Chapter: 12th Commerce : Chapter 7 : Financial Markets : Stock Exchange

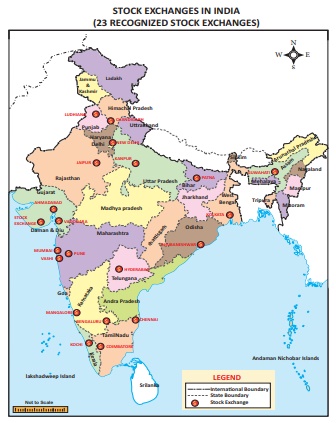

Stock Exchanges In India

Stock Exchanges In India

There are 24 stock exchanges in the country, with

21 of them being regional in nature. Three others that have been set up in the

reforms era, viz., National Stock Exchange (NSE), the Over the Counter Exchange

of India Limited (OTCEI), and Interconnected Stock Exchange of India Limited

(ISE) have mandate to nationwide trading network. The ISE has been promoted by

15 regional stock exchanges in the country and is based at Mumbai. The ISE

provides a member-broker of any of these stock exchanges an access into the

national market segment, which would be in addition to the local trading

segment available at present.

The NSE, OTCEI, ISE, and majority of the regional

stock exchanges have adopted the Screen Based Trading System (SBTS) to provide

automated and modern facilities for trading in a transparent, fair and open

manner with access to investors across the country.

Following are the names of the various stock exchanges in India:

i. The Bombay Stock Exchange

ii. The Ahmedabad Stock Exchange

Association Ltd.

iii. Bangalore Stock Exchange Ltd.

iv. Bhubaneshwar Stock Exchange

v. The Calcutta Stock Exchange

Association Ltd.

vi. The Cochin Stock Exchange Ltd.

vii. The Delhi Stock Exchange

Association Ltd.

viii. The Guwahati Stock Exchange

Ltd.

ix. The Hydrabad Stock Exchange Ltd.

x. The Jaipur Stock Exchange Ltd.

xi. The Kanara Stock Exchange Ltd.

xii. The Ludhiana Stock Exchange

Association Ltd.

xiii. The Madras Stock Exchange Ltd.

xiv. The Madhya Pradesh Stock

Exchange Ltd.

xv. The Magadh Stock Exchange Ltd.

xvi. The Mangalore Stock Exchange

Ltd.

xvii. The Pune Stock Exchange Ltd.

xviii. The Saurashtra Kutch Stock

Exchange Ltd.

xix. The Vadodara Stock Exchange Ltd.

xx. The Coimbatore Stock Exchange

Ltd.

xxi. The Meerut Stock Exchange Ltd.

xxii. The Over The Counter Exchange

of India (OTCEI)

xxiii. The National Stock Exchange of

India (NSE) Ltd.

xxiv. The Interconnected Stock

Exchange of India Ltd.

Top 10 Stock Exchanges in the World.

As on January 31st, 2017, the ten biggest stock exchanges

in the world by market capitalisation of listed securities are:

i. The New York Stock Exchange - Located in New York City; $19.223 trillion in

listed market capitalization.

ii. NASDAQ - Short for the "National Association of Securities Dealers Automated

Quotation", this electronic stock exchange is located in New York City;

$6.831 trillion in listed market capitalization.

iii. London Stock Exchange - Located

in London, England; $6.187 trillion

in listed market capitalization.

iv. Tokyo Stock Exchange -

Formally known as the Japan Exchange

Group, located in Tokyo, Japan; $4.485 trillion in listed market

capitalization.

v. Shanghai

Stock Exchange - Located in

Shanghai, China; $3.986 trillion in listed market capitalization.

vi. Eronext

- Located

throughout Europe (France, Portugal,

The Netherlands, and Belgium); $3.321 trillion in listed market capitalization.

vii. Hong

Kong Stock Exchange - Located in

Hong Kong, Hong Kong; $3.325 trillion in listed market capitalization.

viii. Shenzhen

Stock Exchange - Located in

Shenzhen, China; $2.285 trillion in listed market capitalization.

ix. MX

Group - The Canadian stock exchange

is located in Toronto, Canada; $1.939 trillion in market capitalization.

x. Bombay

Stock Exchange - Located in

Mumbai, India; $1.682 trillion in market capitalization.

REMISERS

He acts as an agent of a member of a

stock exchange. He obtains businessfor his principal ie., the member and gets a

commission for that service.

AUTHORIZED CLERKS

The authorised clerks are mere employees

of the members, appointed by themember of stock exchange. The authorised clerks

transact business on behalf of their employers on the floor of the stock

exchange. They are paid a salary, plus acommission.

BROKERS

Brokers are commission agents, who act as

intermediaries between buyers and sellers of securities. They do not purchase

or sell securities on their behalf. They bring together the buyers and sellers

and help them in making a deal. Brokers charge a commission from both the

parties for their service. Brokers are experts in estimating trends of price

and can effectively advice their clients in getting a fruitful gain. Brokers

get orders from investing public and execute the orders through Jobbers and

they are entitled to a prescribed sale of brokerage.

JOBBERS

Jobbers are security merchants dealing in

shares, debentures as independent operators. They buy and sell securities on

their own behalf and try to earn through price changes. Jobbers cannot deal on

behalf of public and are barred from taking commission. In India, they are

called Taravaniwalas.

SPECULATION

Speculation involves trading a financial

instrument involving high risk, in expectation of significant returns. The

motive is to take maximum advantage from fluctuations in the market.

Speculators are prevalent in the markets where price movements of securities

are highly frequent and volatile.

GAMBLING

There is no reasoning involved in

gambling. It accentuates fluctuations in price and it is unethical and illegal.

It does not perform economic function.

Related Topics