Chapter: 12th Commerce : Chapter 7 : Financial Markets : Stock Exchange

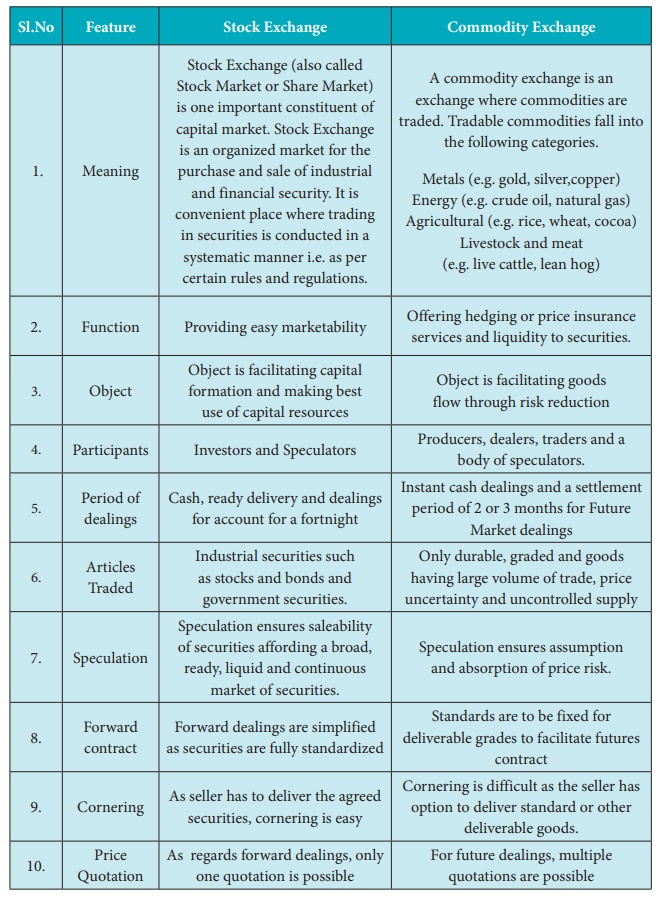

Feature of Stock Exchange and Commodity Exchange

Feature of Stock Exchange

1.

Meaning

Stock Exchange (also called Stock Market or Share

Market) is one important constituent of capital market. Stock Exchange is an

organized market for the purchase and sale of industrial and financial

security. It is convenient place where trading in securities is conducted in a

systematic manner i.e. as per certain rules and regulations.

2.

Function

Providing easy marketability

3. Object

Object is facilitating capital formation and making

best use of capital resources

4.

Participants

Investors and Speculators

5. Period

of dealings

Cash, ready delivery and dealings for account for a

fortnight

6.

Articles Traded

Industrial securities such as stocks and bonds and

government securities.

7.

Speculation

Speculation ensures saleability of securities

affording a broad, ready, liquid and continuous market of securities.

8.

Forward contract

Forward dealings are simplified as securities are

fully standardized

9.

Cornering

As seller has to deliver the agreed securities,

cornering is easy

10. Price

Quotation

As regards forward dealings, only one quotation is

possible

Feature of Commodity Exchange

1.

Meaning

A commodity exchange is an exchange where

commodities are traded. Tradable commodities fall into the following

categories. Metals (e.g. gold, silver,copper) Energy (e.g. crude oil, natural

gas) Agricultural (e.g. rice, wheat, cocoa) Livestock and meat (e.g. live

cattle, lean hog)

2.

Function

Offering hedging or price insurance services and

liquidity to securities.

3. Object

Object is facilitating goods flow through risk

reduction

4.

Participants

Producers, dealers, traders and a body of

speculators.

5. Period

of dealings

Instant cash dealings and a settlement period of 2

or 3 months for Future Market dealings

6.

Articles Traded

Only durable, graded and goods having large volume

of trade, price uncertainty and uncontrolled supply

7.

Speculation

Speculation ensures assumption and absorption of

price risk.

8.

Forward contract

Standards are to be fixed for deliverable grades to

facilitate futures contract

9.

Cornering

Cornering is difficult as the seller has option to

deliver standard or other deliverable goods.

10. Price

Quotation

For future dealings, multiple quotations are

possible

Related Topics