Admission of a Partner | Accountancy - Distribution of accumulated profits, reserves and losses | 12th Accountancy : Chapter 5 : Admission of a Partner

Chapter: 12th Accountancy : Chapter 5 : Admission of a Partner

Distribution of accumulated profits, reserves and losses

Distribution

of accumulated profits, reserves and losses

Profits and losses of

previous years which are not distributed to the partners are called accumulated

profits and losses. Any reserve and accumulated profits and losses belong to

the old partners and hence these should be distributed to the old partners in

the old profit sharing ratio. Reserves include general reserve, reserve fund,

workmen compensation fund and investment fluctuation fund. Incase of workmen

compensation fund, the excess amount after providing for anticipated claim is

the accumulated profit to be transferred.

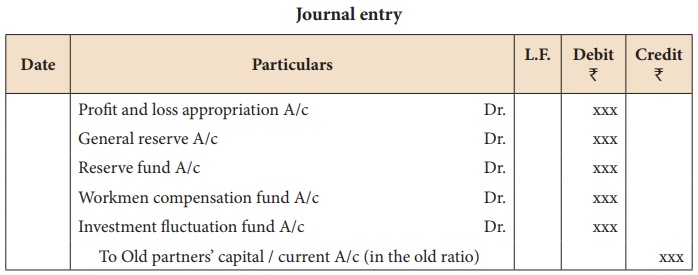

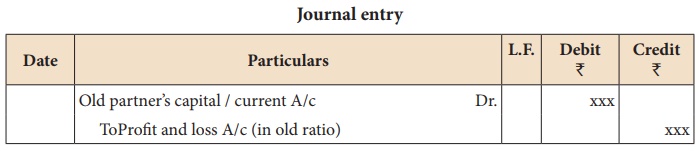

Following are the journal entries to be passed:

(a) For transferring accumulated profit and reserves

(b) For transferring accumulated loss

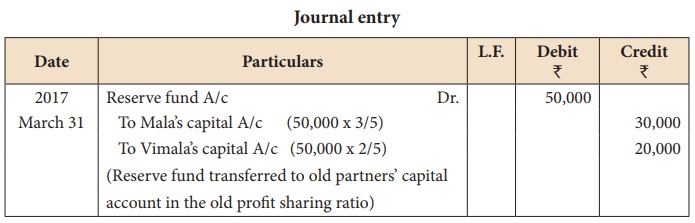

Illustration 1

Mala and Vimala were

partners sharing profits and losses in the ratio of 3:2. On 31.3.2017, Varshini

was admitted as a partner. On the date of admission, the book of the firm

showed a reserve fund of ₹

50,000. Pass the journal entry to distribute the reserve fund.

Solution

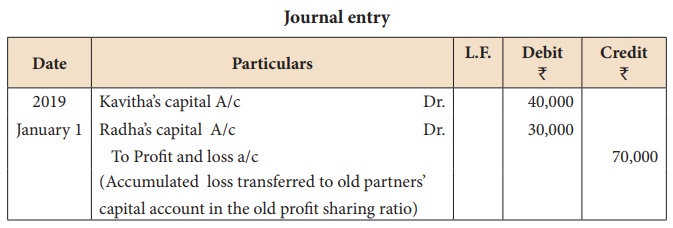

Illustration 2

Kavitha and Radha are

partners of a firm sharing profits and losses in the ratio of 4:3. They admit

Deepa on 1.1.2019. On that date, their balance sheet showed debit balance of

profit and loss account being accumulated loss of ₹ 70,000 on the asset

side of the balance sheet. Give the journal entry to transfer the accumulated

loss on admission.

Solution

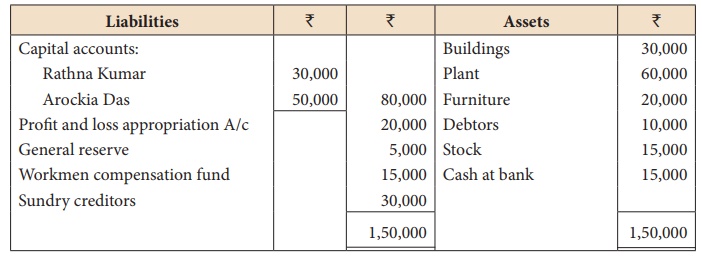

Illustration 3

Rathna Kumar and Arockia

Das are partners in a firm sharing profits and losses in the ratio of 3:2.

Their balance sheet as on 31st March, 2017 is as follows:

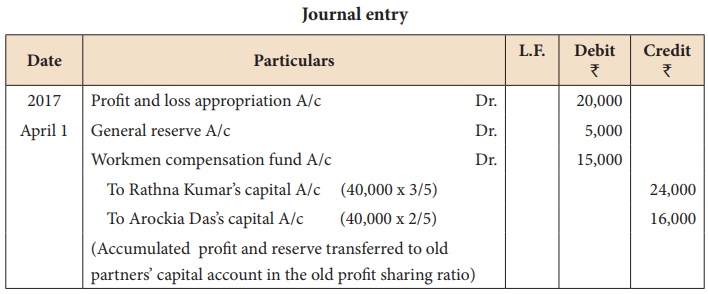

Solution

David was admitted into the

partnership on 1.4.2017. Pass journal entry to distribute the accumulated

profits and reserve on admission.

Related Topics