Meaning, Definition, Form, Contents, Types - Auditing - Audit Report | 12th Auditing : Chapter 10 : Company Audit

Chapter: 12th Auditing : Chapter 10 : Company Audit

Audit Report

Audit Report

Audit

report is the final stage of audit process. The results of the audit are

communicated through audit report. Audit report is the written opinion of an

auditor regarding companies financial statements. Audit report is a document

prepared by an auditor to certify the financial position and accounting records

of a firm.

Meaning of Audit Report

Audit

report is the statement included in the financial statements. It contains the

opinion of the auditor in financial statements. The auditor reports to the

shareholders who have appointed him. He has to provide his opinion on the truth

and fairness of financial statements. Thus, the auditor protects the interest

of shareholders through audit report.

Definition of Audit Report

Lancaster has defined a report as “a report is a statement of collected and

considered facts, so drawn up as to give clear and concise information to

persons who are not already in possession of the full facts of subject matter

of the report.”

According

to Cambridge Business English Dictionary, Audit report is defined as a formal

document that states an auditor’s judgment of a company’s accounts.

Under

Sec. 143(3), auditor of a company must report to its members.

(a) The

accounts examined by him;

(b) Balance

Sheet, Profit and Loss Account, and Cash Flow statement, which are laid in

general meeting of a company during his tenure of office; and

(c) The

document declared to be attached to the Balance Sheet and Profit and Loss

Account.

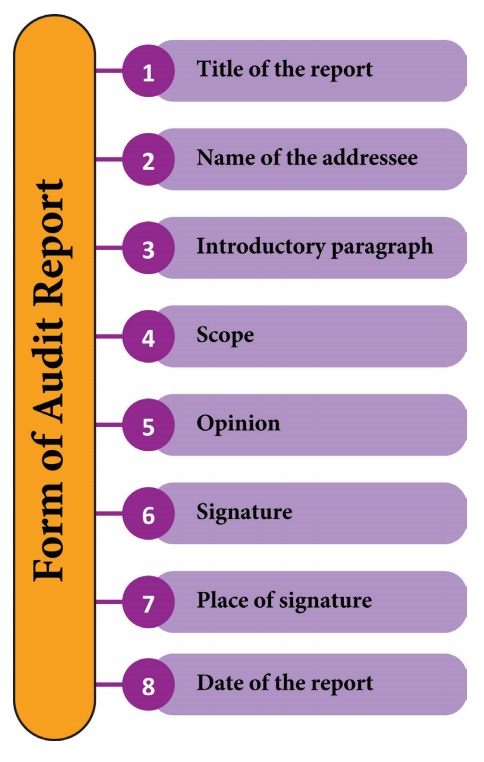

Form of Audit Report

1. Title of the report

The

title of audit report should help the reader to identify the report. It should

disclose the name of the client. The title distinguishes the audit report from

other reports.

2. Name of the Addressee

The

addressee normally refers to the person who appoints the auditor. If a company

appoints the auditor, the addressee should be shareholders. As per law, the

complete address of the addressee is required. Addressee for the statutory

audit shall be shareholders and in case of Special Audit, it is Central

Government.

3. Introductory Paragraph

The

introductory paragraph should specify that it is the auditor’s opinion on

financial statements audited by him. The period covered by financial statements

should be stated with exact dates.

4. Scope

This

part should include the matter-of-fact relating to the manner in which audit

examination was made. The audit examination should cover company’s accounts,

Profit and Loss Account, Balance Sheet and Cash Flow Statements. The

examination should be as per the relevant law. The auditor should not curtail

or limit any examination task.

5. Opinion

The

auditor’s opinion on the books of account and financial statements examined by

him is based on the information and free from bias. The auditor has to give his

opinion as follows:

·

Whether the financial statements are

arithmetically correct and correspond to the figures recorded in the books of

accounts.

·

In case of unqualified opinion, whether the

financial statements represent a true and fair view of the state of affairs and

the results of operations.

·

In case of qualified opinion, if the Balance

Sheet and Profit and Loss account do not present a true and fair view, the

reasons for what and where is wrong.

6. Signature

The

signature part should include the manual signature of the auditor.The personal

name and signature of the auditor should be given. If the auditor is a firm,

the signature in the personal name and firm name should be given.

7. Place of Signature

This

should include the location of the auditor or the auditor firm, which is

ordinarily their city.

8. Date of the Report

The date

of completion of the audit work should be mentioned in this section.

Contents of Audit Report

As per

Sec. 143 of the Companies Act, the auditor’s report shall also state—

a. whether he has sought and

obtained all the information and

explanations which to the best of his knowledge and belief were necessary for

the purpose of his audit and if not, the details thereof and the effect of such

information on the financial statements;

b. whether, in his opinion,

proper books of account as required

by law have been kept by the company so far as appears from his examination of

those books and proper returns adequate for the purposes of his audit have been

received from branches not visited by him;

c. whether the report on the

accounts of any branch office of the

company audited under sub-section (8) by a person other than the company’s auditor

has been sent to him and the manner in which he has dealt with it in preparing

his report;

d. whether the company’s Balance

Sheet and Profit and Loss account

dealt with in the report are in agreement with the books of account and

returns;

e. whether, in his opinion, the

financial statements comply with the

Accounting Standards;

f. the observations or comments of the auditors on

financial transactions or matters which have any adverse effect on the

functioning of the company;

g. whether any director is disqualified from being appointed as a director

under sub-section (2) of section 164;

h. any

qualification, reservation or adverse remark relating to the maintenance of

accounts and other matters connected therewith;

i. whether

the company has adequate internal financial control system in place and the

operating effectiveness of such controls;

j. such

other matters as may be prescribed.

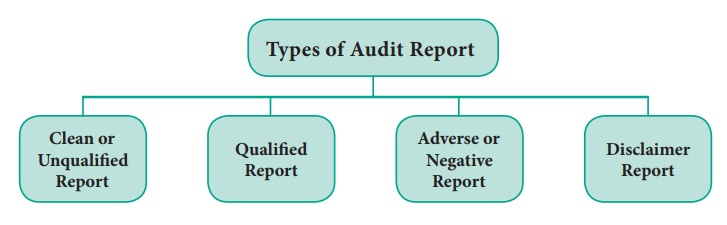

Types of Audit Report

The

audit report may be of the following types:

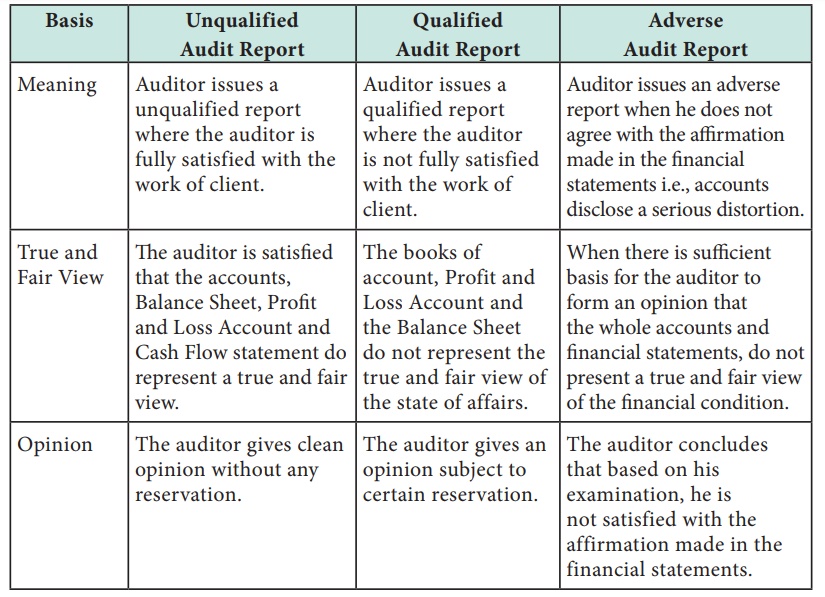

1. Clean or Unqualified Report

Clean or Unqualified report will be given by the auditor if the auditor is satisfied that the accounts, Balance Sheet, Profit and Loss Account and Cash Flow statement do represent a true and fair view and they are prepared in conformity with the accounting principles and statutory requirements.

2. Qualified Report

In

qualified report the auditor believes that overall financial statements are not

fairly stated. The reasons for giving Qualified Report are be as follows:

i. The

books of accounts, Profit and Loss Account and the Balance Sheet do not

represent the true and fair view of the state of affairs and results of the

operations, due to lack of conformity with the accounting principles and

statutory requirements,

ii. The

auditor is not able to verify the value and existence of certain assets,

iii. The

information requested by the auditor is not furnished,

iv. Proper

books of account are not maintained as required by law,

v. Part

of audit examination done by other auditors.

3. Adverse or Negative Report

When

there is sufficient basis for the auditor to form an opinion that the whole

accounts and financial statements, do not present a true and fair view of the

financial condition and results of operation, the adverse or negative opinion

will be given. The adverse or negative report will be given on the following

grounds:

·

When the auditor is not satisfied with the

truth and fairness of financial statements,

·

Non conformity with the Generally Accepted

Accounting Principles,

·

Mistakes, discrepancies and material

misstatement in the financial statements,

·

Omission of a material disclosure.

4. Disclaimer Report

![]() The auditor may disclaim or

refuse opinion on the accounts, Profit and Loss Account and the Balance Sheet,

when he does not have sufficient information to base his opinion. In the scope

and opinion paragraph, the auditor should give disclaimer information. This may

happen on the following grounds:

The auditor may disclaim or

refuse opinion on the accounts, Profit and Loss Account and the Balance Sheet,

when he does not have sufficient information to base his opinion. In the scope

and opinion paragraph, the auditor should give disclaimer information. This may

happen on the following grounds:

·

The auditor has not been able to obtain

sufficient information to form his opinion,

·

The audit examination is not adequate to form

an opinion,

·

There are some material un-determined item in

audit examination.

Differences between Unqualified, Qualified Differences between Unqualified, Qualified

Related Topics