Economics - Taxes and Development | 10th Social Science : Economics : Chapter 4 : Government and Taxes

Chapter: 10th Social Science : Economics : Chapter 4 : Government and Taxes

Taxes and Development

Taxes and Development

The role

of taxation in developing economies is as follows.

1. Resource mobilisation: Taxation

enables the government to mobilise a substantial amount of revenue. The tax

revenue is generated by imposing direct taxes such as personal income tax and

corporate tax and indirect taxes such as customs duty, excise duty, etc.

2. Reduction inequalities of

income: Taxation follows the principle of equity. The direct taxes are

progressive in nature. Also certain indirect taxes, such as taxes on luxury

goods, is also progressive in nature.

3. Social welfare: Taxation

generates social welfare. Social welfare is generated due to higher taxes on

certain undesirable products like alcoholic products.

4. Foreign exchange: Taxation

encourages exports and restricts imports, Generally developing countries and

even the developed countries do not impose taxes on export items.

5. Regional development: Taxation

plays an important role in regional development, Tax incentives such as tax

holidays for setting up industries in backward regions, which induces business

firms to set up industries in such regions.

6. Control of inflation: Taxation can be used as an instrument for controlling inflation. Through taxation the government can control inflation by reducing the tax on the commodities.

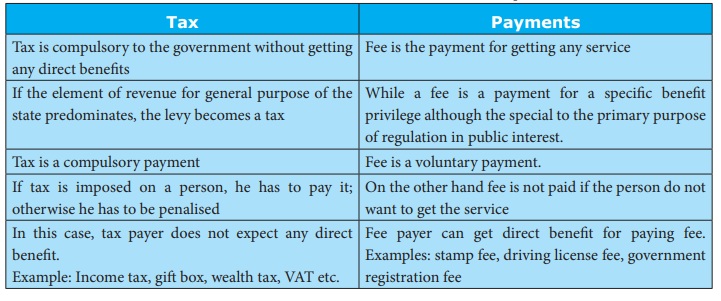

Difference between Tax and other Payments

Tax

1. Tax is

compulsory to the government without getting any direct benefits

2. If the

element of revenue for general purpose of the state predominates, the levy

becomes a tax

3. Tax is

a compulsory payment

4. If tax

is imposed on a person, he has to pay it; otherwise he has to be penalised

5. In

this case, tax payer does not expect any direct benefit

6. Example:

Income tax, gift box, wealth tax, VAT etc.

Payments

1. Fee is

the payment for getting any service

2. While

a fee is a payment for a specific benefit privilege although the special to the

primary purpose of regulation in public interest.

3. Fee is

a voluntary payment.

4. On the

other hand fee is not paid if the person do not want to get the service

5. Fee

payer can get direct benefit for paying fee.

6. Examples:

stamp fee, driving license fee, government registration fee

Related Topics