Computation of ratios | Accountancy - Long term solvency ratios | 12th Accountancy : Chapter 9 : Ratio Analysis

Chapter: 12th Accountancy : Chapter 9 : Ratio Analysis

Long term solvency ratios

Long term solvency ratios

Long term solvency means

the firm’s ability to meet its liabilities in the long run. Long term solvency

ratios help to determine the ability of the business to repay its debts in the long

run. The following ratios are normally computed for evaluating long term

solvency of the business:

i.

Debt equity ratio

ii.

Proprietary ratio

iii.

Capital gearing ratio

(i) Debt equity ratio

Debt equity ratio is

calculated to assess the long term solvency position of a business concern.

Debt equity ratio

expresses the relationship between long term debt and shareholders’ funds.

It is computed as

follows:

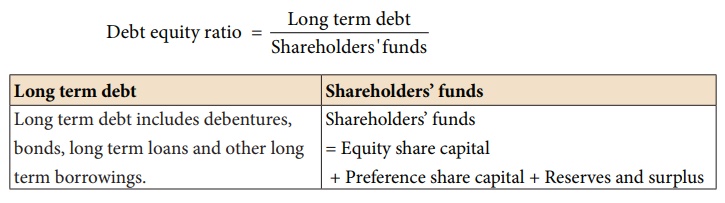

Debt equity ratio = Long term debt / Shareholders'funds

In general, lower the debt equity ratio, lower is the risk to the long-term lenders. A high ratio indicates high risk as it may be difficult for the business concern to meet the obligation to outsiders.

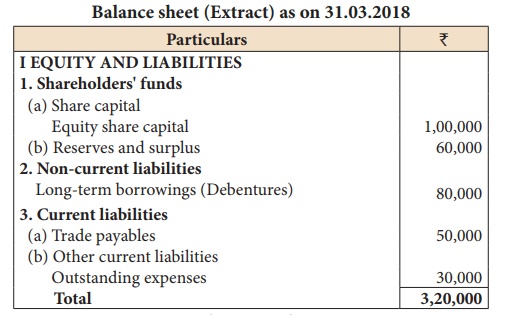

Illustration 4

From the following

information, calculate debt equity ratio:

Solution

Debt equity ratio = Long term debt/Shareholders'funds = 80,000/1,60,000 = 0.5:1

Long term debt = Debentures = ₹ 80,000

Shareholders’ funds = Equity share capital + Reserves and surplus

= 1,00,000 + 60,000 = ₹ 1,60,000

(ii) Proprietary ratio

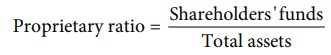

Proprietary ratio gives

the proportion of shareholders’ funds to total assets. Proprietary ratio shows

the extent to which the total assets have been financed by the shareholders’

funds. It is calculated as follows:

Higher the proprietary

ratio, greater is the satisfaction for lenders and creditors, as the firm is

less dependent on external sources of finance.

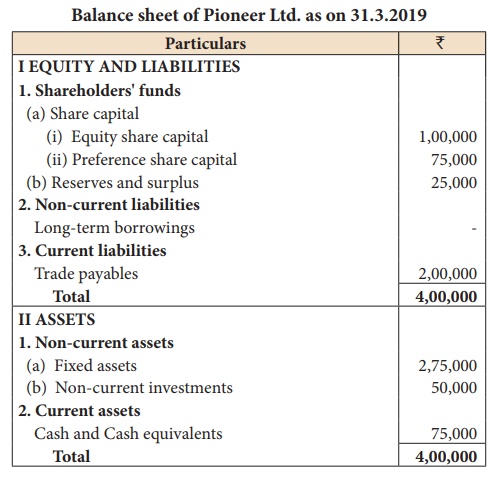

Illustration 5

From the following

Balance Sheet of Pioneer Ltd. calculate proprietary ratio:

Solution

Proprietary ratio =

Shareholders'funds / Total assets = 2,00,000 / 4,00,000 = 0.5:1

Shareholders’ funds =

Equity share capital + Preference share capital + Reserves and surplus

= 1,00,000 + 75,000 +

25,000

= ₹ 2,00,000

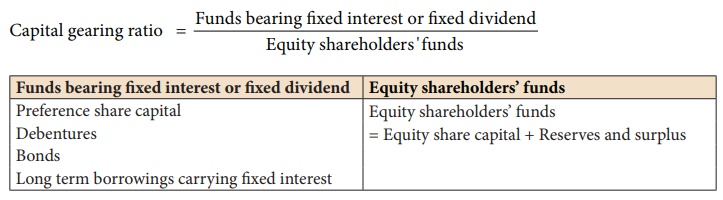

(iii) Capital gearing ratio

Capital gearing ratio is

the proportion of fixed income bearing funds to equity shareholders’ funds.

Fixed income bearing funds include fixed interest and fixed dividend bearing

funds. It is calculated as follows:

Capital gearing ratio =

Equity shareholders'funds / Funds bearing Fixed interest or Fixed dividend

Capital gearing ratio is

a measure of long term solvency as well as capital structure. When the capital

gearing ratio is greater than one, the firm is said to be high geared.

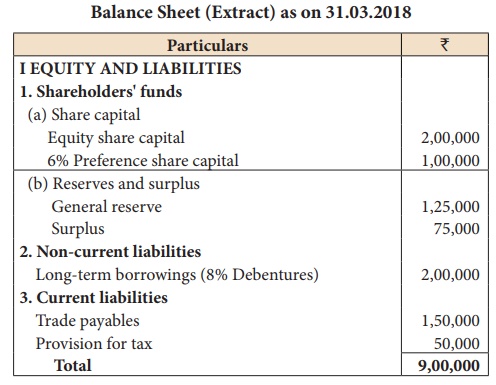

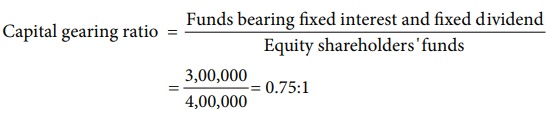

Illustration 6

From the following

information calculate capital gearing ratio:

Funds bearing fixed interest and

dividend = 6% Preference share capital + 8% Debentures

= 1,00,000 + 2,00,000 = ₹ 3,00,000

Equity shareholder’s funds = Equity

share capital + General reserve + Surplus

= 2,00,000 + 1,25,000 + 75,000 = ₹

4,00,000

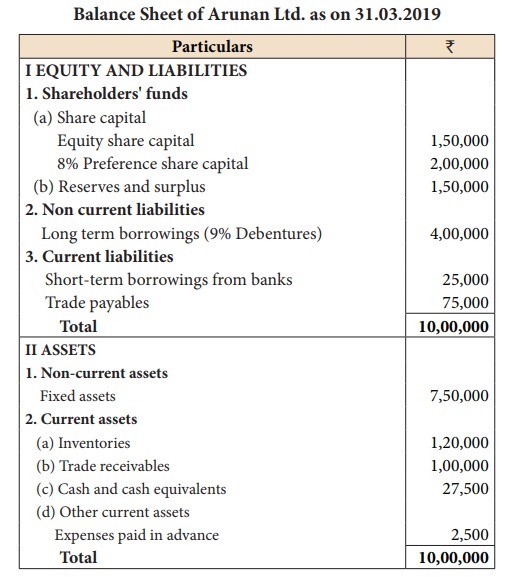

Illustration 7

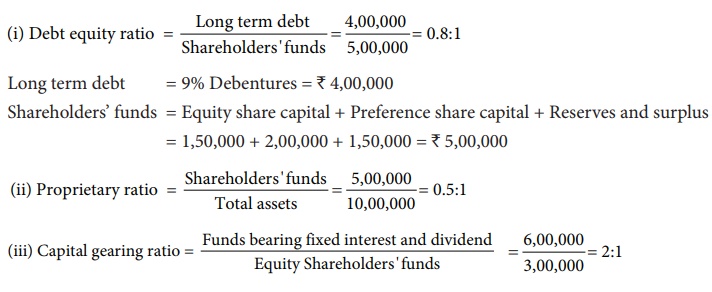

From the following

Balance Sheet of Arunan Ltd. as on 31.03.2019 calculate (i)

Debt-equity ratio (ii) Proprietary ratio and (iii) Capital gearing ratio.

Solution

Funds bearing fixed

interest or dividend = 8% Preference

share capital + 9% Debentures

= 2,00,000 + 4,00,000 = ₹ 6,00,000

Equity shareholders’

funds = Equity share capital + Reserves and surplus

= 1,50,000 + 1,50,000 = ₹ 3,00,000

Related Topics