Computation of ratios | Accountancy - Liquidity ratios | 12th Accountancy : Chapter 9 : Ratio Analysis

Chapter: 12th Accountancy : Chapter 9 : Ratio Analysis

Liquidity ratios

Liquidity ratios

Liquidity means

capability of being converted into cash with ease. Liquidity ratios help to

assess the ability of a business concern to meet its short term financial

obligations. Short term assets (current assets) are more liquid as compared to

long term assets (fixed assets). Liquidity ratios are also called as short term

solvency ratios.

Liquidity ratios

include: (i) Current ratio and (ii) Quick ratio.

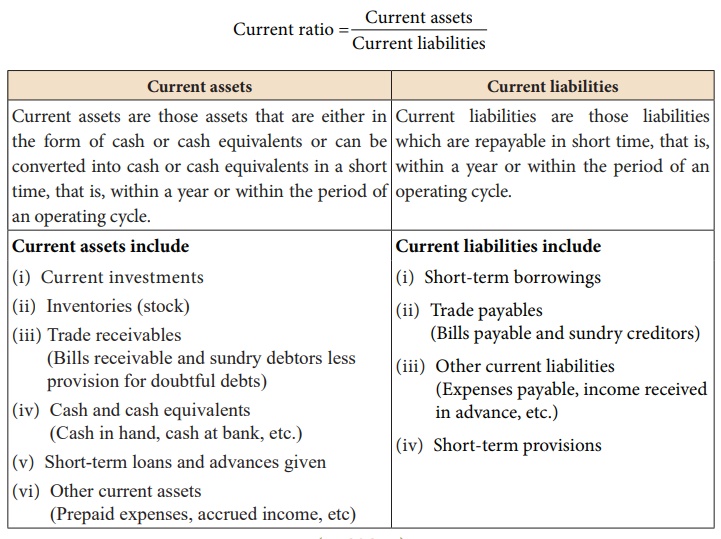

(i) Current ratio

Current ratio gives the

proportion of current assets to current liabilities of a business concern. It

is computed by dividing current assets by current liabilities. Current ratio

indicates the ability of an entity to meet its current liabilities as and when

they are due for payment. It is calculated as follows:

Higher the current

ratio, the better is the liquidity position, as the firm will be in a better

position to pay its current liabilities. However, a much higher ratio may

indicate inefficient investment policies of the management.

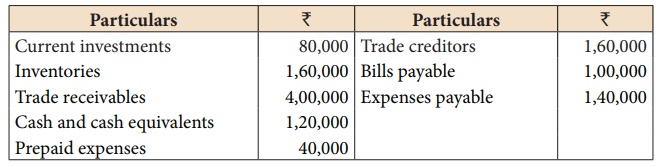

Illustration 1

Calculate current ratio

from the following information:

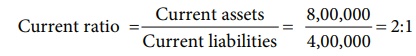

Solution

Current assets = Current investments + Inventories + Trade receivables + Cash and cash equivalents + Prepaid expenses

= 80,000 + 1,60,000 + 4,00,000 + 1,20,000 + 40,000 = ₹ 8,00,000

Current liabilities = Trade creditors +Bills payable + Expenses payable

= 1,60,000 + 1,00,000 + 1,40,000 = ₹ 4,00,000

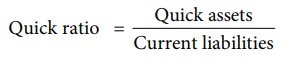

(ii) Quick ratio

Quick ratio gives the

proportion of quick assets to current liabilities. It indicates whether the

business concern is in a position to pay its current liabilities as and when

they become due, out of its quick assets. Quick assets are current assets

excluding inventories and prepaid expenses. It is otherwise called liquid ratio

or acid test ratio. It is calculated as follows:

Quick ratio = Quick

assets / Current liabilities

Quick assets = Current

assets – Inventories – Prepaid expenses

Higher the quick ratio, better is the short-term financial position of an enterprise.

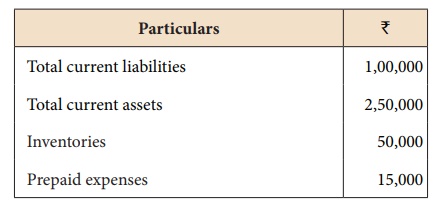

Illustration 2

Calculate quick ratio of

Ananth Constructions Ltd from the information given below.

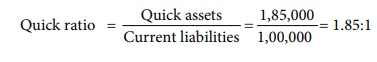

Solution

Quick assets = Current assets – Inventories – Prepaid expenses

= 2,50,000 – 50,000 – 15,000

= ₹ 1,85,000

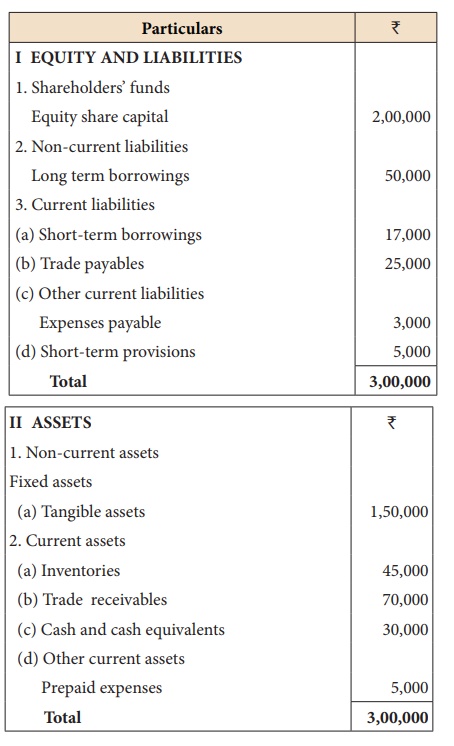

Illustration 3

Following is the balance

sheet of Magesh Ltd. as on 31st March, 2019:

Calculate: (i) Current ratio (ii) Quick ratio

Solution

(i) Current ratio = Current assets/Current liabilities = 1,50,000/50,000 = 3:1

Current assets = Inventories + Trade receivables + Cash and cash equivalents + Prepaid expenses

= 45,000 + 70,000 + 30,000 + 5,000 = ₹ 1,50,000

Current liabilities = Short term borrowings + Trade payables + Expenses payable + Short term provisions

= 17,000 + 25,000 + 3,000 + 5,000 = ₹ 50,000

(ii) Quick ratio = Quick assets / Current liabilities

= 1,00,000/50,000 = 2:1

Quick assets = Total current assets – Inventories – Prepaid expenses

= 1,50,000 – 45,000 – 5,000 = ₹ 1,00,000

Related Topics