Economics - Credit | 9th Social Science : Economics: Money and Credit

Chapter: 9th Social Science : Economics: Money and Credit

Credit

Credit

Farmers avail credit

during monsoons for buying seeds, agricultural input and other expenses.

Traders and small entrepreneurs need credit for their needs. Even large

industries receive credit to take up their new projects.

Credit is available

from:

·

Formal financial institutions like nationalised and private banks

and co-operative banks

·

Informal financial institutions

·

Micro credit is received through Self Help Groups (SHG)

As far as nationalised

banks and co-operative banks are concerned the interest to credit is

comparatively lesser and there is gurantee for the pledged, goods.

Informal Financial Institutions

Informal financial

institutions are easily approachable to the customers with flexible procedures.

But there are issues like the safety of items pledged high rates of interest

and modes of recovery.

People who live in a

particular place or those who are involved in a certain work join together as a

group and start saving. These are called as Self Help Groups. The nationalised

banks provide help to these groups through micro-credit. . Credit given though

Self Help Groups for street vendors, fishermen, especially women and the poor

really make a difference in their life.

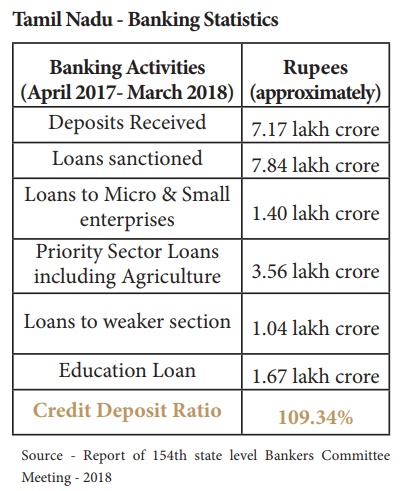

In Tamil Nadu, all the

banks have 10,612 branches,across the state They carry on a total transaction

of around 15 lakh crore rupees during the financial year (2017-2018).

A few salient features

of the Tamil Nadu Bank transactions are given in the table below.

Tamil Nadu - Banking

Statistics

Related Topics