Chapter: 11th Commerce : Chapter 33 : Indirect Taxation

Differences between Direct Taxes and Indirect Taxes

Differences

between Direct Taxes and Indirect Taxes

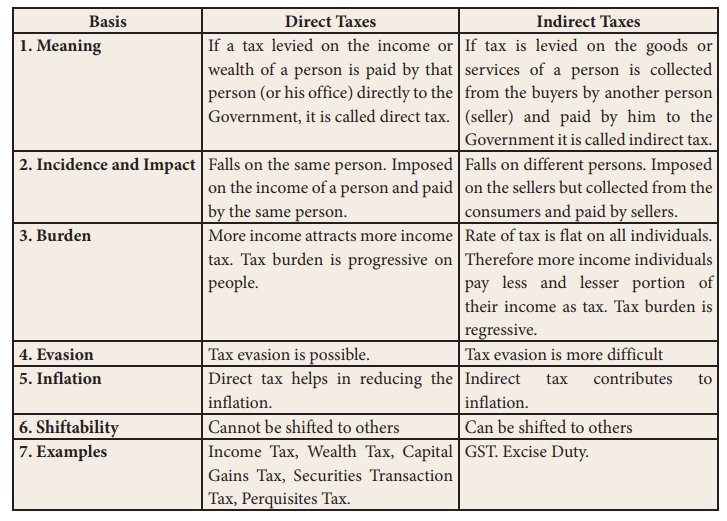

The main differences between direct

taxes and indirect taxes are given in table.

Direct Taxes Vs Indirect Taxes

1.

Meaning

Direct

Taxes: If a tax levied on the income or wealth of a person

is paid by that person (or his office) directly to the Government, it is called

direct tax.

Indirect

Taxes: If tax is levied on the goods or services of a

person is collected from the buyers by another person (seller) and paid by him

to the Government it is called indirect tax.

2.

Incidence and Impact

Direct

Taxes: Falls on the same person. Imposed on the income of a

person and paid by the same person.

Indirect

Taxes: Falls on different persons. Imposed on the sellers

but collected from the consumers and paid by sellers.

3.

Burden

Direct

Taxes: More income attracts more income tax. Tax burden is

progressive on people.

Indirect

Taxes: Rate of tax is flat on all individuals. Therefore

more income individuals pay less and lesser portion of their income as tax. Tax

burden is regressive.

4.

Evasion

Direct

Taxes: Tax evasion is possible.

Indirect

Taxes: Tax evasion is more difficult

5.

Inflation

Direct

Taxes: Direct tax helps in reducing the inflation.

Indirect

Taxes: Indirect tax contributes to inflation.

6.

Shiftability

Direct

Taxes: Cannot be shifted to others

Indirect

Taxes: Can be shifted to others

7.

Examples

Direct

Taxes: Income Tax, Wealth Tax, Capital Gains Tax,

Securities Transaction Tax, Perquisites Tax.

Indirect

Taxes: GST. Excise Duty.

Related Topics