Chapter: Business Science : Industrial Relations and Labour Welfare : Welfare of Special Categories of Labour

Welfare of Special Categories of Labour

WELFARE OF SPECIAL CATEGORIES OF LABOUR

1 Child labour

2 Female labour

3 Contract labour

4 Construction labour

5 Agricultural labour&differently abled labour

6 BPO&KPO Labour

7 Social assistance

8 Social security

1 Child labour

Children

have to be taken care and must be protected frombeing exploited by the society.

Children of any age, whether, male or female should be not only protected but

also safeguarded and developed to grow in a healthy atmosphere.

Laws pertaining to the

prohibition of Child Labour

1. Children

(Pledging of Labour] Act (1933)

2. Employment

of Children Act (1938)

3. The

Bombay Shop and Establishments Act (1948)

4. Child

Labour (Prohibition and Regulation Act) 1986

5. The

Indian Factories Act (1948)

6. Plantations

Labour Act (1951)

7. The Mines

Act (1952)

8. Merchant

Shipping Act (1958)

9. The

Apprentice Act (1961)

10.

The Motor Transport Workers Act (1961)

11.

The Atomic Energy Act (1962)

12.

Bidi and Cigar Workers (Condition of Employment)

Act (1966)

13.

State Shops and Establishments Act

Some of the Statutory Provisions

on Child Labour

The child

shall enjoy special protection and shall be given opportunities and facilities,

by law and other means, to enable him to develop, physically, mentally,

spiritually and socially in a healthy and normal manner and in conditions of

freedom and dignity. In the enactment of laws for this purpose, the best

interest of the child shall be the Paramount Consideration

main provisions of child labour act, 1986.

The Act

came into force from 23rd December 1986. Its main objectives are to prohibit

the employment of children in certain categories of industries and to regulate

the conditions of work of children in certain industries. It was amended in

1988.

(1)Scope

The Act

is applicable to all establishments such as workshop, farm, residential hotels,

restaurants, eating houses, theatre or other places of public amusement where

child labour is largely employed. The Act extends to the whole of India.

―Child‖

means a person who had not completed fourteen years of age.

Main Provisions of the Act

(1)Prohibition

of employment of children in certain occupations and processes:

(2)No

child can be employed, or permitted to work in nay of the occupations set forth

in Part A of the Schedule or in any workshop wherein any of the processes set

forth in Part B of the schedule is carried on.

(3)Hours

and period of work:

Ø No child

shall be allowed to work in any establishment in excess of such number of hours

as many be prescribed for such establishment or class establishment;

Ø The daily

hours or work shall be so fixed that no child shall be allowed to work for more

than three hours without prior interval of an hour:

Ø The hours

of work shall be so arranged that inclusive of rest interval, time spread and

the time spend in waiting for the work shall not exceed six hours a day;

Ø No child

shall be allowed to work between 7. P.M and 8 P.M

(3)Weekly

Holiday

Every

child employed in any establishment shall be given one weekly holiday of 24

hours.

(4)Healthy

and Safety

(i)The

appropriate government by notification in the Official Gazette, can make rules

for health and safety of children employed or permitted to work in any

establishment or class of establishment.

(ii)Without

any prejudice to the generality of the foregoing provisions, the rules for

health and safety may provided for all or any of the following matters namely;

Ø Cleanliness

in the place of work and its freedom from nuisance

Ø Disposal

of wastes and effluents

Ø Ventilation

and temperature

Ø Dust and

fumes

Ø Lighting

Ø Drinking

water

Ø Artificial

humidification

Ø Latrine

and urinal

Ø Spittoons

Ø Fencing

of machines

Ø Work at

or near machinery in motion

Ø Employment

of children on dangerous machines

Ø Instructions training and supervision in

relation to employment of children on

dangerou

Ø Device

for cutting off power

Ø Self-acting

machines

Ø Casing of

new machinery

Ø Floor,

stairs and means of access

Ø Pits,

sumps, opening in floors etc.

Ø Excessive

weights

Ø Protection

eyes

Ø Explosive

or inflammable dist gas etc

Ø Precaution

in case of fire; maintenance of buildings; and safety of buildings and

machinery.

2 Female Labour

Participation

of women in economic activity is common in all countries. But in developing

countries, the incomes of women labour by and large are low. Moreover, if women

have to work, she needs more protection than man in her working environment in

developing countries and in traditional occupations.

RESTRICTIONS

ON THE EMPLOYMENT OF WOMEN

(a)

Maximum daily work is 9 hours: No exemption from the provisions of Section 54

(which lays down that the maximum daily hours of work shall be nine hours) can

be granted in respect of any women.

(b)

prohibition of night work: No women shall be required or¬ allowed to work in

any factory except between the hours of 6 a.m. and 7 p.m. The State Government

may by notification in the official Gazette vary the limits for any factory or

group or class or descrip-tion of factories. But such variation must not authorise

the employ¬ -ment of women between the hours 10 p.m. and 5 a.m..

(c) Exception:

There is an

exceptional case. The

State Government may

make rules providing for the

exemption from the afore~aid restrictions (wholly or partially or conditionally)

of women working in fish-curing or fish-canning factories. In factories,

mentioned above, the employment of women beyond the hours specified is

necessary to prevent damage to or deterioration in any raw material. But such

rules shall remain in force for not more than three years at a time.

Other

restrictions: There are other restrictions on the employ¬ ment of women workers

:

1. Work on

or near machinery in motion. No woman or young person shall be allowed to

clean, lubricate or adjust any part of the machinery while the prime mover or

transmission machinery is in motion or to work between moving parts, or between

fixed and moving parts of any machinery which is in motion.-Sec. 22(2}.

2. Cotton

openers. No woman or child shall be employed in any part of a factory for

pressing cotton in which a cotton opener is at work. If the feed-end of a

cotton opener is in a room separated from the delivery-end by a partition

extending to the roof or to such height as the Inspector may in a particular

case specify in writing , women and children may be employed on the side of the

partition where the feed-end is situated.-Sec. 27

3. Excessive

weights. The State Government may make rules prescribing the maximum weights

.which may be lifted, carried. or moved by adult men, adult women, adolescents

and children employed in factories or in any class or description of factories

or in carrying on any specified process.-Sec. 34.

4. Creches.

In every factory wherein more than thirty women workers are ordinarily employed

there shall be provided and main¬ tained a suitable room or rooms for the use

of children under the age of six years of such women.-Sec. 48.

5. Dangerous

operations. The State Government is empowered to make special rules for the

purpose of controlling and regulating factories which carry on operations

exposing women, young persons and other workers to a serious risk of bodily

injury, poisoning or disease.-Sec. 87 (b).

3 Contract Labour

Ø The

contract labour is labour which is not carried on the payroll and is not directly

paid. It is usually divided into two categories.

Ø Those

employed on job contracts; and Those employed on labour contracts

Ø The large

establishments offer job contracts for such operations as the loading and

unloading of the metals by the mining industry or the construction of roads or

buildings by Public Works Department.

The Contract Labour Act, 1970.

Scope and

Coverage

The Act

came into force from 10th February 1971. It extends to the whole of India and

applies to every establishment in which twenty or more workmen are or were,

employed on any day during the preceding twelve months as contract labour, and

to every contractor

The Act

does not apply to establishments where work is of a casual (irregular or

occasional or intermittent (interrupted or non-continues) nature. The work

performed in an establishment is not considered to be of an intermittent

nature:

(i) If it is

performed for more than one hundred and twenty days in the preceding twelve

months;

(ii) It is not

of seasonal character if it is performed for more than sixty days in a year.

THE MAIN

PROVISIONS OF THE ACT

(1)

Setting Up of Advisory Boards

The Act

requires that the Central and State Advisory Boards are to be set up by the

Central and State Governments, respectively to advise them on such matters

arising out of the administration of the Act as may be refereed to them, and

carry out any other functions assigned to them under the Act. Besides, the

government nominees, the Boards havemembers representing industry, contractors,

workers, and any other interesgovernment may consider should be represented on

the Boards. The number of nominees of the workers is to be equal to that of

industry and contractors, both on the State and the Central Boards (section

3,4)

(2)

Registration of Establishment

Every

principal employer who wishes to employ contract labour has to get the

establishment is accepted for registration. the registration officer issues a

registration certificate if the establishment is accepted for registration.

This certificate can be cancelled if it has been obtained by misrepresentation

or suppression of any material fact, or if the registration has become useless

or ineffective or requires to be revoked.

The

contract labour cannot be employed so long as the registration certificate has

not been issued or after it is revoked. The employer has to play a registration

fee of twenty rupees to five hundred rupees depending on the number of workers

to be employed (Section 6, 7, 8, 9)

(3)

Prohibition of employment of Contract Labour

Both the

Central and State Governments can prohibit the employment of contract labour in

any process, operation or other work in any establishment after consulting

their Advisory Boards, and consider the conditions of work and benefits

provided for contract labour in the establishment. The employment of contract

labour may not be permitted for any process, operation and other work if it is:

(a) incidental

to or necessary for the industry, trade, business, manufacture or occupation

that is carried on in the establishment;

(b) of

perennial or perpetual nature or of a sufficient duration

(c) done

ordinarily through regular workmen in that establishment or an similar thereto:

(d) capable

of employing considerable number of wholetime workmen.

(4) Licensing of Contractors

Every

contractor has to obtain a licensing for employing contract labour from the

licensing officer appointed by the government for this purpose. In this

application for a licensing he has to mention the location of his

establishment, the nature of the operation or the work for which contract

labour is to be employed, and such other particulars as may be required by the

licensing officer. He is charged a licence fee, which may vary from fivec

rupees to one hundred and twenty five rupees, depending on the number of

workers to be employed

(5) Welfare

and Health of Contract Labour

Ø A

contractors are required to provide and maintain:

Ø A

Sufficient supply of wholesome drinking water at convenient places;

Ø A

sufficient number of latrines and urinals of the prescribed type conveniently

situated and accessible.

Washing

facilities;

A first

–aid box equipped with prescribed contents at every place where contract labour

is employed; One or more canteens if the work is to continue for more than 6

months and 100 or more workers are employed. The number of canteens, the

standard of their construction, furniture and equipment, and the type of food

to be supplied will be as prescribed under the rules framed by the government

(6)

Responsibility for payment of Wages

Ø The

contractor is also to be responsible for making regular and timely payment of

wages to his workers. The payment is to be made in the presence of the

authorized representative of the principal employer. If the contractor does not

make payment, the principal employer will do the same and recover the amount so

paid from the contractor (Section 16 to 21)

Ø Get his

establishment registered with the registering officer appointed by the

government (Section 7);

Ø Obtain a

license from the licensing officer for employing contract labour and comply

with the terms and conditions of the grant of the license (Section 12);

Ø Not to

employ contract labour without obtaining a registration certificate and

license, or after the registration certificate and license are revoked or suspended

(Section 9, 12, 1);

Ø Provide

welfare and health facilities as required under the Act and its rules (Section

16, 19);

Ø Pay wages

to workers before the expiry of the wages period (Section 21);

Ø Co-operate

with the inspectors in the inspection of premises, documents and records and

examining any person to determine if the provisions of the Act and the rules

framed there under are being complied with (Section 28);

Ø Maintain

the registers and records with such particulars of contract labour, as nature

of work performed, rates of wages and other information specified in Rules 74

and 78 of the Act (Section 29);

Ø Exhibit

in the premises of the establishment where contract labour is employed a notice

showing hours of work, rates of wages, wage periods, dates of payment of wages,

nature of duties and other particulars as mentioned in Rule 81 of the Act

(Section 29 (2)); and

Ø Send a half-yearly return to the licensing officer

and yearly return to the registration officer, and to supply such information

and statistics as may be required by the government from time to time.

(9)Rights

of Contract Labour

Ø Claim

such working conditions, facilities and other benefits as are provided for

under the Act and the rules framed there under (Section 16 to 22); and

Ø They can

be represented by their representatives on the Central and State Advisory

Boards (Section 4)

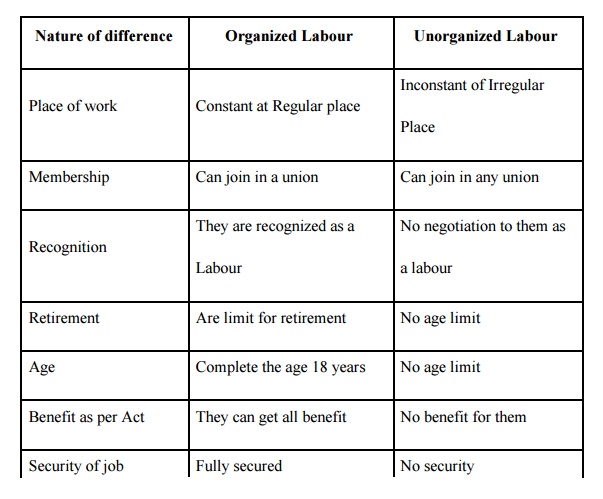

Organized

Labour and Unorganized Labour

4 Construction Labour

Construction

industry employs around three million workers and the nature of work is

considered hazardous. Large number of unskilled and semiskilled labour both

male and female is employed on various form of building operation and road

constructions.

5 Agriculture labour &Differently abled Labour

A

handicapped person is one who is having some shortcoming or infirmity which

detracts a person from being a normal human being.

Handicapped

may be divided into different categories viz.

*Physically

handicapped, *Mentally handicapped, *Socially handicapped, and *Aged persons.

Disablement Benefit

A person

who sustains disablement for not less than 3 days, in entitled to periodic

payment (at the rate of 40% more than the standard benefit rate which of `.14

or more depending upon his wages).

A person

who sustains permanent disablement whether total or partial is entitled to

periodical payment at such percentage of benefit payable in the cage of

disablement as of proportionate to the percentage of loss of earning capacity.

Various schemes for differently abled persons.

Ø Assistance

to Disabled Persons for Purchase / Fitting of Aids and Appliances (ADIP

Scheme)- External website that opens in a new window

Ø Deendayal

Disabled Rehabilitation Scheme to promote Voluntary Action for Persons with

Disabilities- External website that opens in a new window

Ø Scheme of

National Awards for Empowerment of Persons with Disabilities-External website

that opens in a new window

Ø Scheme of

National Scholarships for Persons with Disabilities- External website that

opens in a new window

Ø Scheme of

Integrated Education for the Disabled Children Scheme for providing Employment

to Persons with Disabilities in the Private Sector - Incentives to the

Employers- External website that opens in a new window

Ø Conveyance

Allowance- External website that opens in a new window

Ø Income

Tax Concessions- External website that opens in a new window

Ø Reservation

of Jobs & Other Facilities For Disabled Persons- External website that

opens in a new window

Ø Financial

Assistance to Person with Disabilities- External website that opens in a new

window

Ø Equal

Insurance Benefits- External website that opens in a new window

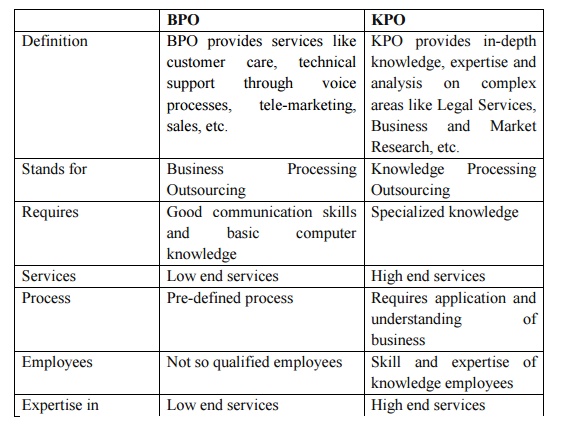

6 KPO &BPO Labour

Communication

and information technology industry is an important enabler in enhancing

productivity. The structure and functions of IT industries are largely

different than the conventional organizations which demand a different rule of

the game to manage effectively.

KPO and BPO in Detail

7 Social assistance Meaning of Social Assistance

Social

Assistance schemes are funded from the consolidated fund of the state rather

than from individual contributions, with statutory scales of benefit adjusted

according to a person‘s means.

Definition

According

to I.L.O define as, ―A service or scheme which provides benefits to persons of

small means as right in amounts sufficient to meet minimum standards of need

and financed from taxation‖.

Ø 1995: The

NSAP is launched with the aim of providing social assistance to destitutes

'defined as any person who has little or no regular means of subsistence from

his/her own source of income or through financial support from family members

or other sources'. The NSAP includes three components:

Ø National

Old Age Pension Scheme (NOAPS);

Ø National

Family Benefit Scheme (NFBS);

Ø National

Maternity Benefit Scheme (NMBS)

2000:

Annapurna Yojana is introduced to provide eligible beneficiaries, who were

not covered under NOAPS, 10 kg of free rice.

2001:

NMBS is transferred to the Department of Family Welfare.

2006:

Monthly pension amount for NOAPS raised from Rs. 75 to Rs. 200

2007:

The NSAP is extended to cover all individuals living below the poverty line. The

NOAPS is renamed Indira Gandhi National Old Age Pension Scheme (IGNOAPS).

2009:

The NSAP is expanded to include the Indira Gandhi National Widow Pension Scheme

(IGNWPS) - for widows aged 40–64 years - and the Indira Gandhi National

Disability Pension Scheme (IGNDPS) - for persons with multiple or severe

disabilities aged 18–64 years living below the poverty line.

2011:

Age limit for IGNOAPS is lowered from 65 to 60 years under IGNOAPS and

monthly pension amount for those 80 years and above is raised from Rs. 200 to

Rs. 500.

Age

limits for IGNWPS and IGNDPS are changed to 40-59 and 18-59, respectively.

2012:

Monthly pensions under IGNWPS and IGNDPS increased from Rs. 200 to Rs. 300. Age

limit changed to 40–79 years and 18–79 years, respectively.

2013:

Report of the Task Force on Comprehensive Social Assistance Programme submitted

to the Government of India. Recommends raising monthly pension and expanding

coverage.

8 Social security and its implications

Meaning of Social Security:

Social

Security means the security provided by the society to the needy citizens on

the principles of human dignity and social justice. Social Security Programmes

are now sincreasingly being accepted as useful and necessary instrumented for

the protection and stability of the labour force.

Definition:

According

to Friedlander define as, ―The programme of protection provided by society

against the contingencies of modern life, sickness, unemployment, old age

dependency, industrial accidents and invalidism against which the individual

cannot be exploited to protect himself and his family by his own ability for

foresight‖.

Important social security measures were introduced

by the Government

Ø Workers

Compensation Act, 1923

Ø Employees

State Insurance Act, 1948

Ø Maternity

Benefits Act – By State and Central Gover nment

Ø Coal

Mines Provident Fund and Bonus Act, 1948

Ø Employees

Provident Fund Act, 1952

Ø Family

Pension Schemes, 1971

Ø Payment

of Gratuity Act, 1952

Ø Deposit

Linked Insurance Scheme

Ø Social

Security Certificate Scheme, 1982

Social Insurance

Definition:

―Giving

in return for contribution, benefits upon subsistence level as if right and

without means tests so that an individual may build freely upon it. Thus social

insurance implies that it is compulsory and that men stand together with their

follows‖.

The Principle Elements of Social Insurance

Ø Participation

is compulsory with few exceptions.

Ø Contributions

are accumulated in special funds out of which benefits are paid.

Ø Surplus

funds, not needed to pay current benefits are invested to earn further income.

Ø A

person‘s right to benefit is secured by his contribution record without any

list of need or means.

Related Topics