Chapter: Aquaculture Principles and Practices: Marketing of Aquaculture Products

Risk and insurance - Economics and Financing of Aquaculture

Risk and insurance

Even though comparative figures are not readily available, it is

generally held that the risk in aquaculture is substantially greater than that

in any other form of animal husbandry (Gerhardsen, 1979) and this is mainly due

to the fact that production takes place in water, which is not easily observed

and controlled by man. It is said that there are very few other stock-rearing

industries that are so exposed to such a rapid and extensive loss of stock from

so many varied causes (Secretan, 1979). Risks of loss or loss of value have

been broadly listed as: pollution, disease, food poisoning, failure of water

supply, break-down of equipment and machinery, net and cage failure, predation,

extreme (hot or cold) weather conditions, power failure, poaching, negligence,

floods and other natural disasters like cyclones, typhoons and hurricanes and

malicious damage. Of these, which ones account for maximum losses is difficult

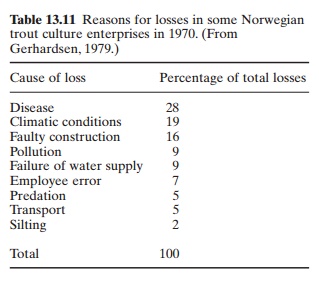

to say. Gerhardsen (1979) published the result of an investigation of trout

culture in Norway (Table 13.11) which showed that disease was the most frequent

reason for losses.

Secretan (1986) reported that over 20 per cent of losses handled by the

Aquaculture Insurance Service of England were due to diseases. Pollution, which

was expected to be a major cause of loss, accounted for only 3.65 per cent of

the losses. When it is remembered that many of the serious diseases have no

known cures, and infected fish have to be destroyed, the magnitude of the risk

involved will become evident. To the risks mentioned above should be added

other business risks like price risk and other sundry risks like claims on

customers and advances to suppliers.

This high-risk status seriously affects the availability of venture capital

for aquaculture. In evaluating investments, cash flows are discounted at a

high-risk rate and this may affect the attractiveness of the project to

investors.

A means of limiting the risk of an owner’s capital is the formation of

companies, for example a joint stock company or limited partnership, with

limited liabilities (Gerhardsen, 1979). However, this only helps to limit

individual risk. Insurance, when possible, is probably a better way of covering

risk and represents security of the interests of all those who are financially

interested in the venture, including investors, shareholders, bankers and

suppliers of equipment and supplies. An insurance on the important insurable

interests of an operation will probably make it easier for even a small operator

to obtain the necessary bank credit. Aquaculture insurance is a new and

developing industry and presently serves mostly industrially advanced countries

only.

Insurance is concerned with the spreading of risks and hazards of the

industry among policy holders. Being a new industry dealing with a high-risk

activity, both the underwriters and insurers face problems in choosing the type

of risks to be covered. Premium rates remain high because of the absence of any

track record for the insured and the large number of claims that the insurers

have to settle.

The most important asset to be insured in an aquaculture enterprise is

the stock of species raised. As most of the risks listed earlier are

interrelated and not adequately defined for legal purposes, an ‘all risks’

coverage may be the best guarantee. It may be possible to exclude from this

selected individual risks (i.e. risks considered not applicable or important)

and thus reduce the premium to be paid.

The main areas of liability that are important in aquaculture are

employers’ liability, public liability and products liability. Depending on the

legal system in the country, provision can be made to meet these through

insurance coverage. Employer’s liability or workmen’s compensation is fairly

easily determined, based on the nature of the work carried out by them. Public

liability can involve somewhat more complicated situations. This could include

third-party personal injury or property damage, especially in open-water cage

or raft culture. In countries where products liability laws exist, it is

important to have insurance coverage for this. Death or disability caused by

the consumption of contaminated aquaculture products or damage caused by the

supply of infected fry or fingerlings can result in payment of considerable

compensations.

Risk management that can be effected through cooperation with the

insurance industry relates to pure risks as opposed to business risks. These

pure risks include (i) natural disasters, (ii) technical (breakdown and failure

of equipment and plants), (iii) theft, poaching, negligence and (iv) personal

risks. It is believed that losses due to all these can be reduced by proper

management practices, making use of the experience of insurers (Secretan,

1979).

Related Topics