Admission of a Partner | Accountancy - Adjustments required at the time of admission of a partner | 12th Accountancy : Chapter 5 : Admission of a Partner

Chapter: 12th Accountancy : Chapter 5 : Admission of a Partner

Adjustments required at the time of admission of a partner

Adjustments

required at the time of admission of a partner

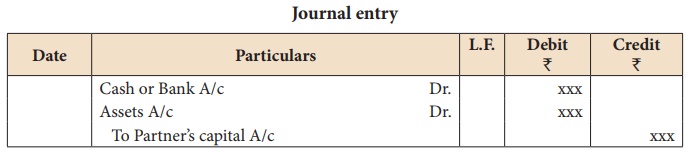

On admission, the new

partner may bring capital in cash or in kind or both. The following journal

entry is passed to record the capital brought in.

On the admission of a

partner, generally there is a change in the mutual rights of the partners. The

new partner becomes liable for all the acts which are carried out by the firm

from the date of his / her admission into the firm. Hence, the accumulated

profits, losses and reserves before admission are to be distributed to the

existing partners. Similarly, assets and liabilities are to be revalued and the

profit or loss on revaluation is to be distributed to the existing partners.

The following adjustments are necessary at the time of admission of a partner:

1. Distribution of

accumulated profits, reserves and losses

2. Revaluation of assets

and liabilities

3. Determination of new

profit-sharing ratio and sacrificing ratio

4. Adjustment for goodwill

5. Adjustment of capital on

the basis of new profit sharing ratio (if so agreed)

Related Topics