Chapter: Aquaculture Principles and Practices: Marketing of Aquaculture Products

Market research - Market strategies for industrial aquaculture

Market strategies for industrial aquaculture

Market research

The type of data required and the methods of evaluation vary considerably between species meant for marketing in domestic and export markets and between indigenous and exotic species. Similarly, the data required for assessing the market potential for a nationwide aquaculture programme are different from those required for determining markets for products of individual operations.The collection of any type of data and their analysis are expensive and therefore decisions have to be based on the estimated value of the expected business.

When investigating the market potential of a nationwide aquaculture development programme, detailed food consumption and dietary habits of the population, stratified geo-graphically and socio-economically (ethnically and income-based), will be necessary. The consumption pattern of aquatic products in different groups and areas and their importance in local diets are important factors in determining the effective demand for the products. The consumer habits are affected not only by tradition and culture, but also by income level. There are species for which the demand will increase as the average income increases. On the other hand, the consumption and therefore total demand for the species may go down with increased income, if the product is not a particularly preferred one. It will also be necessary to examine whether capture fishery production of the species will be adequate to satisfy future demand, and if it is necessary to augment the supplies to meet the projected demand. The magnitude of production needed to fill the gap, if any, has to be determined.

When considering aquaculture for export purposes, additional information will be required on market trends in the importing countries and the extent of competition, besides freight and customs rates, product quality regulation and exchange rates. The ability to compete in an export market may often be dependent on the cost of production and relevant technology, availability of government incentives for export and quality of the product.

It is much more difficult to make any realistic assessment of the markets for a non-indigenous species. Consumer attitude towards local species of comparable qualities and the price at which it can be sold in local markets may be indicative of the potential for developing a market. Test marketing may be a more useful way of assessing acceptability and demand in such cases. When markets for products of individual operations are to be evaluated, the geographic coverage can be much less, and this would make it possible to obtain much more detailed information for analysis.

Consumer habits

All the types of studies and evaluations mentioned above are ultimately based on a proper knowledge of consumer habits, within the producing country or in the importing countries. Distinction has to be made between a consumer market and an industrial market. A consumer market relates to products purchased by individuals and households for personal consumption. It is greatly influenced by the traditions and social values of the community. An industrial market is concerned with the purchase of a material for the purpose of making a tangible economic return. Even though one would expect a much more rational approach in industrial buying, it is also greatly affected by the

attitudes and habits of the personnel involved. It is not easy to understand the relationship between the purchasing behaviour of consumers and the main marketing variables which are described as ‘product quality and price, market location and market promotion’.

When the required information on consumer habits is not available from previous market research, it will be necessary to carry out special surveys to obtain data on consumer preferences, attitudes and consumption patterns. Shang (1981) grouped consumers broadly into three categories: householders, restaurants and institutions. To these should be added industrial consumers. For each group,stratified samples will have to be studied. These comprise households on socio-economic characteristics;restaurants on the basis of their customers and classification of the standards and nature of the cuisine; and institutions according to their basic functions (hospitals, schools, children’s and old people’s homes, etc.).The socio-economic characteristics of those who consume the product, and the basis of the business of and value added to the product by industrial consumers, will have to be considered. The quantity of the product or products purchased during a given time in the recent past, buying and eating habits and the consumers’ view of prices, quality and substitutes are important pieces of information to be collected. The frequency of repurchase of the product and intentions for future purchasing would be necessary to assess levels of satisfaction with the product.

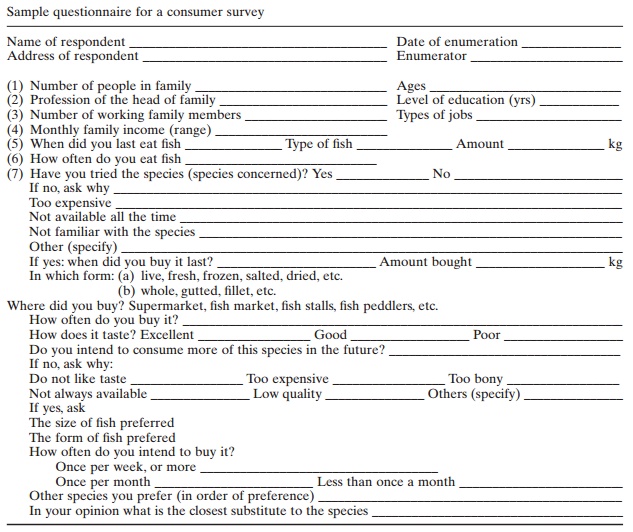

There are several methods of collecting consumer data and each has its drawbacks and merits. The most commonly employed method is through the medium of questionnaires. To obtain useful answers, questionnaires have to be prepared with great skill and understanding of the respondent’s psychology. Some appropriate questions are shown in the sample questionnaire reproduced from Shang (1981). Open-ended questions usually elicit very general answers, which may not be of much use in evaluations. The selection of the consumers, the number to be surveyed and the methods of contacting them are very important. Though a large random sample would be the best, cost considerations may make it necessary to limit the number; but it should be as representative as possible of the individuals who purchase or influence the purchase of the product. The method of contacting respondents will depend largely on their behavioural patterns and communication facilities. Response rates to mailed questionnaires and enquiries over the telephone are not always satisfactory. Personal interviews are probably the best method, as the interviewer can try to influence the respondent to provide all available information through supplementary questions and also make some judgements on the accuracy of the answers.

When cross-tabulated and analysed, the data can give useful estimates of the relationship between a number of factors under study, such as acceptability of the product or quantity consumed as a function of income, race, religion, social status and lifestyle.

When a product is unknown to the potential consumers surveyed, as for example a non- indigenous species under consideration for introduction, any amount of interviews and questionnaires would give only hypothetical answers, which can be only of very limited value. In such cases, test marketing is probably the best means of obtaining useful information.

Income and price elasticities

Using time-series data obtained through the survey on per capita consumption, per capita income, prices of species concerned and prices of competing products, the elasticities of demand (price, income and cross-elasticities) can be calculated by the regression method. These elasticities help in assessing the market potential for an aquaculture product.

Shang (1981) described the ways in which price and income elasticity values can be used to estimate market potentials. The price elasticity of demand is defined as the percentage change in demand created by a 1 per cent change in price in either direction, while other factors (such as income and prices of substitutes) remain unchanged. The demand for the product is considered to be elastic when the absolute value of the price elasticity is greater than 1. This would show that increased production can be absorbed by the market as a result of a relatively small decline in price. Producers will realize higher incomes and consumers will pay lower prices.

The demand for the product is considered inelastic when the absolute value of the price elasticity is less than 1. An increase in production will lead to substantially reduced prices. Consumers will be benefited, but producers will have to sell at lower prices.

Income elasticity of demand measures the percentage change in the quantity of demand as a result of a 1 per cent change in income, when other factors remain unchanged. An increase in income will induce proportionately more demand if the income elasticity is greater than 1. On the other hand, if the income elasticity is less than 1, an increase in income will result in a less than proportional increase in the quantity of demand. In cases where the income elasticities are negative, the demand will decline as income increases. Obviously species with negative income elasticity have only limited potential for culture. By multiplying the projected rate of growth of real per capita income by the estimated income elasticity of demand for a species, the rate of growth which may result from increased income if other factors remain constant can be projected.

The total effective demand for a given species, resulting from increases in population and income, can be estimated using the following formula:

Dt= D0[1+ N +(Ee)]

where

Dt=total demand at year t

D0=total apparent consumption at the baseyear (total apparent consumption is defined as total local production plus imports minus exports)

N = rate of growth of population between base year and year t

E = rate of growth of income between base year and year t

e = income elasticity of demand

t = number of years after the base year

It will be advisable to make separate estimates for urban and rural areas, because of the differences in their population and income-growth patterns.

Test marketing

The need for test marketing or sales experiments to assess consumer acceptance and demand for new species has already been referred to. Besides determining the acceptability of newly introduced and unfamiliar species, this method can also be used to fore-cast consumer response to changes in product specifications and presentation, price changes, etc. Properly designed test marketing permits actual observation and recording of consumer behaviour and reaction, rather than depending on answers to questionnaires or interviews with their inherent limitations. It has, however, to be recognized that it is costly and time-consuming. Control of all the factors that affect sales will also be difficult in such tests.

Tests should ideally be designed to evaluate (i) the actual product trial rate, (ii) the level and frequency of repeat purchase, (iii) the relative effectiveness of various marketing plans (e.g. a high- versus a low-weight promotional programme), (iv) consumer acceptance of product benefit claims, (v) reaction of the trade to the new product and (vi) potential problems of establishing an effective distribution channel (Chaston, 1983). The retail stores or markets selected for testing should be located in areas that have a population structure similar to that of the nation as a whole. Different sizes of the species likely to be produced and the product forms (e.g. fresh, on ice, fillets, frozen, smoked, etc.) that can be sold at different price ranges should be introduced. Detailed data on the buyers and their purchases should be recorded for evaluation. It has been suggested that only a few variables should be tried at a time, but this

may result in prolongation of the test period. In fact, a critical problem of test marketing is the duration of the tests. It is essential to continue until an evaluation of the trial and repeat purchasing can be made. The longer the duration of the experiment, the greater will be the accuracy of the results. However, it will be necessary to limit the duration for reasons of cost and the need for early decisions on the introduction of the species or product. If the first-time purchase or repeat purchase frequency is low, it may be necessary to continue the trials.

Ready acceptability of the product will be characterized by high rates of trial and repeat sales. If the trial rate is high, but the repeat sales are poor, it may show lack of customer satisfaction. The opposite situation of low trial but high repeat sales would indicate that, with better promotional work, the product can become a success. Low trial and repeat sale rates can be taken as proof of the unattractiveness of the product in the markets.

If the results of the test marketing are positive, an estimate of likely market demand can be attempted, using the sales data. The ratio of the number of buyers to the household population of the test area and to the quantity of sales can be used as an indicator of the approximate market demand in the area. The national market demand can be roughly estimated, using the ratio of the household population in the testing area to the entire country.

If the purpose of the trial marketing is to assess the effect of selected stimuli, such as changes in the quality or presentation of products, it will be necessary to select an adequate number of representative stores or markets to serve as controls. The data relating to sales from the test stores and markets should be compared with those in the control markets. An appreciable improvement of sales in the test marketing would clearly show the beneficial effects of the changes.

Related Topics