Chapter: Business Science : Financial Management : Long Term Sources of Finance

Indian Capital and stock Market

Indian Capital & stock Market

• Capital

Market/ Securities Market

o Primary

capital market

o

Secondary capital market

• Money

Market

• Debt

Market

Capital

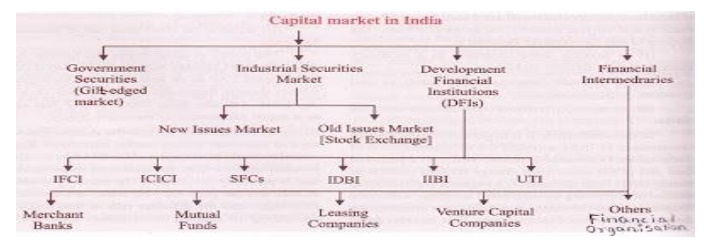

Market in India

Government Securities Market

This is

also known as the Gilt-edged market. This refers to the market for government

and semi- government securities backed by the Reserve Bank of India (RBI).

Industrial Securities Market

This is a

market for industrial securities i.e. market for shares and debentures of the

existing and new corporate firms. Buying and selling of such instruments take

place in this market. This market is further classified into two types such as

the New Issues Market (Primary) and the Old (Existing) Issues Market

(secondary). In primary market fresh capital is raised by companies by issuing

new shares, bonds, units of mutual funds and debentures. However in the

secondary market already existing i.e old shares and debentures are traded.

This trading takes place through the registered stock exchanges. In India we

have three prominent stock exchanges. They are the Bombay Stock Exchange (BSE),

the National Stock Exchange (NSE) and Over The Counter Exchange of India

(OTCEI).

Development

Financial Institutions (DFIs) : This is yet another important segment of Indian

capital market. This comprises various financial institutions. These can be

special purpose institutions like IFCI, ICICI, SFCs, IDBI, IIBI, UTI, etc.

These financial institutions provide long term finance for those purposes for

which they are set up.

Financial Intermediaries

The

fourth important segment of the Indian capital market is the financial

intermediaries. This comprises various merchant banking institutions, mutual

funds, leasing finance companies, venture capital companies and other financial

institutions.

Related Topics