Admission of a Partner | Accountancy - Adjustment of capital on the basis of new profit sharing ratio | 12th Accountancy : Chapter 5 : Admission of a Partner

Chapter: 12th Accountancy : Chapter 5 : Admission of a Partner

Adjustment of capital on the basis of new profit sharing ratio

Adjustment

of capital on the basis of new profit sharing ratio

Sometimes, it may be

agreed by the partners that their capitals in the reconstituted firm be in the

proportion of their new profit sharing ratio. There can be two situations.

The new partner may be

required to bring proportionate capital for his share of profit. New partner’s

capital is calculated on the basis of the capital of the reconstituted firm or

on the basis of combined capitals of the old partners for their share of

profit.

The old partners may be

required to make their capital in proportion to their new profit sharing ratio.

Old partners’ capital is calculated on the basis of the capital brought by the

new partner for his share of profit. The deficiency or excess in the old

partners’ capital account may be adjusted through the current accounts or cash

may be brought in or withdrawn by the partners.

Comprehensive

problems

Illustration 24

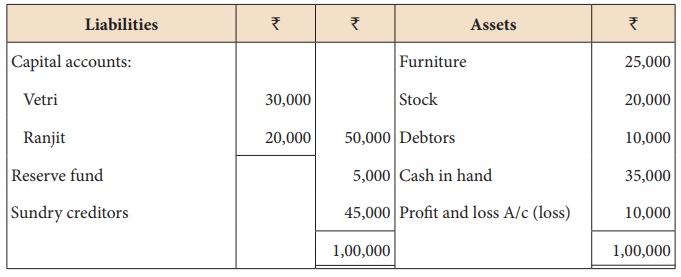

Vetri and Ranjit are

partners, sharing profits in the ratio of 3:2. Their balance sheet as on 31st December

2017 is as under:

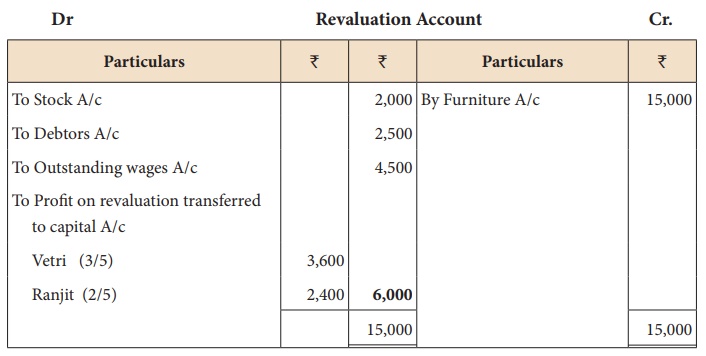

On 1.1.2018, they admit

Suriya into their firm as a partner on the following arrangements.

(i) Suriya brings ₹ 10,000 as capital for

1/4 share of profit.

(ii) Stock to be

depreciated by 10%

(iii) Debtors to be

revalued at ₹ 7,500.

(iv) Furniture to be

revalued at ₹ 40,000.

(v) There is an

outstanding wages of ₹

4,500 not yet recorded.

Prepare revaluation

account, partners’ capital account and the balance sheet of the firm after

admission.

Solution

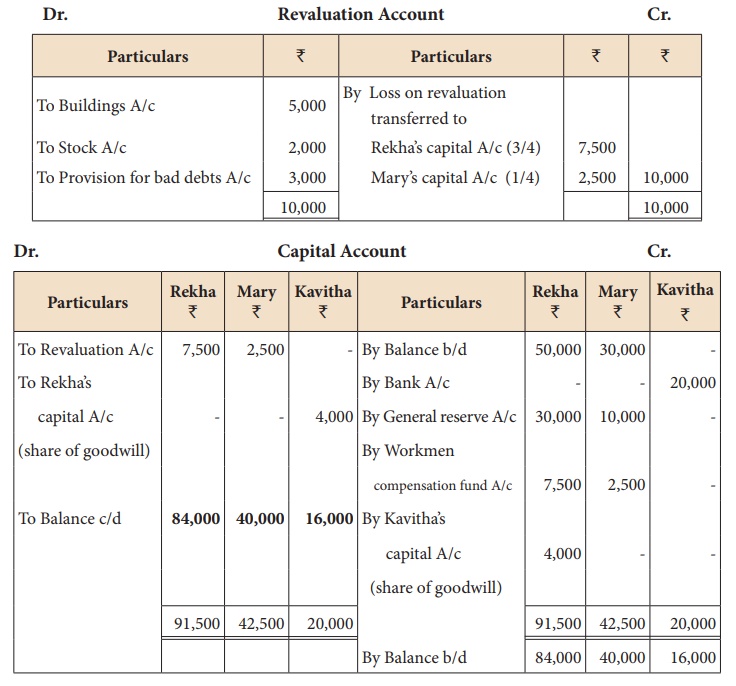

Illustration 25

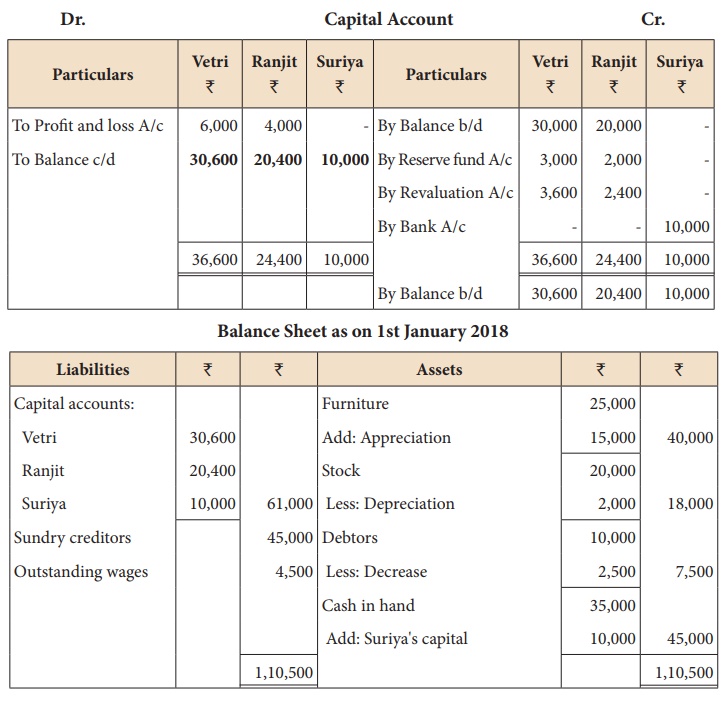

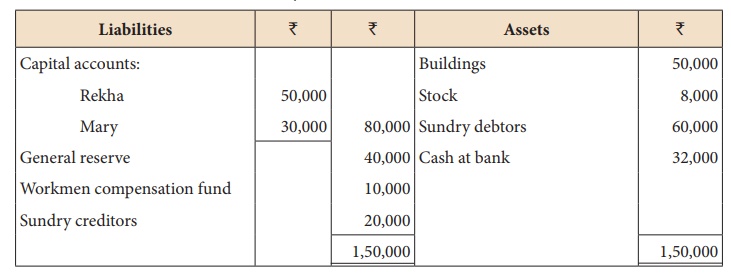

The balance sheet of

Rekha and Mary on 31st March 2018 is as follows:

They share the profits

and losses in the ratio of 3:1.They agreed to admit Kavitha into the

partnership firm for 1/4 share of profit which she gets entirely from Rekha.

Following are the

conditions:

i.

Kavitha has to bring ₹

20,000 as capital. Her share of goodwill is valued at 4,000. She could not

bring cash towards goodwill.

ii.

Depreciate buildings by 10%

iii.

Stock to be revalued at ₹

6,000

iv.

Create provision for doubtful debts at 5% on debtors

Prepare necessary ledger

accounts and the balance sheet after admission.

Solution

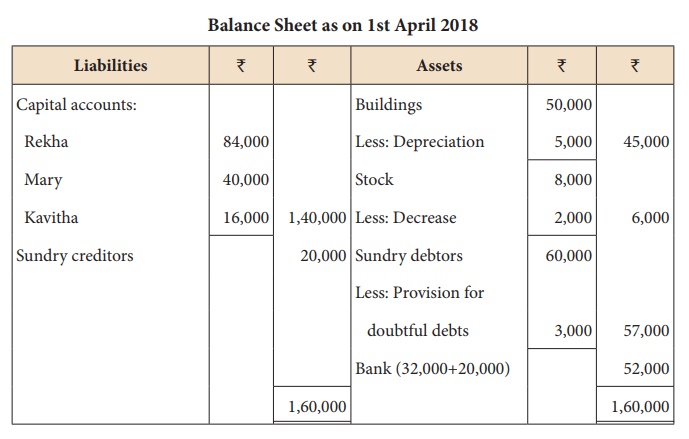

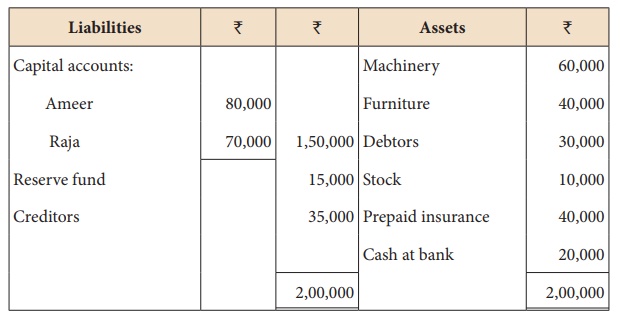

Illustration 26

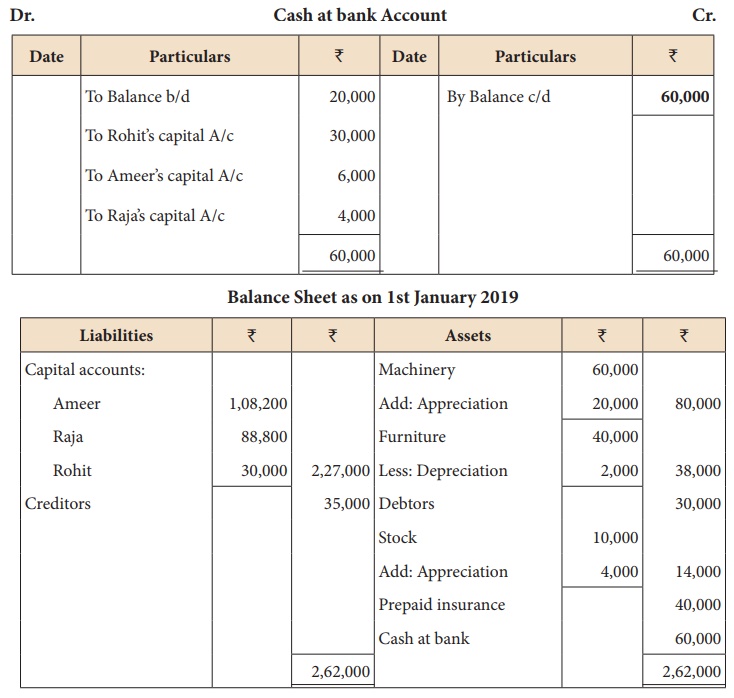

Ameer and Raja are

partners sharing profits in the ratio of 3:2. Their balance sheet is shown as

under on 31.12.2018.

Rohit is admitted as a

new partner who introduces a capital of ₹

30,000 for his 1/5 share in future profits. He brings ₹ 10,000 for his share of

goodwill.

Following revaluations

are made:

i.

Stock is to be appreciated to ₹

14,000

ii.

Furniture is to be depreciated by 5%

iii.

Machinery is to be revalued at ₹

80,000

Prepare the necessary

ledger accounts and the balance sheet after the admission.

Solution

*Note: Since the

sacrificing ratio is not given and the new partner’s share is given, it is

assumed that the old profit sharing ratio (3:2) is the sacrificing ratio and

the new partner’s share of goodwill is distributed to the old partners

accordingly.

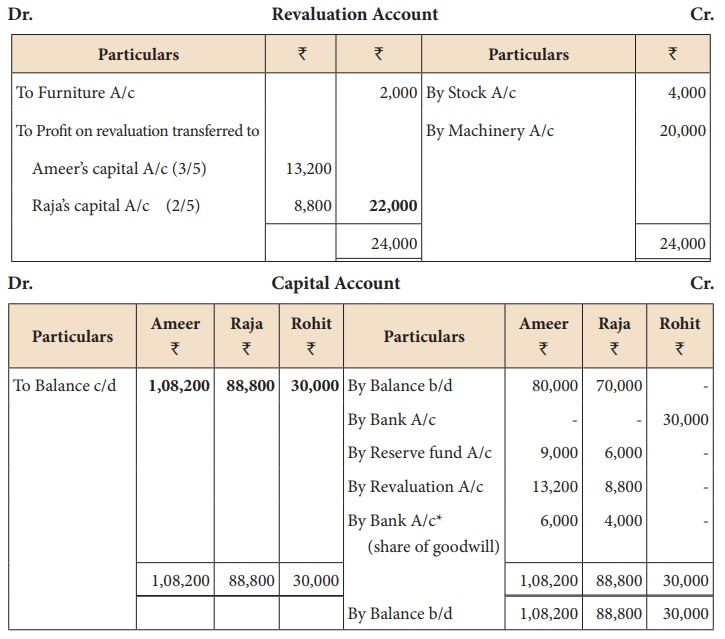

Illustration 27

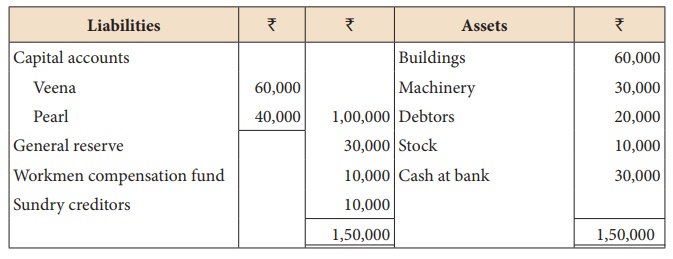

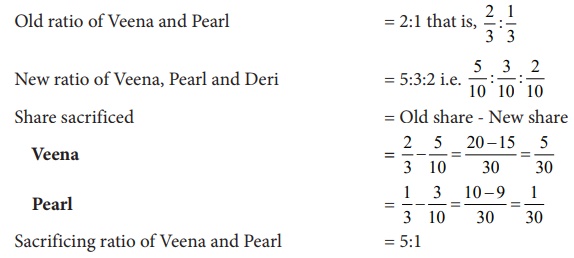

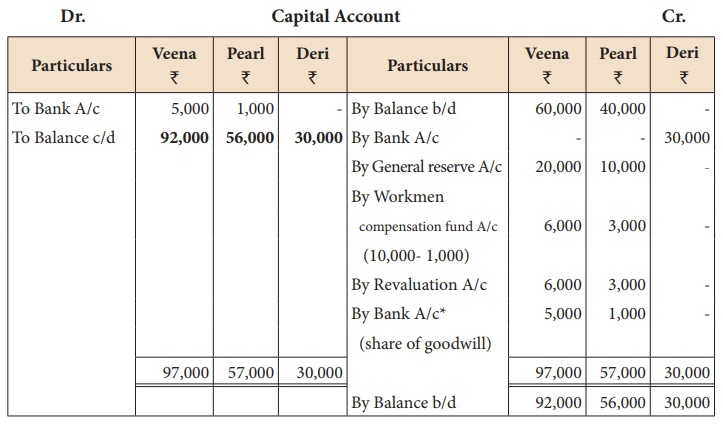

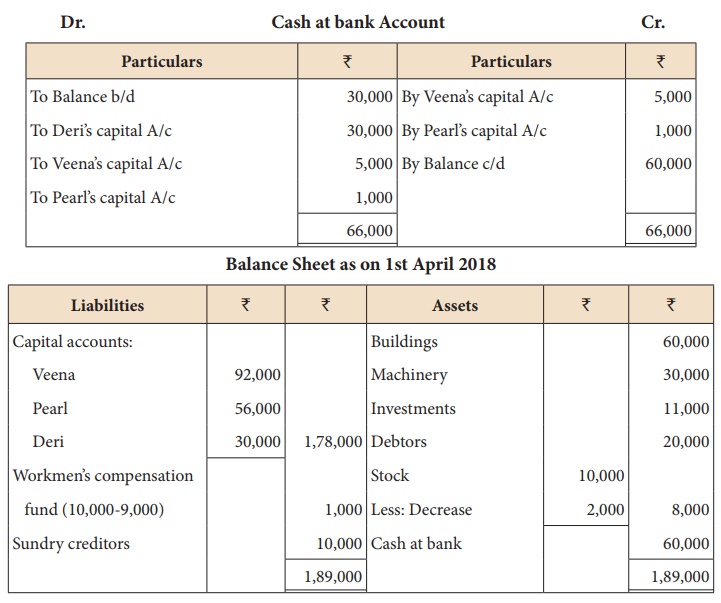

Veena and Pearl are

partners in a firm sharing profits and losses in the ratio of 2:1. Their

balance sheet as on 31st March, 2018 is as follows:

Deri is admitted on

1.4.2018 subject to the following conditions:

a) The new profit sharing

ratio among Veena, Pearl and Deri is 5:3:2.

b) Deri has to bring a

capital of ₹ 30,000

c) Stock to be depreciated

by 20%

d) Anticipated claim on

workmen compensation fund is ₹

1,000

e) Unrecorded investment of

₹ 11,000 has to be

brought into books

f)

The goodwill of the firm is valued at ₹ 30,000 and Deri brought

cash for his share of goodwill. The existing partners withdraw the entire

amount brought by Deri towards goodwill.

Prepare the necessary

ledger accounts and balance sheet after admission.

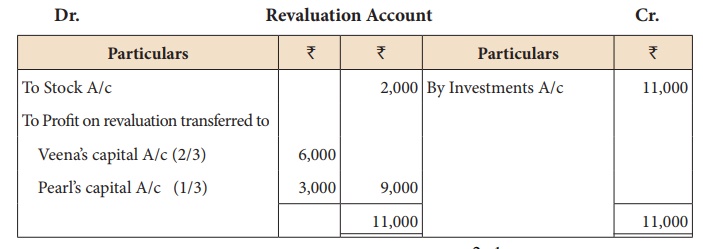

Solution

* Goodwill of the firm is ₹ 30,000

Deri’s share of goodwill = 30,000 ×

2/10 = ₹ 6,000

It is to be distributed to Veena and

Pearl in their sacrificing ratio of 5:1

Related Topics