Family Resource Management - Savings and Investments | 11th Home Science : Chapter 7 : Family Resource Management

Chapter: 11th Home Science : Chapter 7 : Family Resource Management

Savings and Investments

SAVINGS AND INVESTMENTS

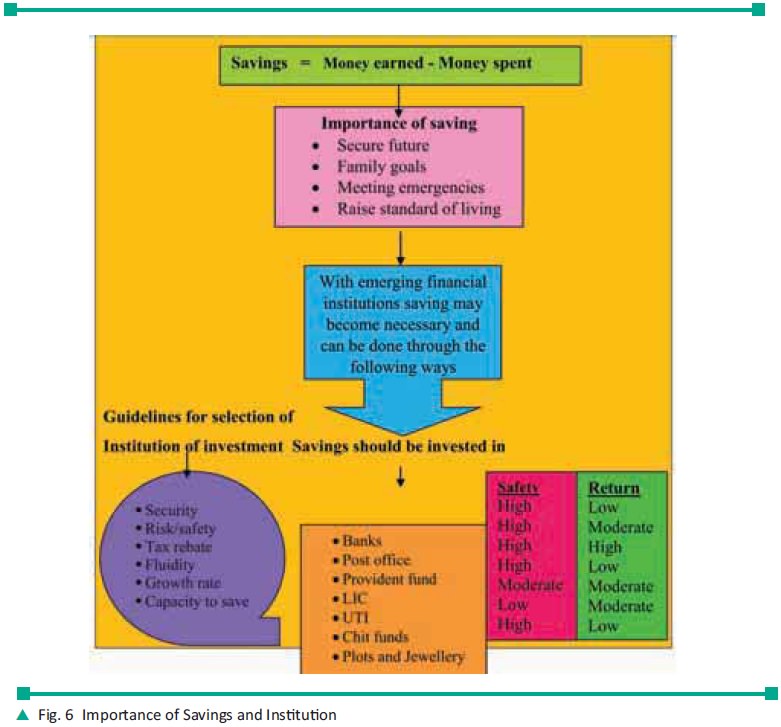

Money from the present income that is

collected and put aside for future consumption is known as savings. Savings of a month is the difference between the income and

expenditure of that month. Families should make sure that they save by cutting

down their wasteful expendi-tures. The following figure shows the importance of

savings and various institu-tions for savings and guidelines for selec-tion of

those institutions.

1. Bank Accounts

Savings Account

Current Account

2. Post office

Savings Account

Recurring Deposit Scheme

Post Office Time Deposit Scheme

3. Provident Fund

General Provident Fund

Contributory Provident Fund

4. Life Insurance Scheme

LIC (Whole Life Policy)

Medical Insurance Scheme

Endowment Policy

5. Units of Unit Trust of India

6. Shares and debentures

7. Bonds

8. Chit Funds

9. Real Estate

10. Gold, Silver Jewellerys

Important Avenues of Investment

When the savings are made to grow, it is called investment. There are various ave-nues of investment. They are:

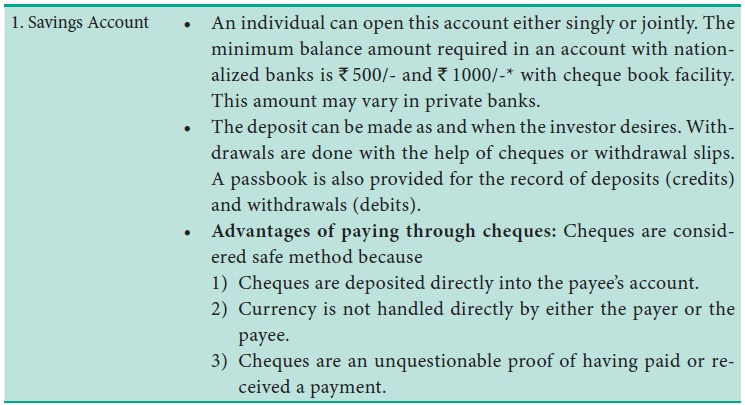

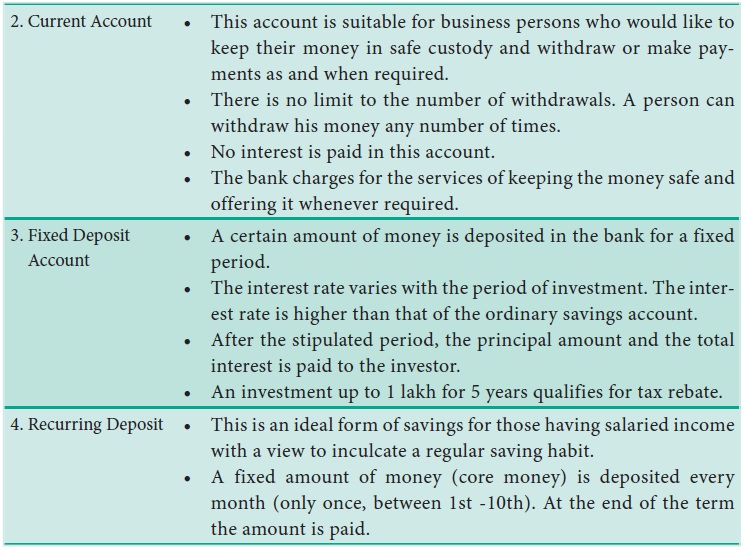

Banks

An investor deposits his savings in a bank

account which earns him a nominal rate of interest. Besides banking, the banks

offer a series of diverse financial ser-vices such as loans, credit cards, ATMs

(Automatic Teller Machines). With the computerization and networking of some of

the banks, their services have become faster and customers can operate their

account from any of its branches. This is called core banking. These are the

main accounts used for depositing money in a bank.

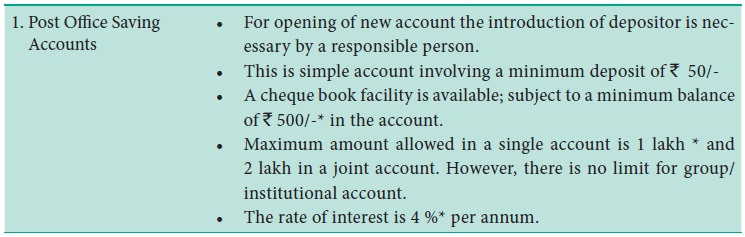

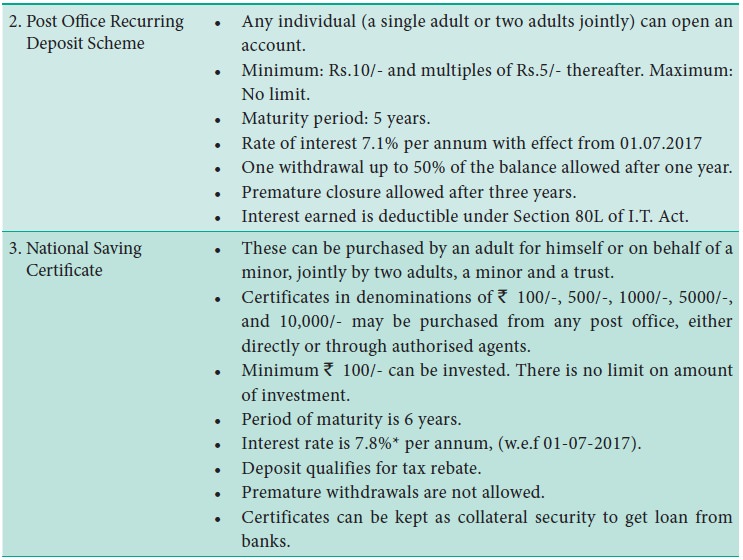

Post Office

Post offices are situated in every locality and are found even in remote areas. There are various post office schemes, each hav-ing its distinct advantages.

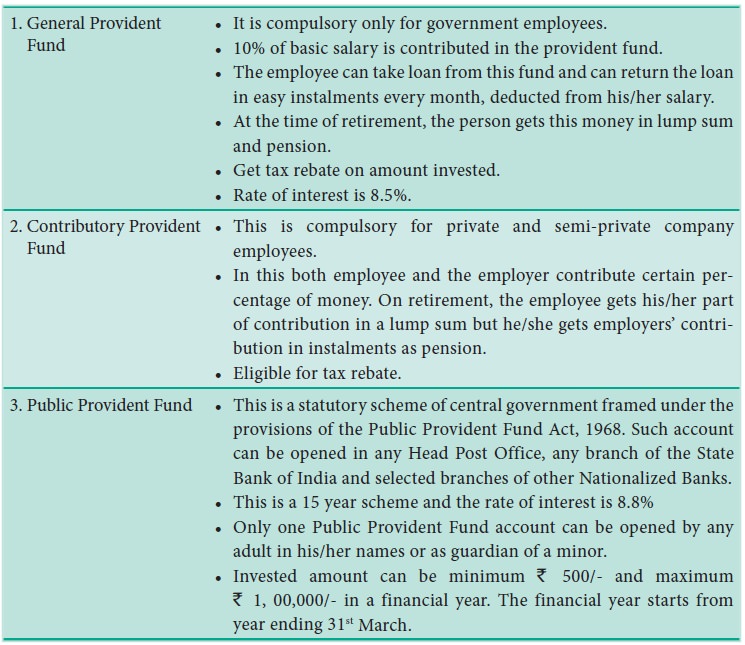

Provident fund

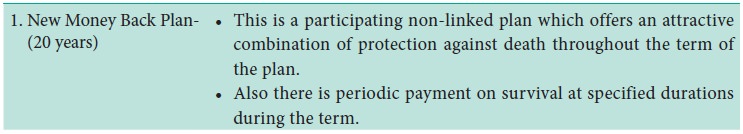

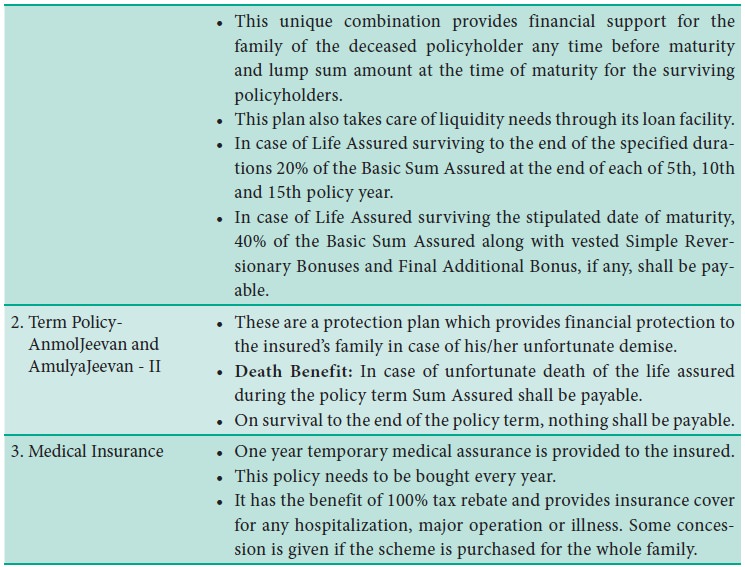

Insurance

Insurance is provided by private as well as

government institutions. Life Insurance Corporation is provided by government

of India. It is a means of providing against loss caused by natural or man-made

fac-tors. It is the most popular method of securing the future.

LIC has a variety of schemes to choose from.

These schemes cater to all categories of people and to their diverse needs.

Some of the popular schemes are given below:

Shares

Shares are a fractional part of the capital of

a company. When a company wants to

When

a person buys shares she becomes part owner of the company. She will then share

both profit and loss of the company. The profits are called dividends.

·

A person can get high rate of interest, if the company is making

profits.

·

Dividends are tax-free.

·

There is a risk of losing money, in case the company goes in a

loss.

·

Investor may not be able to find a suit-able buyer for his/her

shares or may not get a good price.

Debentures

A debenture is an instrument of debt.

Debenture holder is a creditor to the com-pany who loans funds to the company

for a period of time against a fixed rate of interest.

Units

Mutual fund is a public and private sector

financial institution which offers various schemes for attracting investments

from public. It issues units to the investors (unit holders) and invests the

collected amount in securities. Each unit is of Rs

10/-.

Profit and losses are shared by the investors

in proportion to their invest-ment. Mutual fund is required to be reg-istered

under SEBI (Securities Board of India), before it can collect funds from

public. SEBI protects the interest of inves-tors and regulates the securities

market.

·

Open end fund-scheme is available for subscription and

repurchase on a con-tinuous basis. These do not have a stip-ulated maturity

date.

·

Close end fund- these schemes have a stipulated maturity period.

Fund is open for subscription only for a speci-fied period of time.

·

Investors have an option to sell back the units to mutual fund

at the NAV (Net Asset Value) market value of assets.

·

Tax rebate is available under some schemes such as ULIP (Unit

Linked Insurance Plan and Pension Plans).

·

There is no limit on investment in some schemes.

·

Units can be pledged as security for loans.

·

Unit holders can switch from close end to open end schemes.

·

Some schemes may have high risk and high rate of interest. On

the other hand, some schemes have fixed rate of interest but no risk.

·

Dividends are tax free.

Bonds

Bonds are also debentures which are issued by

government or Government Company. On liquidation (closing) of the company, the

creditor is secured.

Chit Funds

This is an easy and simple device where a

group of people join as committee and agree to contribute a fixed sum every

month. Chits are taken out once every month. Chits are taken out once every

month. The promoter gets the first collection and after that, whosoever gets

his name on the chit drawn, gets the money.

Related Topics