Computation of ratios | Accountancy - Profitability ratios | 12th Accountancy : Chapter 9 : Ratio Analysis

Chapter: 12th Accountancy : Chapter 9 : Ratio Analysis

Profitability ratios

Profitability ratios

Profitability ratios

help to assess the profitability of a business concern. These ratios also help

to analyse the earning capacity of the business in terms of utilisation of

resources employed in the business. Generally these ratios are expressed as a

percentage.

The profitability ratios

commonly used are

(i) Gross profit ratio

(ii) Operating cost

ratio

(iii) Operating profit

ratio

(iv) Net profit ratio

(v) Return on investment

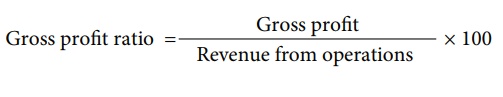

(i) Gross profit ratio

Gross profit ratio is the

proportion of gross profit to net revenue from operations. Gross profit ratio

shows the margin of profit available out of revenue from operations. It is

computed as below:

Gross profit ratio = [

Gross profit / Revenue from operations ] × 100

Gross profit = Revenue from operations – Cost of revenue from operations

A higher gross profit

ratio indicates high profitability. It should be sufficiently high to provide

for indirect expenses to be paid by a business.

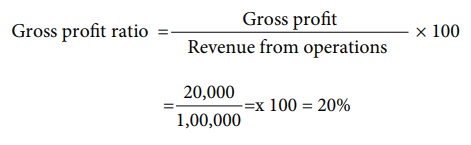

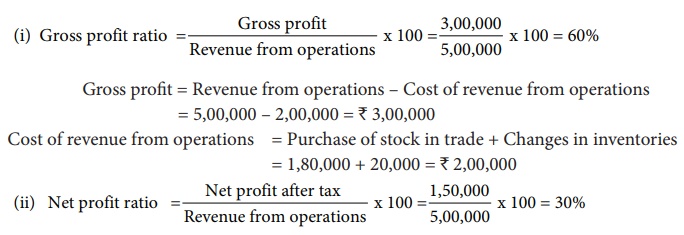

Illustration 13

Calculate gross profit

ratio from the following:

Revenue from operations ₹ 1,00,000, Cost of revenue from operations ₹ 80,000 and purchases 62,500.

Solution

Gross profit = Revenue from operations – Cost of revenue from operations

= 1,00,000 – 80,000 = ₹ 20,000

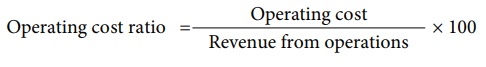

(ii) Operating cost ratio

Operating cost ratio is

the proportion of operating cost to revenue from operations. This

ratio is a test of the operational efficiency of the business. It is calculated

as under.

Operating cost ratio =

[ Operating cost / Revenue from operations ] × 100

Operating cost is the

cost which is associated with the operating activities of the business.

Operating cost = Cost

of revenue from operations + Operating expenses

Operating expenses =

Employee benefit expenses + Depreciation + Other expenses related to office and

administration, selling and distribution

A lower operating ratio

indicates better profitability. Lesser the operating cost ratio, higher is the

margin available for payment of non operating expenses such as interest on

loans, loss on sale of fixed assets, etc.

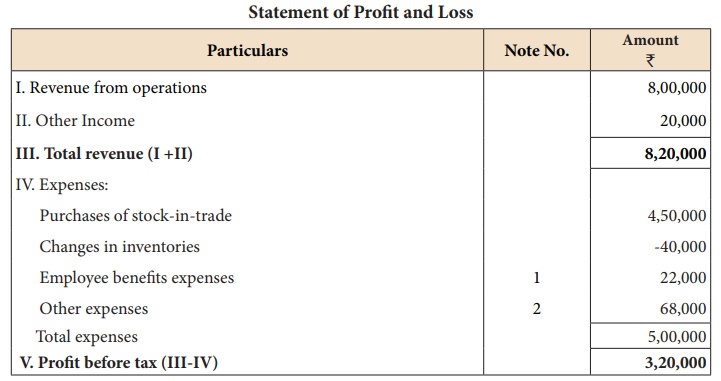

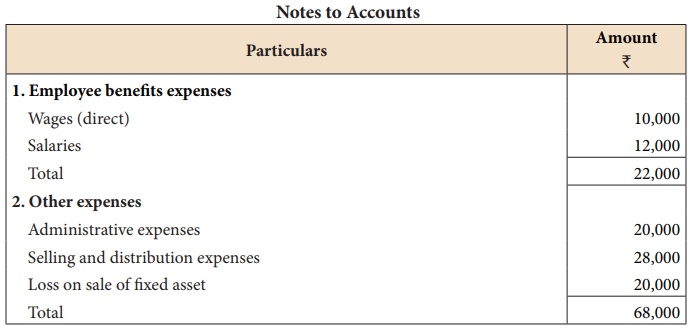

Illustration 14

Following is the

statement of profit and loss of Maria Ltd. for the year ended 31st March, 2018.

Calculate the operating

cost ratio.

Solution

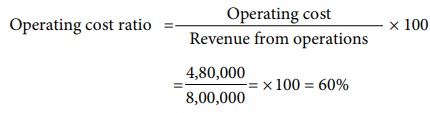

Operating cost ratio = [

Operating cost / Revenue from operations ] × 100

= 4,80,000 /8,00,000 ×

100 = 60%

Cost of revenue from

operations = Purchases of stock-in-trade + Change in inventories of stock in

trade + Direct expenses (wages) = 4,50,000 + (40,000) + 10,000 = ₹ 4,20,000

Operating expenses =

Administrative expenses+Selling and distributionexpenses+ Employee benefits expenses

(salaries) = 20,000 + 28,000 + 12,000 = ₹

60,000

Operating cost = Cost of

revenue from operations + Operating expenses

= 4,20,000 + 60,000= ₹ 4,80,000

Tutorial Note

Loss on sale of fixed

assets is a non-operating item, hence it is ignored.

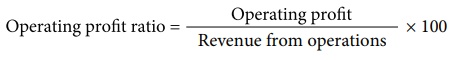

(iii) Operating profit ratio

Operating profit ratio

gives the proportion of operating profit to revenue from operations. Operating

profit ratio is an indicator of operational efficiency of an organisation. It

may be computed as follows:

Operating profit ratio

= [ Operating profit x Revenue from operations ] × 100

Alternatively, it is

calculated as under.

Operating profit ratio

= 100 – Operating cost ratio

Operating profit = Revenue from operations – Operating cost

A higher ratio indicates

better profitability. Greater the operating ratio, higher is the margin

available for paying non-operating expenses.

Tutorial note

Operating cost ratio +

Operating profit ratio = 100%

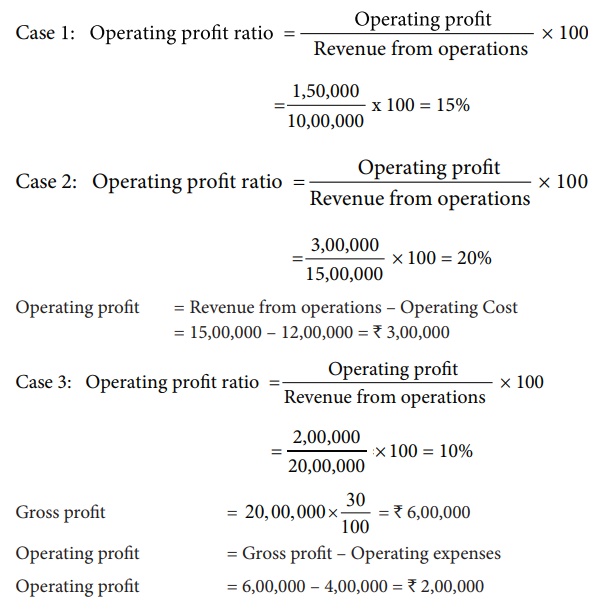

Illustration 15

Calculate operating

profit ratio under the following cases.

Case 1: Revenue from

operations ₹ 10,00,000, Operating

profit ₹ 1,50,000.

Case 2: Revenue from

operations ₹ 15,00,000, Operating

cost ₹ 12,00,000.

Case 3: Revenue from

operations ₹ 20,00,000, Gross profit

30% on revenue from operations, Operating expenses ₹ 4,00,000

Solution

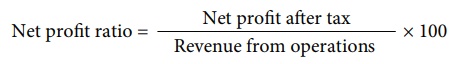

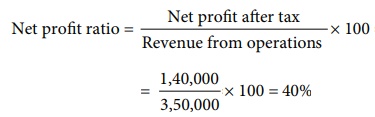

(iv) Net profit ratio

Net profit ratio is the

percentage of net profit on revenue from operations. It is calculated as under:

Net profit ratio = [

Net profit after tax / Revenue from operations ] × 100

Net profit after tax =

Gross profit + Indirect income – Indirect expenses – Tax (OR)

Net profit after tax =

Revenue from operations – Cost of revenue from operations – Operating expenses

–Non operating expenses + Non-operating income - Tax

Net profit ratio is an

indicator of the overall profitability of the business. A higher net profit

ratio indicates high profitability.

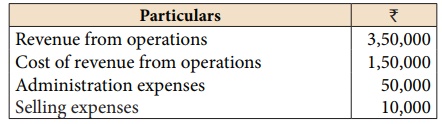

Illustration 16

From the following

details of a business concern calculate net profit ratio.

Solution

Net profit = Revenue

from operations – Cost of revenue from operations – Administration expenses –

Selling expenses = 3,50,000 – 1,50,000 – 50,000 – 10,000 = ₹ 1,40,000

Tutorial note

It is assumed that there

is no tax payable.

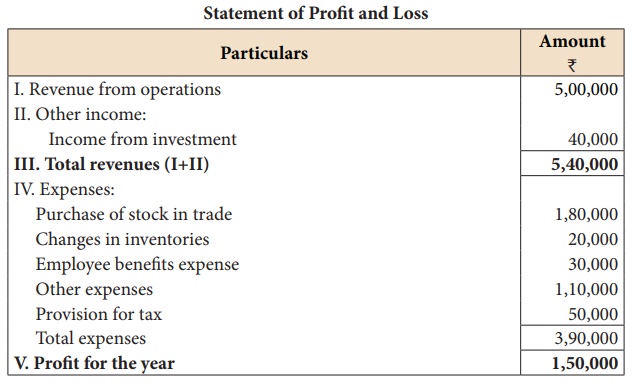

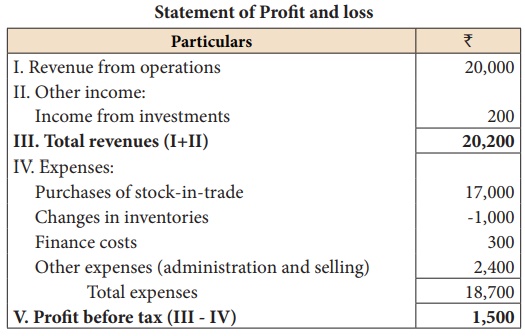

Illustration 17

From the following

statement of profit and loss of Mukesh Ltd. Calculate

(i) Gross profit ratio

(ii) Net profit ratio.

Solution

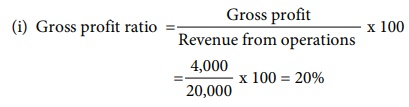

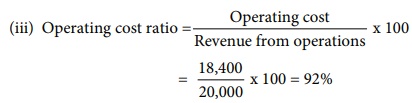

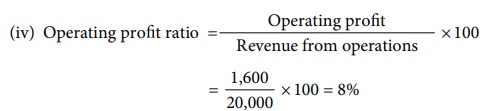

Illustration 18

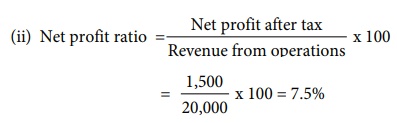

From the following

trading activities of Naveen Ltd. calculate

(i) Gross profit ratio

(ii) Net profit ratio (iii) Operating cost ratio (iv) Operating profit ratio

Solution

Cost of revenue from operations = Purchase of stock-in-trade + Changes in inventory + Direct expenses

= 17,000 – 1,000 + 0 = ₹ 16,000

Gross profit = Revenue from operations – Cost of revenue from operations

= 20,000 – 16,000 = ₹ 4,000

Tutorial note

It is assumed that there

is no tax payable.

Operating cost = Cost of revenue from operations + Operating expenses

Operating expenses = Other expenses = ₹ 2,400

Operating cost = 16,000 + 2,400 = ₹ 18,400

Operating profit = Revenue from operations – Operating cost

= 20,000 – 18,400 = ₹ 1,600

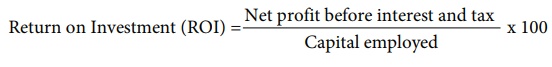

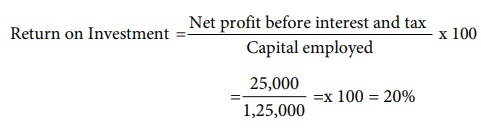

(v) Return on Investment (ROI)

Return on investment

shows the proportion of net profit before interest and tax to capital employed

(shareholders’ funds and long term debts). This ratio measures how efficiently

the capital employed is used in the business. It is an overall measure of

profitability of a business concern. It is computed as below:

Return on Investment

(ROI) = [ Net profit before interest and tax / Capital employed ] x 100

Capital employed =

Shareholders’ funds + Non current liabilities

Greater the return on

investment better is the profitability of a business and vice versa.

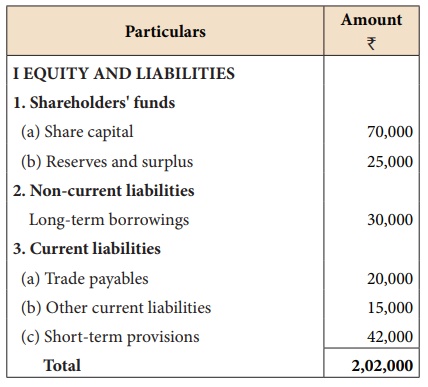

Illustration 19

Following is the extract

of the balance sheet of Babu Ltd., as on 31st March, 2018:

Net profit before interest and tax

for the year was ₹ 25,000. Calculate the return on capital employed for the

year.

Solution

Capital employed = Share capital +

Reserves and surplus + Long term borrowings

= 70,000 + 25,000 +30,000 = ₹ 1,25,000

Related Topics