Chapter: Business Science : Financial Management : Long Term Sources of Finance

Hire purchase

Hire Purchase:

1 Introduction

2 Features

3 Hire Purchase Agreement

4 Difference between leasing and hire-purchase

Hire purchase

1Introduction

Hire

purchase is a mode of financing the price of the goods to be sold on a future

date. In a hire purchase transaction, the goods are let on hire, the purchase

price is to be paid in installments and hirer is allowed an option to purchase

the goods by paying all the installments. Hire purchase is a method of selling

goods. In a hire purchase transaction the goods are let out on hire by a

finance company (creditor) to the hire purchase customer (hirer). The buyer is

required to pay an agreed amount in periodical installments during a given

period. The ownership of the property remains with creditor and passes on to

hirer on the payment of the last installment.

A hire

purchase agreement is defined in the Hire Purchase Act,

1972 as

peculiar kind of transaction in which the goods are let on hire with an option

to the hirer to purchase them, with the following stipulations :

a. Payments

to be made in installments over a specified period.

b. The

possession is delivered to the hirer at the time of entering into the contract.

c. The

property in goods passes to the hirer on payment of the last installment.

d. Each

installment is treated as hire charges so that if default is made in payment of

any installment, the seller becomes entitled to take away the goods, and

e. The

hirer/ purchase is free to return the goods without being required to pay any

further installments falling due after the return.

2 Features

v Under

hire purchase system, the buyer takes possession of goods immediately and

agrees to pay the total hire purchase price in installments.

v Each

installment is treated as hire charges.

v The

ownership of the goods passes from the seller to the buyer on the payment of

the last installment.

v In case

the buyer makes any default in the payment of any installment the seller has

right to repossess the goods from the buyer and forfeit the amount already

received treating it as hire charges.

v The hirer

has the right to terminate the agreement any time before the property passes.

That is, he has the option to return the goods in which case he need not pay

installments falling due thereafter. However, he cannot recover the sums

already paid as such sums legally represent hire charges on the goods in

question.

3 Hire Purchase

Agreement

1.Nature of Agree ment: Stating

the nature, term and commencement of the

agreement.

2.Delivery of Equipment: The place

and time of delivery and the hirer‘s liability to bear delivery charges.

3.

Location:

The place

where the equipment shall be kept during the period of hire.

4. Inspection: That the hirer has examined the

equipment and is satisfied with it.

5.Repairs: The hirer to obtain at his cost,

insurance on the equipment and to hand over

the insurance policies to the owner.

6.Alteration:

The hirer not to make any alterations, additions and so on to the equipment,

without prior consent of the owner.

7. Termination: The events or acts of hirer that

would constitute a default eligible to

terminate the agreement.

8.

Risk: of loss

and damages to be borne by the hirer.

9.Registration and fees: The hirer

to comply with the relevant laws, obtain registration and bear all requisite fees.

10. Indemnity clause: The

clause as per Contract Act, to indemnify the lender.

11. Stamp duty: Clause specifying the stamp duty

liability to be borne by the hirer.

12. Schedule: of equipments forming subject

matter of agreement.

13. Schedule of hire charges.

The

agreement is usually accompanied by a promissory note signed by the hirer for

the full amount payable under the agreement including the interest and finance

charges.

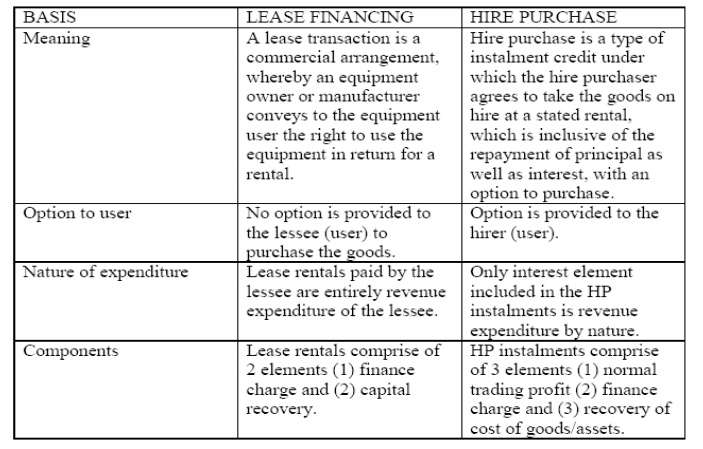

4 DIFFERENCE BETWEEN LEASING AND HIRE-PURCHASE

Related Topics