Chapter: 10th Social Science : Economics : Chapter 4 : Government and Taxes

How are Taxes Levied?

How Are Taxes Levied?

Tax is

levied by the government progressively, proportionately as well as

regressively.

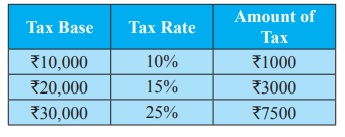

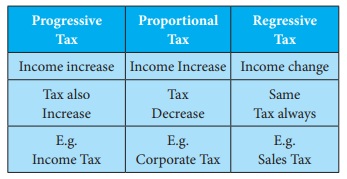

Progressive tax

Progressive

tax rate is one in which the rate of taxation increases (multiplier) as the tax

base increases (multiplicand). In the case of a progressive tax, When income

increases, the tax rate also increases.

Example

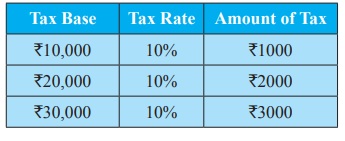

Proportionate taxes

Tax

levied on goods and service in a fixed portion is known as proportionate taxes.

All tax payers contribute the same proportion of their incomes.

Regressive Taxes

It

implies that higher the rate of tax lower the income groups than in the case of

higher income groups. It is a very opposite of progressive taxation.

Related Topics