Auditing - Liabilities of an Auditor | 12th Auditing : Chapter 9 : Qualifications, Rights and Duties of Auditor

Chapter: 12th Auditing : Chapter 9 : Qualifications, Rights and Duties of Auditor

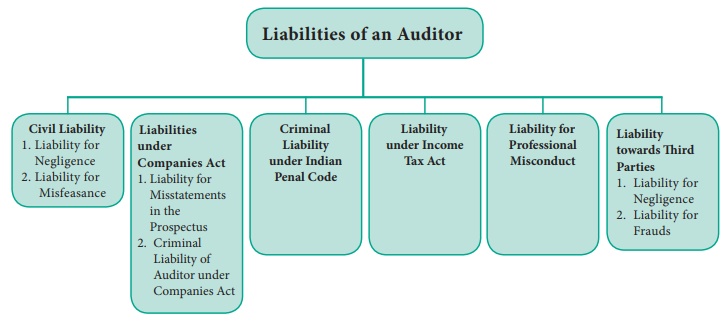

Liabilities of an Auditor

Liabilities of an Auditor:

A

Chartered Accountant is associated with the valuable profession. His primary

duty is to present a report on the accounts and statements submitted by him to

members of the company. He is responsible not only to the members of the

company but also to the third parties of the company, i.e., creditors, bankers

etc.

Normally

the liability of auditor based on the work done by him as professional

accountant and carry out his work due care, caution and diligence. The nature

of liabilities of an auditor is discussed below:

1. Civil Liability:

1. Liability for Negligence:

Negligence

means breach of duty. An auditor is an agent of the shareholders. He has to

perform his professional duties. He should take reasonable care and skill in

the performance of his duties. If he fails to do so, liability for negligence

arises. An auditor will be held liable if the client has suffered loss due to

his negligence. It should be noted that an auditor will not be liable to

compensate the loss or damage if his negligence is not proved.

2. Liability for Misfeasance:

Misfeasance

means breach of trust. If an auditor does something wrongfully in the

performance of his duties resulting in a financial loss to the company, he is

guilty of misfeasance. In such a case, the company can recover damages from the

auditor or from any officer for breach of trust or misfeasance of the company.

Misfeasance proceedings can be initiated against the auditor for any untrue

statement in the prospectus or in the event of winding up of the company.

2. Liabilities under Companies Act

The

following are the liabilities of an auditor under the provisions of the

Companies Act.

(1) Liability for Misstatements in the

Prospectus [Sec.35]:

An

auditor shall be held liable to compensate every person who subscribes for any

shares or debentures of a company on the faith of the prospectus containing an

untrue statement made by him as an expert. The auditor shall be liable to

compensate him for any loss or damages sustained by him by reason of any untrue

statement included therein. The auditor may escape from liability if he proves

that:

·

The prospectus is issued without his knowledge

or consent.

·

He withdrew his consent, in writing before

delivery of the prospectus for registration.

·

He should have withdrawn his consent after

issue of prospectus but before allotment of shares and reasonable public notice

has given by him regarding this.

(ii) Criminal Liability of Auditor under

Companies Act:

1. Untrue statement in Prospectus [Sec.34]

The auditor is liable when he authorizes a false or

untrue prospectus. When a prospectus includes any untrue statement, every

person who authorizes the issue of prospectus shall be imprisoned for a period

of six months to ten years or with a fine, which may be three times the amount

involved in the fraud or with both.

2. Non compliance by auditor [Sec. 143 and 145]:

If the

auditor does not comply regarding making his report or signing or authorization

of any document and makes willful neglect on his part he shall be punishable

with imprisonment upto one year or with fine not less than ₹. 25,000 extendable

to ₹. 5,00,000.

3. Failure to assist investigation [Sec.217

(6)]:

WhenCentral

Government appoints an Inspector to investigate the affairs of the company, it

is the duty of the auditor to produce all books, documents and to provide

assistance to the inspectors. If the auditor fails to do so he shall be

punishable with imprisonment upto one year and with fine up to ₹.1,00,000.

4. Failure to assist prosecution of guilty

officers [Sec.224]:

An

auditor is required to assist prosecution when Central Government takes any

action against the report submitted by the Inspector. If he fails to do so, he

is found guilty and is punishable.

![]() 5. Failure to return property, books or papers [Sec.299]:

5. Failure to return property, books or papers [Sec.299]:

When a

company is wound up the auditor is supposed to be present and subject himself

to a private examination by the court and is also liable to return to the court

any property, books or papers relating to the company. If the auditor does not

comply, he may be imprisoned.

6. Penalty for falsification of books

[Sec.336]:

An

auditor when destroys, mutilates, alters or falsifies or secrets any books of

account or document belonging to the company. He shall be punishable with

imprisonment and also be liable to fine.

7. Prosecution of auditor [Sec.342]:

In the

course of winding up of a company by the Tribunal, if it appears to the

Tribunal that an auditor of the company has been guilty of an offence, it shall

be the duty of the auditor to give all assistance in connection with the

prosecution. If he fails to give assistance he shall be liable to fine not less

than ₹ 25,000 extendable upto ₹.1,00,000.

8. Penalty for deliberate act of commission or

omission [Sec.448]: If an auditor deliberately make a statement in

any report, certificate, balance sheet, prospectus, etc which is false or which

contains omission of material facts, he shall be punishable with imprisonment

for a period of six months to ten years and fine not less than amount involved

in fraud extendable to three times of such amount.

3. Criminal Liability under Indian Penal Code

If any

person issues or signs any certificate relating to any fact which such

certificate is false, he is punishable as if he gave false evidence. According

to Sec.197 of the Indian Penal Code, the auditor is similarly liable for

falsification of any books, materials, papers that belongs to the company.

4. Liability under Income Tax Act [Sec.278]

·

For tax evasion exceeds ₹.1,00,000, rigorous

imprisonment of six months to seven years.

·

A person who induces another person to make and

deliver to the Income Tax authorities a false account, statement or declaration

relating to any income chargeable to tax which he knows to be false, he shall

be liable to fine and imprisonment of three months to three years. An auditor

may also be charged in case of wrong certification of account.

·

A Chartered Accountant can represent his

clients before the Income Tax Authorities. However, if he is guilty of

misconduct he can be disqualified from practicing.

·

An auditor can face imprisonment upto two years

for furnishing false information.

5. Liability for Professional Misconduct

The

Chartered Accountant Act, 1949 mentions number of acts and omissions that

comprise professional misconduct in relation to audit practice. The council of

ICAI may remove the auditor’s name for five years or more, if he finds guilty

of professional misconduct.

6. Liability towards Third Parties

There

are number of persons who rely upon the financial statements audited by the

auditor and enter into transactions with the company without further enquiry

viz. creditors, bankers, tax authorities, prospective shareholders, etc.

1. Liability for Negligence:

It has

been held in the court that auditor is not liable to third parties, as there is

no contract between auditor and third parties. He owes no duty towards them.

2. Liability for Frauds:

The

third parties can hold the auditor liable, if there is fraud on the part of

auditor even if there is no contractual relationship between auditor and third

parties. In certain cases negligence of auditor may amount to fraud for which

he may be held liable to third parties. But it must be proved that auditor did

not act honestly and he knew about it.

Related Topics