International Economic Organisations - International Monetary Fund | 12th Economics : Chapter 8 : International Economic Organisations

Chapter: 12th Economics : Chapter 8 : International Economic Organisations

International Monetary Fund

International Monetary Fund

The purpose of International Monetary Fund is to secure and

promote economic and financial cooperation among member countries. The IMF was

established to assist the member nations to tide over the Balance of Payments

disequilibrium in the short term. At present, the IMF has 189 member countries

with Republic of Nauru joined in 2016.

1. Objectives of IMF

i.

To promote international monetary cooperation

among the member nations.

ii.

To facilitate faster and balanced growth of international trade.

iii.

To ensure exchange rate stability by curbing competitive exchange

depreciations.

iv.

To eliminate or reduce exchange controls imposed by member

nations.

v.

To establish multilateral trade and payment system in respect of

current transactions instead of bilateral trade agreements.

vi.

To promote the flow of capital from developed to developing nations.

vii.

To solve the problem of international liquidity.

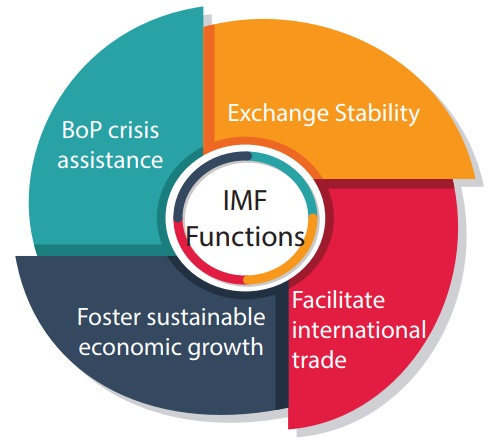

2. Functions Of IMF

i) Bringing stability in exchange rate

The IMF is maintaining exchange rate stability and emphasising

devaluation criteria, restricting members to go in for multiple exchange rates

and also to buy or sell gold at prices other than declared par value.

ii) Correcting BOP Disequilibrium

The IMF is helping the member countries in eliminating or

minimizing the short-period disequilibrium in their balance of payments either

by selling or lending foreign currencies to the member nation.

iii) Determining par values

IMF enforces the system of determination of par values of the

currencies of the member countries. According to the Articles of Agreement of

the IMF, every member nation should declare the par value of its currency in

terms of gold or US dollars. Under this article, IMF ensures smooth working of

the international monetary system, in favour of some developed countries.

iv) Balancing demand and supply of currencies

IMF is entrusted with the important function of maintaining

balance between demand and supply of various currencies. The Fund (IMF) can

declare a currency as scarce currency which is in great demand and can increase

its supply by borrowing it from the country concerned or by purchasing the same

currency in exchange of gold.

v) Reducing trade restrictions

The Fund also aims at reducing tariffs and other trade barriers

imposed by the member countries with the purpose of removing restrictions on

remittance of funds or to avoid discriminating practices.

vi) Providing credit facilities

IMF is providing different borrowing and credit facilities with

the objective of helping the member countries. These credit facilities offered

by it include basic credit facility, extended fund facility for a period of

three years, compensatory financing facility and structural adjustment

facility.

The functions of the IMF are grouped under three heads.

1. Financial – Assistance to correct short and medium term deficit

in BOP;

2. Regulatory – Code of conduct and

3. Consultative - Counseling and technical consultancy.

3. Facilities offered by IMF

The Fund has created several new credit facilities for its

members. Chief among them are:

(i) Basic Credit Facility:

The IMF provides financial assistance to its member nations to

overcome their temporary difficulties relating to balance of payments. A member

nation can purchase from the Fund other currencies or SDRs, in exchange for its

own currency, to finance payment deficits. The loan is repaid when the member

repurchases its own currency with other currencies or SDRs. A member can

unconditionally borrow from the Fund in a year equal to 25% of its quota. This

unconditional borrowing right is called the reserve tranche.

Special Drawing Rights (SDRs)

The Fund has succeeded in establishing a scheme of Special

Drawing Rights (SDRs) which is otherwise called ‘Paper Gold’. They are a form

of international reserves created by the IMF in 1969 to solve the problem of

international liquidity. They are allocated to the IMF members in proportion to

their Fund quotas. SDRs are used as a means of payment by Fund members to meet

balance of payments deficits and their total reserve position with the Fund.

Thus SDRs act both as an international unit of account and a means of payment.

All transactions by the Fund in the form of loans and their repayments, its

liquid reserves, its capital, etc., are expressed in the SDR.

The achievements of the fund can be summed up in the words of Haien that ‘Fund is like an International Reserve Bank.’

(ii) Extended Fund Facility

Under this arrangement, the IMF provides additional borrowing

facility up to 140% of the member’s quota, over and above the basic credit

facility. The extended facility is limited for a period up to 3 years and the

rate of interest is low.

(iii) Compensatory Financing Facility

In 1963, IMF established compensatory financing facility to

provide additional financial assistance to the member countries, particularly

primary producing countries facing shortfall in export earnings. In 1981, the

coverage of the compensatory financing facility was extended to payment problem

caused by the fluctuations in the cost of cereal inputs.

(iv) Buffer Stock Facility

The buffer stock financing facility was started in 1969. The

purpose of this scheme was to help the primary goods (food grains) producing

countries to finance contributions to buffer stock arrangements for the

stabilisation of primary product prices.

(v) Supplementary Financing Facility

Under the supplementary financing facility, the IMF makes

temporary arrangements to provide supplementary financial assistance to member

countries facing payments problems relating to their present quota sizes.

(vi) Structural Adjustment Facility

The IMF established Structural Adjustment Facility (SAF) in March

1986 to provide additional balance of payments assistance on concessional terms

to the poorer member countries. In December 1987, the Enhanced Structural

Adjustment Facility (ESAF) was set up to augment the availability of

concessional resources to low income countries. The purpose of SAF and ESAF is

to force the poor countries to undertake strong macroeconomic and

structural programmes to improve their balance of payments positions and

promote economic growth.

4. Achievements Of IMF

The main achievements of International Monetary Fund are as

follows:

i) Establishment of monetary reserve fund

The Fund has played a major role in achieving the sizeable stock

of the national currencies of different countries. To meet the foreign exchange

requirements of the member nations, IMF uses its stock to help the member

nations to meet foreign exchange requirements.

ii) Monetary discipline and cooperation

The IMF has shown keen interest in maintaining monetary discipline

and cooperation among the member countries. To achieve this objective, it has

provided assistance only to those countries which make sincere efforts to solve

their problems.

iii) Special interest in the problems of UDCs

The notable success of the Fund is the maintenance of special

interest in the acute problems of developing countries. The Fund has provided

financial assistance to solve the balance of payment problem of UDCs. However,

many UDCs continue to be UDCs, while the developed countries have achieved

substantial growth.

5. India and IMF

Till 1970, India stood fifth in the Fund and it had the power to

appoint a permanent Executive Director. India has been one of the major

beneficiaries of the Fund assistance. It has been getting aid from the various

Fund Agencies from time to time and has been regularly repaying its debt.

India’s current quota in the IMF is SDRs (Special Drawing Rights) 5,821.5

million, making it the 13th largest quota holding country at IMF with

shareholdings of 2.44%. Besides receiving loans to meet deficit in its balance

of payments, India has benefited in certain other respects from the membership

of the Fund.

Related Topics