Chapter: 11th Commerce : Chapter 33 : Indirect Taxation

Kinds of GST (Goods and Services Tax)

Kinds of GST

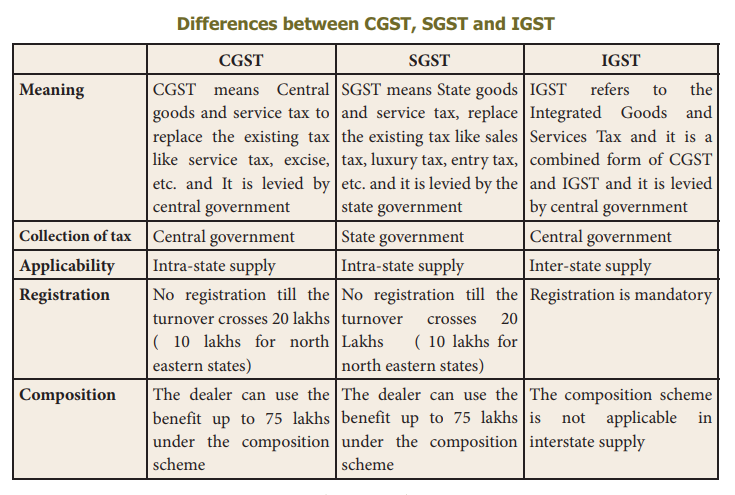

GST is of three kinds: CGST, SGST/UGST,

and IGST.

a.

CGST - Central Goods and Services Tax

imposed and collected by the Central

Government on all supply of goods within a state (intra-state) under CGST Act

2017

b.

SGST - State Goods and Services Tax

imposed and collected by the State

Governments under State GST Act. (Tamil Nadu GST Act 2017 passed by Tamil Nadu

Govt.)

c.

UGST - Union Territory Goods and Services Tax - imposed

and collected by the five Union Territory Administrations in India under UGST

Act 2017.

d.

IGST - Inter-State Goods and Services Tax - imposed and

collected by the Central Government and the revenue shared with States under

IGST Act 2017.

e.

IGST on exports - All exports are treated as

Inter-State supply under GST. Since exports are zero rated, GST is

not imposed on all goods and services exported from India. Any input credit paid

already on exports will be refunded.

Related Topics