E-Commerce - The Development and Growth of Electronic Commerce | 12th Computer Applications : Chapter 15 : E-Commerce

Chapter: 12th Computer Applications : Chapter 15 : E-Commerce

The Development and Growth of Electronic Commerce

The Development and Growth of Electronic Commerce

Economists

describe four distinct waves (or phases) that occurred in the Industrial

Revolution. In each wave, different business strategies were successful.

Electronic commerce and the information revolution brought about by the

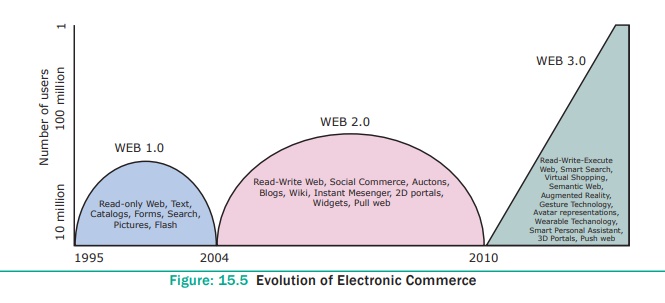

Internet likely go through such series of waves. Refer Figure 15.5

The First Wave of Electronic Commerce: 1995 -2003

The Dotcom companies of first wave are mostly American

companies. Thereby their websites were only in English. The Dotcom bubble had

attracted huge investments to first wave companies.

As the

Internet was mere read-only web (web 1.0) and network technology was in its

beginning stage, the bandwidth and network security was very low. Only EDI and

unstructured E-mail remained as a mode of information exchange between

businesses. But the first wave companies enjoyed the first-move advantage and

customers were left with no option.

The Second Wave of Electronic Commerce: 2004 – 2009

The second wave is the rebirth of E-Commerce after

the dotcom burst. The second wave is considered as the global wave, with

sellers doing business in many countries and in many languages. Language

translation and currency conversion were focused in the second wave websites.

The second wave companies used their own internal funds and gradually expanded

their E-Commerce opportunities. As a result E-Commerce growth was slow and

steady. The rapid development of network technologies and interactive web (web

2.0, a period of social media) offered the consumers more choices of buying.

The increased web users nourished E-Commerce companies (mostly B2C companies)

during the second wave.

The Third Wave of Electronic Commerce: 2010 – Present

The third wave is brought on by the mobile

technologies. It connects users for real-time and on-demand transactions via

mobile technologies. The term Web 3.0, summarize the various characteristics of

the future Internet which include Artificial Intelligence, Semantic Web,

Generic Database etc.

Dotcom Bubble

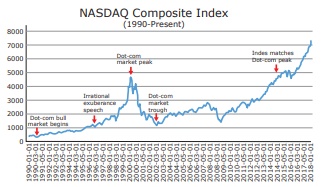

The Dotcom Bubble was a historic

excessive growth (excessive assumption) of economy that occurred roughly

between 1995 and 2000. It was also a period of extreme growth in the usage and

adaptation of the Internet as well.

In the late 1995, there was a

tremendous development in US equity investments in Internet-based companies.

During the dotcom bubble, the value of equity markets grew exponentially with

the NASDAQ composite index of US stock market rising from under 1000 points to

more than 5000 points.

NASDAQ Composite Index

(1990-Present)

Dotcom Burst

The Nasdaq-Composite stock market

index, fell from 5046.86 to 1114.11. This is infamously, known as the Dotcom

Crash or Dotcom Burst. This began on March 11, 2000 and lasted until October 9,

2002. During the crash, thousands of online shopping companies, like as

Pets.com failed and shut down. Some companies like Cisco, lost a large portion

of their market capitalization but survived, and some companies, like Amazon

declined in value but recovered quickly.

Related Topics