Accounts of Partnership Firms Fundamentals | Accountancy - Interest on loan from partners | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Interest on loan from partners

Interest

on loan from partners

Sometimes, a partner may

provide loan or advance to the firm. In such cases, partner’s loan or advance

account is to be separately maintained in the books. The partners are entitled

to interest on the loan or advance at the rate agreed by them. If there is no

such agreement, the partners are entitled to an interest at the rate of 6 per

cent per annum [Section 13(d) of the Indian Partnership Act, 1932]. The

following journal entries are to be made in the books of the firm:

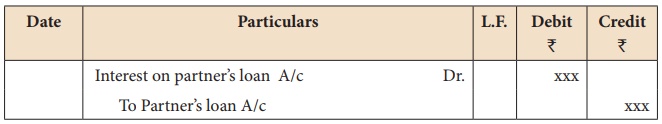

(a) For providing interest on partner’s loan

Note: Interest on partner’s

loan being an expense to the firm is debited in firm’s books. Interest on

loan is due to the partner and it is generally added to the loan amount due and

hence partner’s loan account is credited.

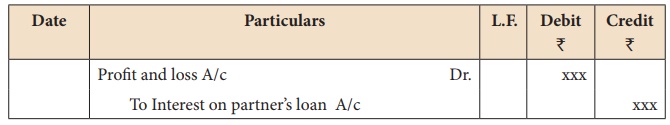

(b) For closing interest on partner’s loan account

Tutorial note: Interest on partners’ loan is a charge against profit, that is, whether there is profit or loss for the firm, this interest is to be provided. Hence, interest on partners’ loan is transferred to profit and loss account.

Related Topics