Retirement and Death of a Partner | Accountancy - Determination of new profit sharing ratio and gaining ratio | 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Chapter: 12th Accountancy : Chapter 6 : Retirement and Death of a Partner

Determination of new profit sharing ratio and gaining ratio

Determination

of new profit sharing ratio and gaining ratio

1. New profit sharing ratio

It is necessary to

determine the new profit sharing ratio at the time of retirement of a partner

because the continuing partners acquire the retiring partner’s share of profit.

New profit sharing ratio is the agreed proportion in which future profit will

be distributed to the continuing partners. If the new profit sharing ratio is

not agreed, the continuing partners will share the profits and losses equally.

2. Gaining ratio

The continuing partners

may gain a portion of the share of profit of the retiring partner. The gain may

be shared by all the partners or some of the partners. Gaining ratio is the

proportion of the profit which is gained by the continuing partners. The

purpose of finding the gaining ratio is to bear the goodwill to be paid to the

retiring partner. The share gained is calculated as follows:

Share gained

= New share – Old share

Gaining ratio =

Ratio of share gained by the continuing partners

Tutorial note: When the new profit

sharing ratio is not given in the problem, it is to be calculated based on the

information given in the problem.

Calculation of gaining ratio and new profit sharing ratio under different situations

1. When new profit sharing ratio is given

When new profit sharing

ratio is given, only gaining ratio has to be calculated as follows:

Gaining ratio = Ratio of

share gained by the continuing partners

Share gained = New share

– Old share

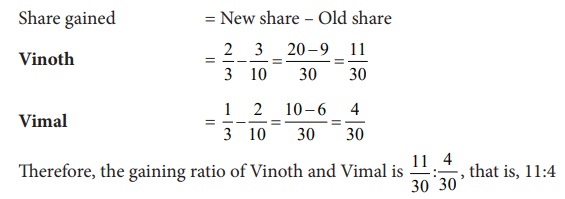

Illustration 7

Kiran, Vinoth and Vimal

are partners sharing profits in the ratio of 5:3:2. Kiran retires and the new

profit sharing ratio between Vinoth and Vimal is 2:1. Calculate the gaining

ratio.

Solution

2. When new profit sharing ratio is not given

(a) Only one partner gains the retiring partner’s share

When new profit sharing

ratio is not given and only one continuing partner gains the entire share of

the retiring partner, new profit sharing ratio is calculated as follows:

New share of continuing

partner = Old share + Share gained

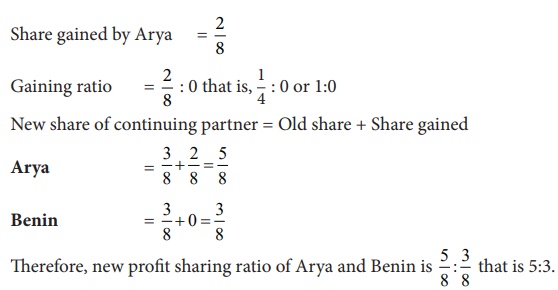

Illustration 8

Arya, Benin and Charles

are partners sharing profits and losses in the ratio of 3:3:2. Charles retires

and his share is taken up by Arya. Calculate the new profit sharing ratio and

gaining ratio of Arya and Benin.

(b) More than one partner gains the retiring partner’s share

(i) Proportion of share gained on retiring partner’s share is given

When new profit sharing

ratio is not given, but the proportion of share gained on retiring partner’s

share is given, new profit sharing ratio is calculated as follows:

New share of continuing

partners = Old share + Share gained

Share gained = Retiring partner’s share × Proportion of

share gained

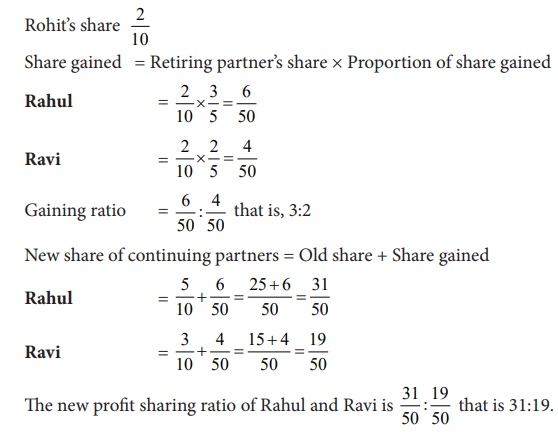

Illustration 9

Rahul, Ravi and Rohit are

partners sharing profits and losses in the ratio of 5:3:2. Rohit retires and

the share is taken by Rahul and Ravi in the ratio of 3:2. Find out the new

profit sharing ratio and gaining ratio.

Solution

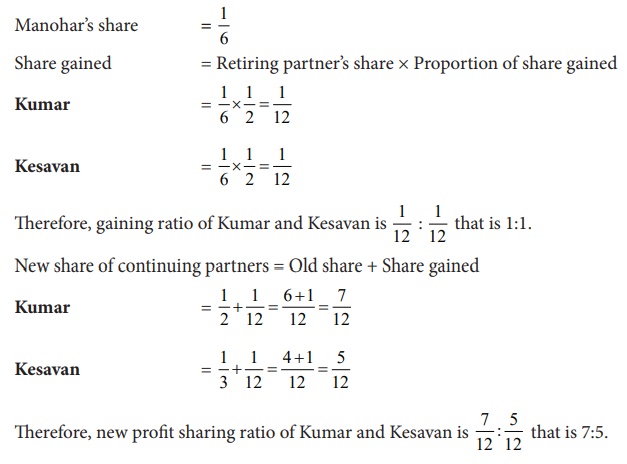

Illustration 10

Kumar, Kesavan and

Manohar are partners sharing profits and losses in the ratio of 1/2, 1/3 and

1/6 respectively. Manohar retires and his share is taken up by Kumar and

Kesavan equally. Find out the new profit sharing ratio and gaining ratio.

Solution

Gaining ratio is 1:1 as

Manohar’s share is taken up by Kumar and Kesavan equally.

(ii) Proportion of share gained is not given

When new profit sharing

ratio, share gained and the proportion of share gained is not given, the new

share is calculated by assuming that share gained is the proportion of the old

share. Therefore, the new profit sharing ratio and the gaining ratio among the

continuing partners is their old profit sharing ratio between them.

Illustration 11

Raja, Roja and Pooja are

partners sharing profits in the ratio of 4:5:3. Roja retires from the firm.

Calculate the new profit sharing ratio and gaining ratio.

Solution

Since, new profit

sharing ratio, share gained and the proportion of share gained is not given,

the new share is calculated by assuming that the share gained is in the

proportion of old ratio. Therefore, the new profit sharing ratio and the

gaining ratio between the continuing partners, Raja and Pooja is their old

profit sharing ratio, that is 4:3.

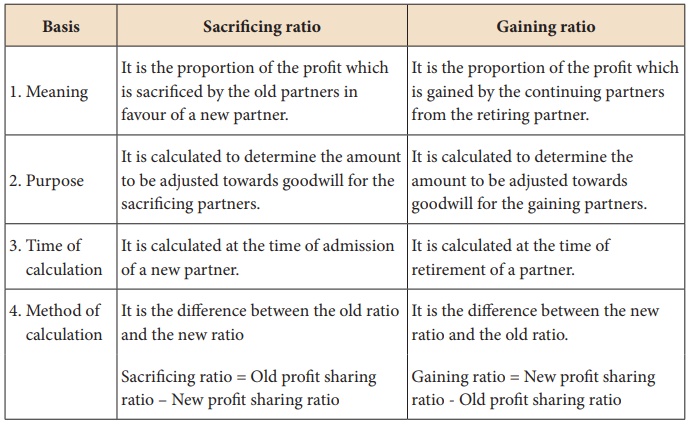

3. Differences between the sacrificing ratio and the gaining ratio

Related Topics