Federalism in India | Political Science - Centre-State Relations | 12th Political Science : Chapter 5 : Federalism in India

Chapter: 12th Political Science : Chapter 5 : Federalism in India

Centre-State Relations

Centre-State Relations

The Centre-State Relations revolve around the

fulcrum of distribution of powers between Centre and States. Distribution of

powers is the foundational feature of federalism and in federal Constitutions

there are three types of distributions, they are:

1. Legislative Power Distribution

2. Executive Power Distribution

3. Financial Power Distribution

1. Legislative Relations

There are two aspects to the distribution of

legislative powers between the Centre and States in our Constitution. They are

a) Territorial Distribution of Powers

b) Subject Distribution

a) Territorial Distribution of Powers

The powers are distributed between the union and

State governments territorially. The Union Government possess the powers over

the entire territory of India while the States have jurisdiction over their own

territories. The Central Government has extra territorial jurisdiction that

means that its laws govern not only persons and property within India but also Indian

citizens and their properties located in any corner of the world. In contrast,

the State legislatures do not possess jurisdiction outside their own territory.

b) Subject Distribution

The Constitution distributes the legislative

subjects between the Union Government and States in an elaborate scheme. There

are three Lists of distribution.

List I (Union List) contains the subjects and powers

exclusively allotted to the union parliament. There are 100 subjects here

including defense, foreign affairs, banking, currency

List II (State List) contains the subjects that are exclusively

allotted to the State governments. There are 59 items including public order,

and police, public health, local government, agriculture, forests, fisheries

List III (Concurrent List) contains 52 items including criminal

law and procedure, civil procedure, marriage, education. This list is called as

Concurrent List. Both the union and State governments have powers over these

subjects. But when there occurs a clash between the union and State governments

the law of the parliament will prevail

There is also another category called residuary

powers. Any subject not mentioned in the above three lists will automatically

come under the jurisdiction of the Union Government. Our Constitution broadly

follows the legislative distribution of powers provided in the Government of

India Act 1935 enacted during the British colonial era.

Exceptions

The above scheme of legislative power distribution

will be normally followed. But under exceptional circumstances the scheme will

be suspended. The power of the Union Parliament will be expanded and

concomitantly the powers of the State legislatures will be diminished.

a) National Emergency

When the President of India declares National

Emergency the union parliament acquires the powers to legislate over the

subjects in the State List. The emergency is declared by the president to tackle

problems like war, external aggression and armed rebellion that pose a danger to

the existence of our nation. For the purpose of tackling the challenges

successfully and effectively, the Union Government gains control over State

legislature powers too.

b) Agreement between States

When two or more States agree that their mutual

interests will be served better if there is common law on a particular subject

and request the Union Government to enact the needed law, the Parliament can

enact a common law for the desiring States on that subject even if it falls in

the List II (State List).

c) International Agreement

The Parliament will have powers of enactment on a

State subject for the purpose of implementing an international agreement.

d) Article 356, Emergency

After the declaration of article 356 emergency in a

State the President can declare that the parliament will enact on State list

subjects for that State

2. Executive Relations

Our Constitution distributes executive powers

between the union and State governments. The distribution is co-terminous with

legislative power distribution to a great extent. The Union Government

possesses executive powers over the subjects that are included in the List I,

namely the Union List. The States have executive powers over the subjects that

are included in the List II, namely the State List. The executive power of the

Union Government extends over the territory of India while the executive power

of the State governments extend over their own territories.

The executive powers over the subjects in the

Concurrent List is ordinarily with the State governments. Nevertheless, the

Union Government retains powers to issue directions to the State governments in

the execution of executive functions both in normal times and during emergencies.

Another feature in the executive powers

distribution scheme in the Constitution relates to mutual delegation of

functions between the union and State governments. The Union Government can

entrust its functions to the State government after getting the consent of the

State Government concerned. Conversely, the State Government can entrust its

executive functions to the Union Government after getting the consent of the

Union Government. Moreover, the Union Government can entrust its executive

function to the State Government without getting the consent of the State

Government concerned but it must obtain the consent of the parliament.

3. Financial Relations

Finances are very fundamental in the successful

operation of federal system. Indian Constitution distributes financial powers

between the union and States in a comprehensive arrangement that is broadly

modeled on the 1935 Government of India Act. There are two sources of revenue

distributed by the Constitution namely Tax Revenue and Non-tax Revenue.

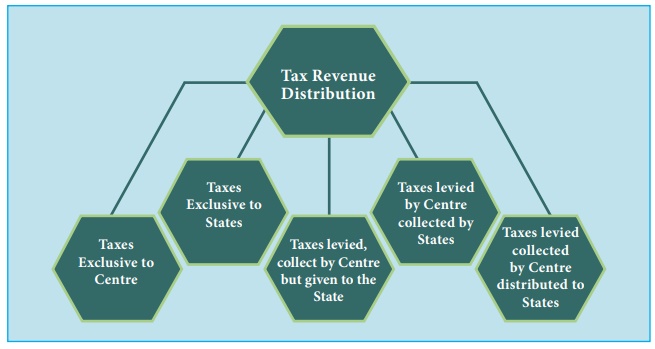

A) Tax Revenue Distribution

There are five important ways in which the tax

revenues are distributed between the union and State Governments.

1. Certain taxes like Corporation tax and Custom

tax are exclusively allotted to the Central Government

2. Certain taxes like sales tax are exclusively

allotted to the States

3. Certain taxes are levied by the Union but

collected and appropriated by the concerned States and the examples are stamp

duties on Bills of Exchange and Excise duties

5. Certain taxes are levied and collected by the

Union Government but the proceeds are assigned to the States in which they are

levied like the taxes on the sale of advertisements in newspapers.

6. Certain taxes are levied and collected by the

Central Government and are distributed between the union and State Governments

in a certain proportion like the tax on income other than an agricultural

income

B) Non-tax Revenue Distribution

Both the union and State Governments are provided

with non-tax revenue sources. The Union Government gets its revenue from the

receipts from commercial and industrial undertakings relating to central

subjects like Industrial Finance Corporation. It gets its revenue from

Railways, Posts and Telegraphs, Broadcasting etc

The State Governments get revenue from the receipts

of commercial enterprises and industrial undertakings allotted to them. The

sources among others include forests, irrigation, electricity, road transport.

The Constitution understands the greater financial

needs of certain States and therefore the article 275 asks the Union Government

to provide Grants- in-Aid to the States like Assam, keeping in mind the

imperative of the development and welfare of the tribal population.

Finance Commission

The president of India consitutes a Finance

Commission once in every five years. The article 280 of the Constitution

describes the composition of the Finance Commission. It will have one Chairman

and four other members. The Chairman will be a person with experience in public

affairs and the members will have experience in financial administration,

special knowledge of economics, special knowledge of public accounts and

government finances, and one member will have the qualification of a High Court

judge.

Finance Commission will provide recommendations in the following manner:

1. For the distribution of net proceeds of taxes

between the Centre and States

2. Principles governing grants-in-aid

3. Measures needed to increase the Consolidated

Fund of India or States to supplement the resources of the Panchayat Bodies

4. Measures needed to increase the Consolidated

Fund of India or States to supplement the resources of the Urban Local Bodies

5. Any other matter referred by the president

So far fourteen Finance Commissions have been

constituted once in every five years

Related Topics