Government and Taxes | Economics | Social Science - Give Short Answers | 10th Social Science : Economics : Chapter 4 : Government and Taxes

Chapter: 10th Social Science : Economics : Chapter 4 : Government and Taxes

Give Short Answers

V. Give Short Answers

1. Define tax.

• Taxes are compulsory payments to government without expectation of direct return or benefit to the tax payer.

or

• According to Prof. Seligman "Tax is a compulsory contribution from a person to the government to defray the expenses incurred in the common interest of all, without reference to special bene

2. Why we pay tax

to the government?

• We pay tax to the

government because the government needs money to carry out many functions

for the welfare of the people.

• A money collected are spent for the following purposes.

• To carry out many functions.

i) Expenditures on economic infrastructure (transportation, sanitation, education, healthcare, public safety) ii) Military iii) Scientific research iv) culture and the arts v) public works and public insurancefits conferred."

3. What are the

types of tax? Give examples.

i. Direct Taxes (Income tax, Wealth tax and Corporate tax)

ii. Indirect Taxes (Stamp duty, Entertainment tax, Excise duty

and GST)

4. Write short note on Goods and

Service Tax.

• The GST is an indirect

tax.

• The motto of the GST is one

nation, one market, one tax. It was passed in the Parliament on 29 March

2017 and it came into effect on 1 July 2017.

• It is a one point tax.

5. What is progressive tax?

• Progressive tax rate is one in which the rate of taxation

increases (multiplier) as the tax base increases (multiplicand).

• In the case of progressive tax, when income increases, the tax rate also increases.

6. What is meant by black money?

• Black money is funds

earned on the black market on which income and other taxes have not been

paid.

• The unaccounted money

that is concealed from the tax administrator is called 'Black money'.

7. What is tax evasion?

• Tax evasion is the

illegal evasion of taxes by individuals, corporations and trusts.

Tax evasion

activities include:

• Under reporting income.

• Inflating deductions or expenses.

• Hiding money

• Hiding interest in offshore accounts.

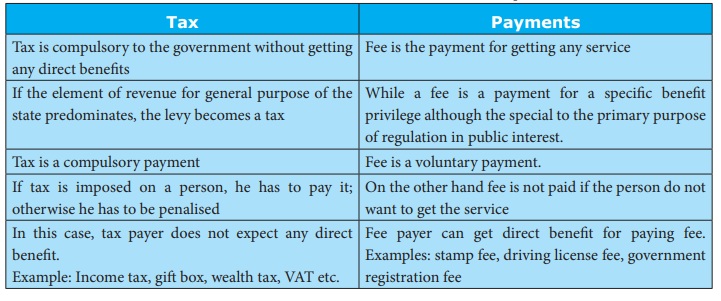

8. write any two difference between tax and payments?

Tax

1. Tax is a compulsory payment

2. Tax payer does not expect any direct benefit. Examples:

Income tax, Wealth tax etc.

Payments

1. Fee is a voluntary payment.

2. Fee payer can get direct benefit for paying fee. Examples:

Stamp fee, Driving license fee etc.

Related Topics