India | Economics - Trade Reforms | 11th Economics : Chapter 9 : Development Experiences in India

Chapter: 11th Economics : Chapter 9 : Development Experiences in India

Trade Reforms

Trade

Reforms:

Trade Policy Reforms: The main

features of the new trade policy as it has evolved over the years since 1991 are as follows:

Free imports and exports: Prior to 1991, in India imports were

regulated. From 1992, imports were

regulated by a limited negative list. For instance, the trade policy of 1 April

1992 freed imports of almost all intermediate and capital goods. Only 71 items

remained restricted. This would affect the domestic industries.

Rationalization of tariff structure and

removal of quantitative restrictions: The Chelliah Committee’s Report had suggested drastic reduction in

import duties. It had suggested a peak rate of 50 percent. As a first step

towards a gradual reduction in the tariffs, the 1991 -92 budget had reduced the

peak rate of import duty from more than 300

percent

to 150 percent. The process of lowering the customs tariffs was carried further

in successive budgets. This also affected the domestic industries.

1. Export and Import Policy

The

Government of India, Ministry of Commerce and Industry announced New Foreign

Trade Policy on 01st April 2015 for the period of 2015-2020.

Salient Features of “EXIM POLICY (2015-2020)”

The new

EXIM policy has been formulated focusing on increasing in exports scenario,

boosting production and supporting the concepts like Make in India and Digital

India.

·

Reduce export obligations by 25% and give boost to

domestic manufacturing supporting the “Make in India” concept.

·

As a step to Digital India concept, online

procedure to upload digitally signed document by CA/CS/Cost Accountant are

developed and further mobile app for filing tax, stamp duty has been developed.

·

Repeated submission of physical copies of documents

available on Exporter Importer Profile is not required.

·

Export obligation period for export items related

to defence, military store, aerospace and nuclear energy to be 24 months.

·

EXIM Policy 2015-2020 is expected to double the

share of India in World Trade from present level of 3% by the year 2020. This

appears to be too ambitions.

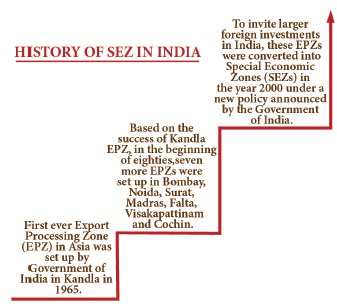

2. Special Economic Zones

With a

view to overcome the shortcomings experienced on account of the multiplicity of

controls and clearances, absence of world-class infrastructure, and an unstable

fiscal regime and with a view to attract larger foreign investments in India,

the Special Economic Zones (SEZs) Policy was announced in April 2000.

As part

of the economic reforms, the system of taking over land by the government for

commercial and industrial purposes was introduced in the country. As per the

Special Economic Zones Act of 2005, the government has so far notified about

400 such zones in the country. Since the SEZ deprives the farmers of their land

and livelihood, it is harmful to agriculture. In order to promote export and industrial

growth in line with globalisation the SEZ was introduced in many countries.

India was

one of the first in Asia to recognize the effectiveness of the Export

Processing Zone (EPZ) model in promoting exports, with Asia’s first EPZ set up

in Kandla in 1965. The broad range of SEZ covers free trade zones, export

processing zones, industrial parks, economic and technology development zones,

high-tech zones, science and innovation parks, free ports, enterprise zones,

and others.

Major Objectives of SEZs

1.

To enhance foreign investment, especially to

attract foreign direct investment (FDI) and thereby increasing GDP.

2.

To increase shares in Global Export (International

Business).

3.

To generate additional economic activity.

4.

To create employment opportunities.

5.

To develop infrastructure facilities.

6.

To exchange technology in the global market.

Main Characteristics of SEZ

a.

Geographically demarked area with physical security

b.

Administrated by single body/ authority

c.

Streamlined procedures

d.

Having separate custom area

e.

Governed by more liberal economic laws.

f.

Greater freedom to the firms located in SEZs. As a

result, they need not respect the Government’s rules and regulations.

The

social and environmental impacts were disastrous.

Related Topics