Chapter: 11th Commerce : Chapter 33 : Indirect Taxation

Meaning of Indirect Tax

Indirect Tax is levied on the goods and services.

INDIRECT

TAXATION

Meaning

of Indirect Tax

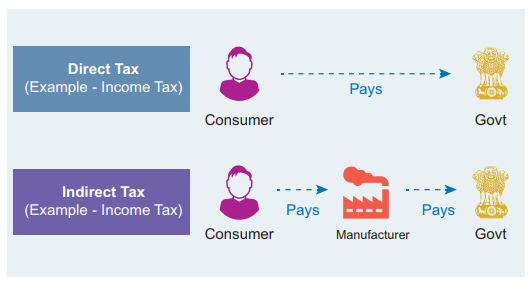

Indirect Tax is levied on the goods and

services. It is collected from the buyers by the sellers and paid by the

sellers to the Government. Since it is indirectly imposed on the buyers it

iscalled indirect tax. e.g. GST - Goods and Services Tax, Excise duty. The

following picture clearly explains the direct tax and indirect tax concepts.

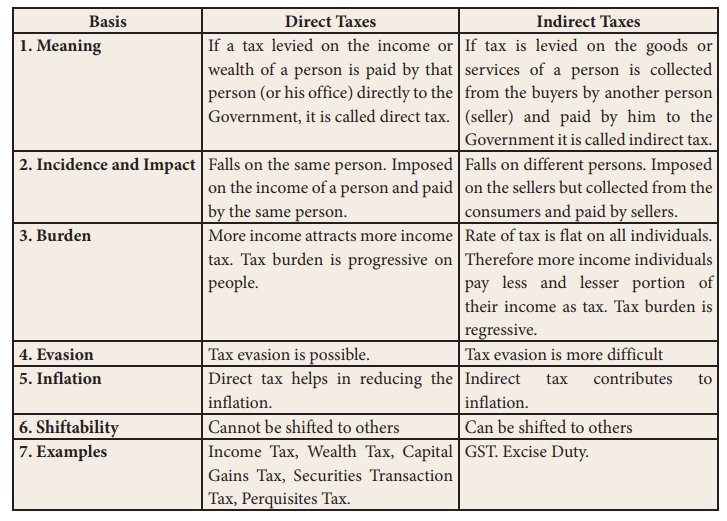

Differences

between Direct Taxes and Indirect Taxes

The main differences between direct

taxes and indirect taxes are given in table.

Study Material, Lecturing Notes, Assignment, Reference, Wiki description explanation, brief detail

11th Commerce : Chapter 33 : Indirect Taxation : Meaning of Indirect Tax |

Related Topics

11th Commerce : Chapter 33 : Indirect Taxation