Economics - Types of Taxes | 10th Social Science : Economics : Chapter 4 : Government and Taxes

Chapter: 10th Social Science : Economics : Chapter 4 : Government and Taxes

Types of Taxes

Types of Taxes

Direct Taxes

A tax

imposed on an individual or organisation, which is paid directly, is a direct

tax. The burden of a direct tax cannot be shifted to others. J.S. Mill defines

a direct tax as “one which is demanded from the very persons who it is intended

or desired should pay it.” Some direct taxes are income tax, wealth tax and

corporation tax.

In India, Income Tax was introduced for the first timein 1860 by

Sir James Wilson in order to meet the losses sustained by the Governmenton

account of the Mutiny of 1857.

Income tax

Income

tax is the most common and most important tax levied on an individual in India.

It is charged directly based on the income of a person. The rate at which it is

charged varies, depending on the level of income.

Students are asked to search a Income Tax website and know the

Income Tax slab for current year.

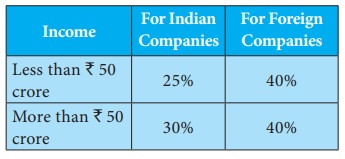

Corporate tax

This tax

is levied on companies that exist as separate entities from their shareholders.

It is charged on royalties, interest gains from sale of capital assets located

in India and fees for a technical services and dividends.

Foreign

companies are taxed on income that it arises in India.

Wealth tax

Wealth

tax is charged on the benefits derived from property ownership. The same

property will be taxed every year on its current market value. The tax is

levied on the individuals and companies alike.

In India taxes are collected by all the three tiers of

government. There are taxes that can be easily collected by the Union

government. In India almost all the direct taxes are collected by the Union

governments. Taxes on goods and services are collected by both Union and State

governments. The taxes on properties are collected by local governments.

In India we collect more tax revenue through indirect taxes than

through direct taxes. The major indirect taxes in India are customs duty and

GST.

Indirect Taxes

If the

burden of the tax can be shifted to others, it is an indirect tax. The impact

is on one person while the incidence is on the another person. Therefore, in

the case of indirect taxes, the tax payer is not the tax bearer.

Some

indirect taxes are stamp duty, entertainment tax, excise duty and goods and

service tax (GST).

Stamp duty

Stamp

duty is a tax that is paid on official documents like marriage registration or

documents related to a property and in some contractual agreements.

Entertainment tax

Entertainment

tax is a duty that is charged by the government on any source of entertainment

provided. This tax can be charged on movie tickets, tickets to amusement parks,

exhibitions and even sports events.

Excise duty

An excise

tax is any duty on manufactured goods levied at the movement of manufacture,

rather than at sale. Excise is typically imposed in addition to an indirect tax

such as a sales tax.

Goods and service tax (GST)

The goods

and service tax (GST) is one of the indirect taxes. The GST was passed in

Parliament on 29 March 2017. The act came into effect on 1 July 2017. The motto

is one nation, one market, one tax.

France was the first country to implement GST in 1954.

Structure of Goods and Service Tax (GST)

State Goods and

Service Tax (SGST): Intra state (within the state) VAT/sales

tax, purchase tax, entertainment tax, luxury tax, lottery tax and state

surcharge and cesses

Central Goods and

Service Tax (CGST): Intra state (within the state) Central

Excise Duty , service tax, countervailing duty, additional duty of customs,

surcharge, education and secondary/higher secondary cess

Integrated Goods

and Service Tax (IGST): Inter state (integrated GST)

There are four major GST rates: (5%, 12%, 18% and 28%) Almost all the necessities of life like vegetables and food grains are excempted from this tax.

Related Topics