Family Resource Management - Expenditure and Budget Management | 11th Home Science : Chapter 7 : Family Resource Management

Chapter: 11th Home Science : Chapter 7 : Family Resource Management

Expenditure and Budget Management

EXPENDITURE AND BUDGET MANAGEMENT

Happiness of the family is secured by income

use or expenditure. The outflow of money is called expenditure. After earning

money, a family spends it on their various needs, basic necessities such as

food, clothing and shel-ter. After their needs are fulfilled, the family

desires to have comforts and luxuries, which makes the family members more

comfort-able. All these expenses are referred to as expenditure. Expenditure

provides the satis-faction of life for the members of the family.

Factors Affecting Expenditure of a Family

Income: In low-income groups, a major portion of income is

spent on food whereas in high income groups only %50 of their money is spent on

food.

Family size: Expenses on food, clothing, and education is more in larger families as compared to small

sized families.

Family composition: In the expanding stage of the family

more money is spent on education and clothes while in the contracting stage,

more expenses are incurred on medicines.

Family status: Influenced by the social circles they move in, a considerable amount of cash may be spent

by some families on, maintaining a number of cars, designer clothes,

entertainment, luxury items.

Type of family: In a joint family, money is saved on rent and childcare.

Family values: Some people give more value to education and prefer spending more on books. Those

giving more importance to religion spend more on religious activities.

Location: There is less expense in small towns as compared to

that in cities. If the school or office is nearby, less money is spent on

transport.

Skill, knowledge and an interest to save: A homemaker with her

knowledge, skill and interest in culinary arts can prepare exotic dishes at

home and thus reduce her expenditure.

Access to community

facilities:

Community facilities help save expenses. A

person using a library need not spend money on buying books.

Budgeting

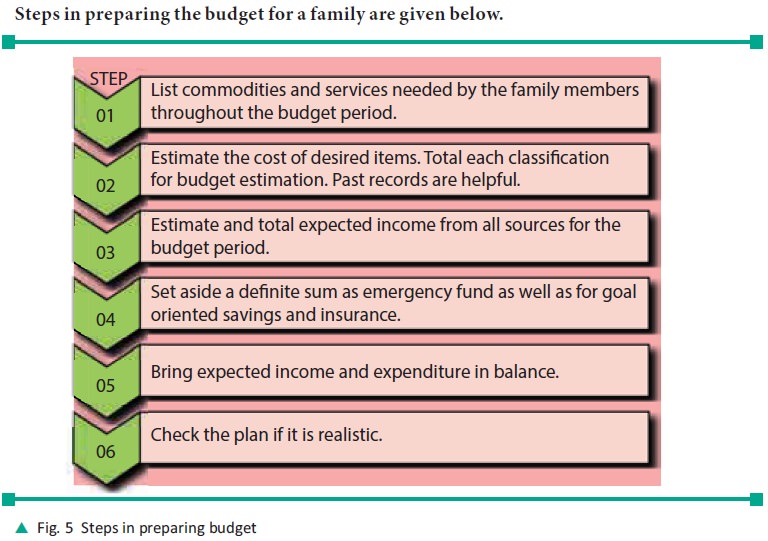

The common planning device for the use of

money is the budget. It is a care-fully prepared spending plan based on the

actual family income. It is a plan based on previous experience, present needs

and future expectations. A budget is always prepared for a fixed period of time

gen-erally for a month. Budget is a guide to realistic spending aimed at

avoiding over expenditure.

Importance of budgeting

·

Budget acts as an intelligent guide to spending.

·

It enables a family to have an overall view of their income.

·

Budgeting facilitates adjusting irregu-lar income to regular

expenditure.

·

Budgeting helps people to discuss their needs and set their own

priorities on them.

·

It helps one to cut unnecessary expenditure.

·

It helps one to be free from debts.

·

It helps one to live within one’s income.

·

It encourages conscious decision mak-ing which may help in

including long term goals in the budget.

·

It relieves the family members from worries of future.

·

It forces one to decide what one wants most out of life.

·

It provides for future saving.

Its success depends upon its being simple,

realistic, flexible and suited to the family or individual for whom it is made.

The List of Budget Items

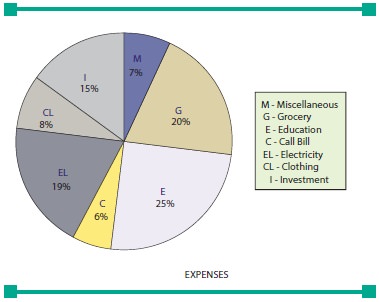

It is necessary to list the chief budget items to make sure that each item is attended to in the expenditure plan while portioning the income. Each family may have their own way of listing the items.

The chief budget items include:

i.

Food

ii.

Clothing

iii. Housing

iv.

Education

v.

Transport

vi.

Personal Expenses (Sundries)

vii.

Household Expenses

viii.

Savings

Related Topics