Admission of a Partner | Accountancy - Adjustment for goodwill | 12th Accountancy : Chapter 5 : Admission of a Partner

Chapter: 12th Accountancy : Chapter 5 : Admission of a Partner

Adjustment for goodwill

Adjustment

for goodwill

Reputation built up by a

firm has an impact on the present profit and future profit to be earned by the

firm. At the time of admission of a partner, the existing partners sacrifice

part of their share of profit in favour of the new partner. Hence, to

compensate the sacrifice made by the existing partners, goodwill of the firm

has to be valued and adjusted. In addition to capital, the new partner may

contribute towards goodwill. This goodwill is distributed in the sacrificing

ratio to the old partners who sacrifice.

1. Accounting treatment for goodwill

Accounting treatment for

goodwill on admission of a partner is disccussed below:

1. When new partner brings

cash towards goodwill

2. When the new partner

does not bring goodwill in cash or in kind

3. When the new partner

brings only a part of the goodwill in cash or in kind

4. Existing goodwill

1. When new partner brings cash towards goodwill

When the new partner

brings cash towards goodwill in addition to the amount of capital, it is

distributed to the existing partners in the sacrificing ratio. The following

journal entries are to be made:

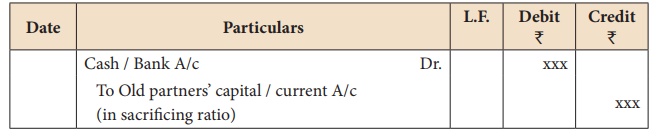

(i) For the goodwill brought in cash credited to old partners’ capital account

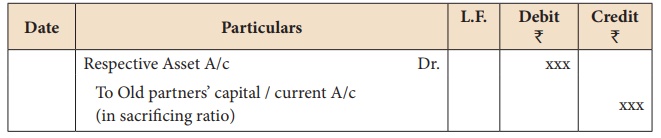

(ii) For the goodwill brought in kind (in the form of assets) credited to old partners’ capital account

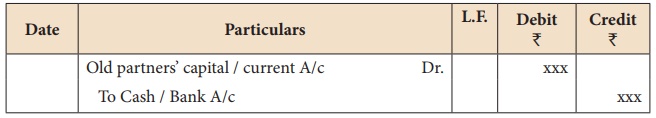

(iii) For withdrawal of cash received for goodwill by the old partners

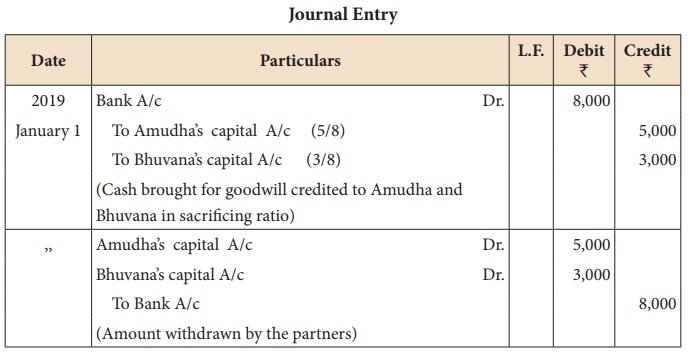

Illustration 18

Amudha and Bhuvana are

partners who share profits and losses in the ratio of 5:3. Chithra joins the

firm on 1st January, 2019 for 3/8 share of profits and brings in cash for her

share of goodwill of ₹

8,000. Pass necessary journal entry for adjusting goodwill on the assumption

that the fluctuating capital method is followed and the partners withdraw the

entire amount of their share of goodwill.

Solution

As the sacrifice made by

the existing partners is not mentioned, it is assumed that they sacrifice in

their old profit sharing ratio 5:3. Therefore, sacrificing ratio is 5:3.

Illustration 19

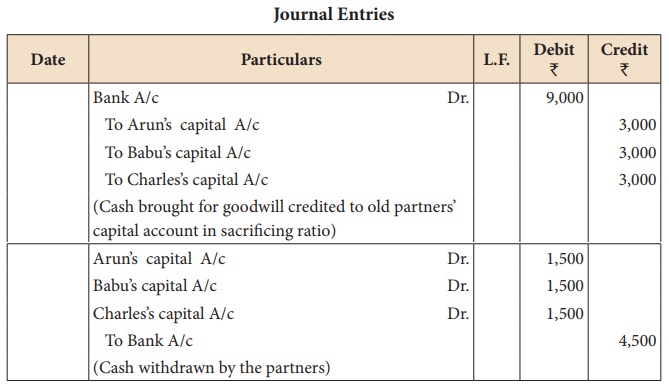

Arun, Babu and Charles

are partners sharing profits and losses equally. They admit Durai into

partnership for 1/4 share in future profits. The goodwill of the firm is valued

at ₹ 36,000 and Durai

brought cash for his share of goodwill. The existing partners withdraw half of

the amount of their share of goodwill. Pass necessary journal entries on the

assumption that the fluctuating capital method is followed.

Solution

Durai’s share of

goodwill = 36,000 × 1/4 = ₹

9,000

As the sacrifice made by

the existing partners is not mentioned, it is assumed that they sacrifice in

their old profit sharing ratio 1:1:1. Therefore, sacrificing ratio is 1:1:1.

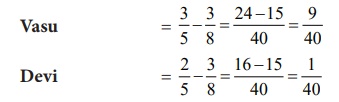

Illustration 20

Vasu and Devi are

partners sharing profits and losses in the ratio of 3:2. They admit Nila into

partnership for 1/4 share of profit. Nila pays cash ₹ 3,000 towards her share

of goodwill. The new ratio is 3:3:2. Pass necessary journal entry on the

assumption that the fixed capital system is followed.

Solution

Calculation of

sacrificing ratio

Sacrificing ratio = Old

share – New share

Therefore, sacrificing ratio is 9:1

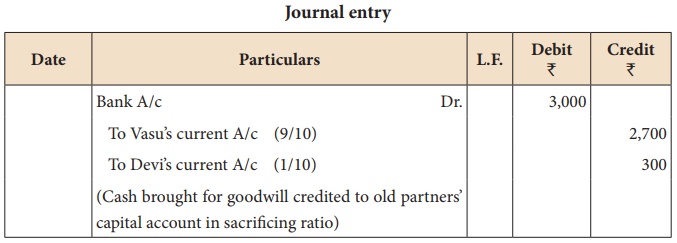

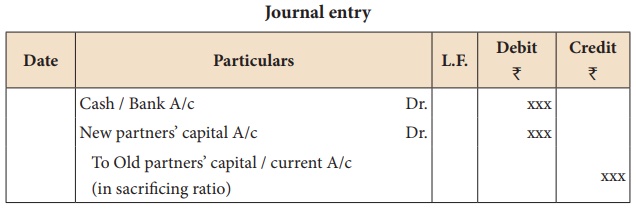

2. When the new partner does not bring goodwill in cash or in kind

If the new partner does

not bring goodwill in cash or in kind, his share of goodwill must be adjusted

through the capital accounts of the partners. The following journal entry is

passed.

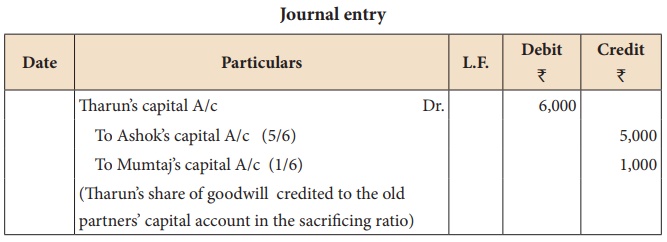

Illustration 21

Ashok and Mumtaj were

partners in a firm sharing profits and losses in the ratio of 5:1. They have

decided to admit Tharun into the firm for 2/9 share of profits. The goodwill of

the firm on the date of admission was valued at ₹ 27,000. Tharun is not able to bring in cash for

his share of goodwill. Pass necessary journal entries for goodwill on the

assumption that the fluctuating capital system is followed.

Solution

As the sacrifice made by

the existing partners is not mentioned, it is assumed that they sacrifice in

their old profit sharing ratio of 5:1. Therefore, sacrificing ratio is 5:1.

Tharun’s share of goodwill = 27,000

x 2/9 = ₹ 6,000

3. When the new partner brings only a part of the goodwill in cash or in kind

Sometimes the new

partner may bring only a part of the goodwill in cash or assets. In such a

case, for the cash or the assets brought, the respective account is debited and

for the amount not brought in cash or kind, the new partner’s capital account

is debited. The following journal entry is passed.

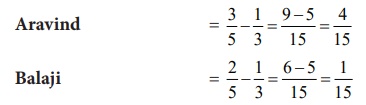

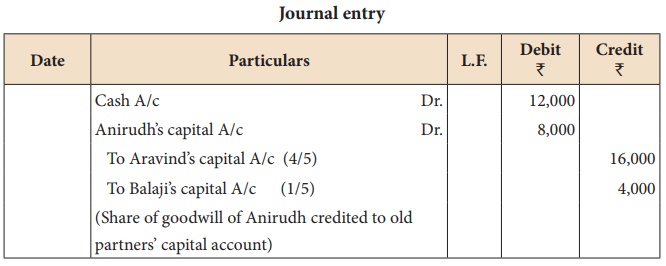

Illustration 22

Aravind and Balaji are

partners sharing profits and losses in 3:2 ratio. They admit Anirudh into

partnership. The new profit sharing ratio is agreed at 1:1:1. Anirudh’s share

of goodwill is valued at ₹

20,000 of which he pays ₹

12,000 in cash. Pass necessary journal entries for goodwill on the assumption

that the fluctuating capital method is followed.

Solution

Calculation of sacrificing ratio

Sacrificing ratio = Old

share – New share

Therefore, sacrificing ratio is 4:1

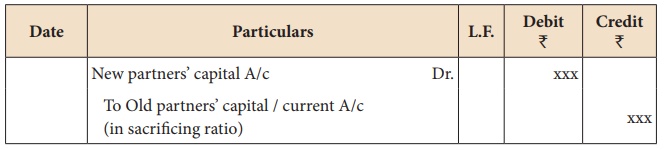

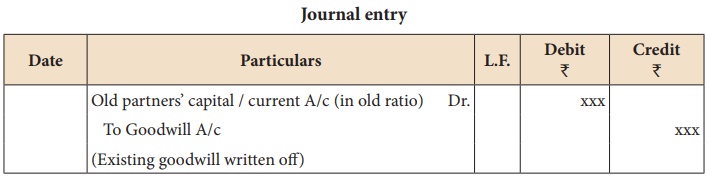

4. Existing goodwill

If goodwill already

appears in the books of accounts, at the time of admission if the partners

decide, it can be written off by transferring it to the existing partners’

capital account / current account in the old profit sharing ratio. The

following journal entry is to be passed:

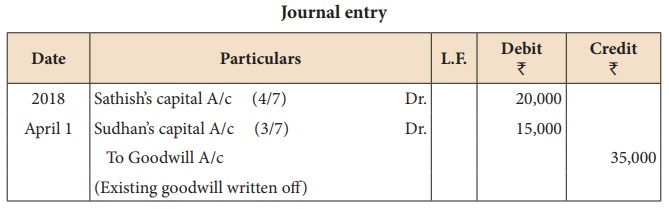

Illustration 23

Sathish and Sudhan are

partners in a firm sharing profits and losses in the ratio of 4:3. On 1st April

2018, they admitted Sasi as a partner. On the date of Sasi’s admission,

goodwill appeared in the books of the firm at ₹ 35,000. By assuming fluctuating capital

account, pass the necessary journal entry if the partners decide to

(i) write off the entire

amount of existing goodwill

(ii) write off ₹ 21,000 of the existing goodwill.

Solution

(i) To write off the entire amount of existing goodwill

Journal entry

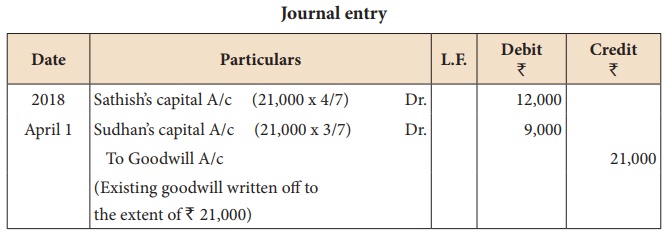

(ii) To write off ₹ 21,000 of the existing goodwill

Journal entry

Related Topics