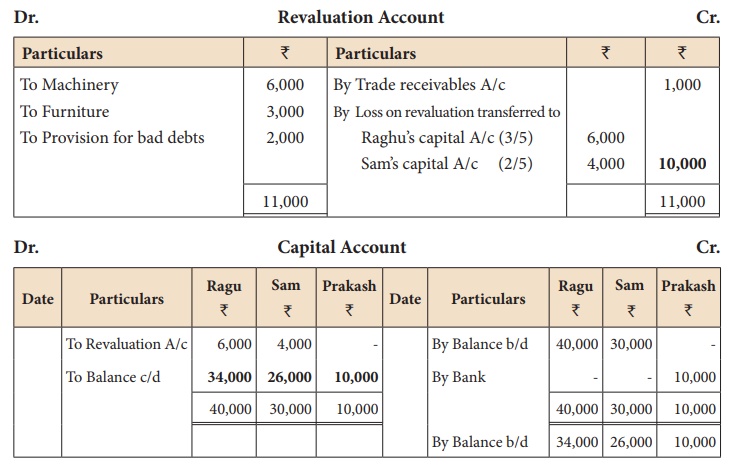

Illustration 6

Raghu and Sam are

partners in a firm sharing profits and losses in the ratio of 3:2. Their

balance sheet as on 31st March, 2017 is as follows:

Prakash is admitted on

1.4.2017 subject to the following conditions:

a) He has to bring a

capital of ₹ 10,000

b) Machinery is valued at ₹ 24,000

c) Furniture to be

depreciated by ₹

3,000

d) Provision for doubtful

debts should be increased to ₹

3,000

e) Unrecorded trade

receivables of ₹

1,000 would be brought into books now

Pass necessary journal

entries and prepare revaluation account and capital account of partners after

admission.

Solution

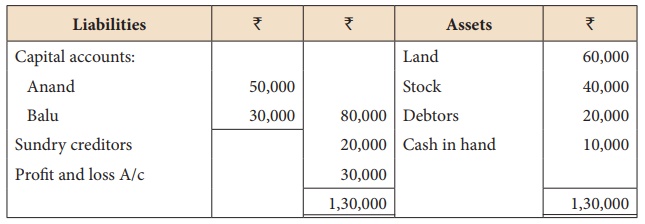

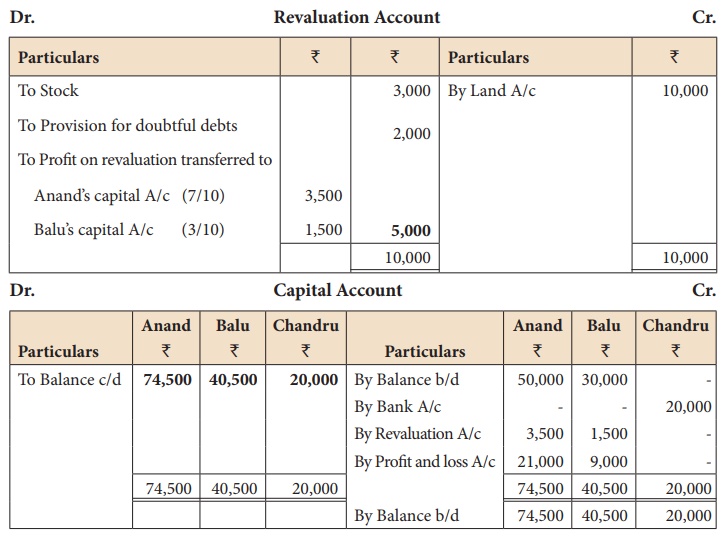

Illustration 7

Anand and Balu are

partners in a firm sharing profits and losses in the ratio of 7:3. Their

balance sheet as on 31st March, 2018 is as follows:

Chandru is admitted as a

new partner on 1.4.2018 by introducing a capital of ₹ 20,000 for 1/4 share in

the future profit subject to the following adjustments:

a) Stock to be depreciated

by ₹ 3,000

b) Provision for doubtful

debts to be created for ₹

2,000.

c) Land was to be

appreciated by ₹

10,000

Prepare revaluation

account and capital account of partners after admission.

Solution

2. When revised values of assets and liabilities are not shown in the books

Under this method, the

assets and liabilities are shown at their original values and not at the

revised values in the books and in the balance sheet which is prepared

immediately after the admission of a partner. The net result of revaluation is

adjusted through the capital accounts of the partners. A Memorandum revaluation

account which is a temporary account is opened when the revised values are not

to be shown in the books of accounts.

Related Topics