International Economic Organisations - International Bank For Reconstruction And Development (IBRD) or World Bank | 12th Economics : Chapter 8 : International Economic Organisations

Chapter: 12th Economics : Chapter 8 : International Economic Organisations

International Bank For Reconstruction And Development (IBRD) or World Bank

International Bank For Reconstruction And Development (IBRD) or

World Bank

The International Bank for Reconstruction and Development (IBRD),

otherwise called the World Bank(WB) was established in 1945 under the Bretton

Woods Conference in 1944. The purpose is to bring about a smooth transition

from war-time to peace-time economy. It is known as a sister institution along

with the International Monetary Fund. The membership in International Monetary

Fund is a prerequisite to become a member of IBRD. The IBRD was established to

provide long term financial assistance to member countries.

1. Objectives of IBRD

Objectives of the World Bank

1. Reconstruction and Development

2. Encouragement to Capital Investment

3. Encouragement to International Trade

4. Establishment of Peace-time Economy

5. Environmental Protection

The following are the objectives of the World Bank:

1. To help member countries for economic reconstruction and

development.

2. To stimulate long-run capital investment for restoring Balance

of Payments (BoP) equilibrium and thereby ensure balanced development of

international trade among the member nations.

3. To provide guarantees for loans meant for infrastructural and

industrial projects of member nations.

4. To help war ravaged economies transform into peace economies.

5. To supplement foreign private investment by direct loans out of

its own funds for productive purposes.

World Bank’s Lending Procedure:

The Bank advances loans to members in three ways

i) Loans out of its own fund,

ii) Loans out of borrowed capital and

iii) Loans through Bank’s guarantee.

The Bank(WB) has changed its development loan strategy and lays

more emphasis on financing schemes which directly influence the well being of

poor masses of the member countries, especially the developing countries. The

amount of agricultural loans has increased more rapidly than in any other

sector. The bank now also takes interest in the activities of the development

of rural areas such as:

a) spread of education among the rural people

b) development of roads in rural areas and

c) electrification of the villages.

2. Functions of IBRD

The World Bank performs the major role of providing loans for

development works to member countries, especially to underdeveloped countries.

The World Bank provides long-term loans for various development projects.

Article 1 of the Agreement states the functions performed by the world bank as

follows.

1. Investment for productive purposes

The World Bank performs the function of assisting in the

reconstruction and development of territories of member nations through

facility of investment for productive purposes. It also encourages the

development of productive facilities and resources in less developed countries.

2.Balanced growth of international trade

Promoting the long range balanced growth of trade at international

level and the maintaining equilibrium in BOPs of member nations by encouraging

international investment.

3. Provision of loans and guarantees

Arranging the loans or providing guarantees on loans by various

other channels so as to execute important projects.

4.Promotion of foreign private investment

The promotion of private foreign investment by means of guarantees

on loans and other investment made by private investors. The Bank supplements

private investment by providing finance for productive purpose out of its own

resources or from borrowed funds.

5. Technical services

The World Bank facilitates different kinds of technical services

to the member countries through Staff College and experts.

3. Achievements of World Bank

The World Bank is said to be successful in achieving its primary

objective of reconstruction and development of war ravaged nations. It helped

greatly in the reconstruction of Europe after the World War II. It has been

providing the developed and developing countries the same treatment in the

process of growth.

i) It is noted that the Bank’s membership has increased from the

initial number of 30 countries to 68 countries in 1960 and to 151 countries in

1988. The IBRD has 189 member countries.

ii) The Bank grants medium and long-term loans (i.e., payable over

a period of 15-20 years) for reconstruction and development purposes to the

member countries. The actual term of a loan depends upon the estimated useful

life of the equipment or plant financed.

iii) Initially the World Bank’s loans were mainly directed at the European

countries for financing their programmes of reconstruction. Later it changed

its development loan strategy and lays more emphasis of financing schemes for

the poor masses of the developing countries.

iv) The World Bank grants loans to member countries only for

productive purposes particularly for agriculture, irrigation, power and

transport. In other words, the Bank strengthens infrastructure needed for

further development.

v) The International Development Association (IDA), the Soft Loan

Window of the Bank provides loans to UDCs at very low rate of interest.

However, the economic inequality among the member-countries goes on increasing.

Many African countries are yet to improve their economic status.

4. India and World Bank:

The name “International Bank for Reconstruction and Development”

was first suggested by India to the drafting committee. Since then the two have

developed close relationship with each other from framing the policies of

economic development in India to financing the implementation of these

policies. The World Bank has given large financial assistance to India for

economic development. Special mention may be made of the assistance World Bank

has given to India in the development of infrastructure such as electric power,

transport, communication, irrigation projects and steel industry.

The World Bank has assisted a number of projects in India. The IFC has identified five priority areas, namely, capital market development, direct foreign investment, access to foreign markets, equity investments in new and expanding companies and infrastructure. The World Bank has also assisted India in accelerating programmes of poverty alleviation and economic development. Until China became the member of World Bank in 1980, India was the largest beneficiary of the World Bank assistance.

INDIA & IBRD : A Sustainable Relationship

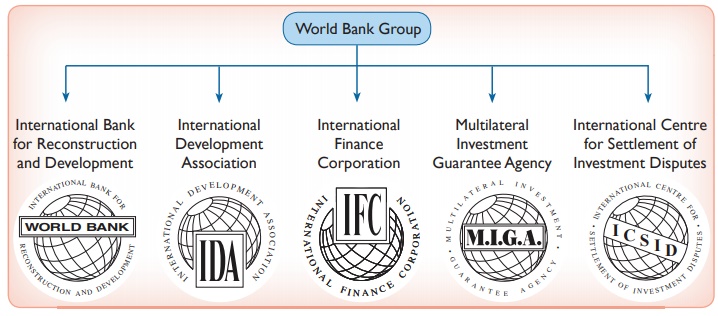

India is a member of four of the five constituents of the World

Bank Group.

·

International Bank for Reconstruction and Development(IBRD, 1945)

·

International Development Association (IDA, 1960)

·

International Finance Corporation (IFC, 1956)

·

Multilateral Investment Guarantee Agency (MIGA, 1958)

·

International Centre for Settlement of Investment Disputes (ICSID,

1966) [India is not its member]

India is one of the founder members of IBRD, IDA and IFC. World

Bank assistance in India started from 1948 when a funding for Agricultural

Machinery Project was approved.

First investment of IFC in India took place in 1959 with US$ 1.5

million.

India became a member of MIGA in January 1994.

India has an Executive Director, in the Board of Directors of IBRD

/ IFC / IDA/ MIGA.

Related Topics