Meaning, Objectives, Procedure, Intermediaries - Import Trade | 11th Commerce : Chapter 26 : Export and Import Procedures

Chapter: 11th Commerce : Chapter 26 : Export and Import Procedures

Import Trade

Import Trade

Meaning

Import trade refers to purchasing goods

and service from a foreign country. For Example Purchase of chemicals by an

Indian company from France is termed as import. Domestic purchaser of goods is

termed as importer and overseas seller is called exporter.

Objectives of Import Trade

Objectives of import trade have been

highlighted hereunder.

1. Achieving Rapid Industrialization

Developing countries can achieve rapid

industrialisation by importing advanced technology scarce raw materials,

capital goods like machinery equipment, etc., and talents from other countries.

2. Meeting Consumer Demand

Certain goods are either

not available or cannot be

manufactured / produced adequately to meet the growing demand in home country.

Hence import is necessary to meet the short supply of those goods.

3. Upgrading Standard of Living of the People

Consumers are able to use a wide variety

of goods like cell phone, car laptop. television audio system, washing machine,

perfume, soaps, etc., manufactured in foreign countries and enhance their

standard of living through import trade.

4. Meeting Shortage Situation

During famine, earthquake, flood

draught, tsunami, abnormal price-increase situations and so on food grains,

vegetables and other essential

commodities are imported from foreign countries and bad situation arising from

the above situations are thus overcome.

5. Strengthening Defence

Many countries around the world import

defence equipments for its armed force. Such imports enable the country to

ensure its sovereignty and territorial integrity.

Import Procedure

Import procedure varies from country to

country depending upon the foreign trade policy of a country. Government of

India has framed rules and regulations for the import. The import procedures

has been clearly spelt out of Government of India. Following are the procedures

of import trade.

1. Obtaining Import License

Importer has to secure Import and Export

Code (IEC) from the Director General of Foreign Trade or its Regional

Authority. The Indian Institute classification (ITC)–Harmonized System

(HS) classified the goods into three categories, namely

Restricted, Canalised and Prohibited. Goods not specified in the above

categories can be freely imported without any restrictions. Import license is

not required to import the goods not mentioned in the above

classification. An import license is valid for 24 months for capital goods and

18 months for other goods.

Importer has to submit the copy of IEC

to customs authorities at the time of clearance of goods. The second copy of

IEC is used to obtain foreign exchange from RBI.

2. Trade Enquiry

Having obtained IEC, the intending

importer has to make enquiry from exporter or his agents. Importer makes

request by e-mail or postal mail to supply the details given below.

a.

Specification of goods like size,

design, quality etc.,

b.

Quantity goods available

c.

Price per unit

d.

Terms of shipping

e.

Terms of payments i.e. Letter of credit

Documents against Acceptance (D/A)or Documents against Payment (D/P)

f.

Probable delivery time

g.

Validity of offer period

Importer responds to enquiry by sending proforma

invoice

3. Obtaining Foreign Exchange

Since importer has to settle import

bills in foreign currency, he has to obtain foreign exchange. Importer has to

provide IEC code in the form supplied by authorized dealer to get foreign

exchange.. The importer has to submit an application along with necessary

documents to the Exchange Control Department of RBI. After scrutinising the

said application, the Reserve Bank of India will sanction the release of

foreign exchange.

4. Placing an Indent Order

Importer places an order

either directly or through an indent houses. The indent

contains the details like type of goods, design of goods, price, quantity,

grade, packing instructions, insurance, delivery mode, desired delivery period,

mode of period, mode of shipment, etc.,

5. Opening Letter of Credit(L/C)

Where foreign exporter does not know

Indian importer, he may like to ensure the creditworthiness of the unknown

importer. In such a case, exporter may advise the importer to arrange for

letter of credit in his favour..Letter of credit is a document under which

issuing bank undertakes to make payment on behalf of the importer or to the

order of importer in exchange for specified documents from exporters bank. The

letter of credit is issued only for financially sound importer. Exporter’s bank

eventually sends the document to issuing bank which releases the payment.

6. Receiving Shipping Document

The importer collects shipping documents

along with the advice note of

shipment of goods from the exporters.

Advice note contains a written message through which exporter informs the

importer about the dispatch of goods and advise him to make agreement for

taking delivery of goods on arrival of goods at the port of destination. The

captain of the ship informs the dock authorities about the arrival of goods on

a document called Import General Manifest. The customs authorities in turn

inform the importer concerned about the arrival of goods at the port.

7. Appointment of Clearing Agents

There are lot of formalities involved in

clearing the goods imported from the port. Normally importer does not feel

comfortable with completing the formalities by himself. In this case he may

delegate the task of clearing the imported goods from the port of discharge to

clearing agent who is well-versed in this job. The latter performs the job for

a fee. The importer sends all the documents to the clearing agent to enable him

to take delivery of goods after fulfilling the customs formalities prescribed

in this regard.

8. Fulfillment of Customs Formalities

Clearing agent engaged by the importer

performs the following activities in connection with taking delivery of goods

from the port.

i.

Getting Endorsement for Delivery

The clearing agent gets bill of lading

endorsed by importer in his favour to enable him to take delivery of goods and

approaches the shipping company. Where the freight is not paid, the clearing

agent pays it. The shipping company may give a separate delivery order after

collecting the freight charges or it may simply endorse on the bill of lading

by the importer or by his agent itself as a proof payment of freight charges.

ii.

Payment of Dock Dues

The clearing agent submits two copies of

filled in Application form to “Landing and Shipping Dues Office. This office

levies charges on all the imported goods. The clearing agent has to pay Dock

charges by Dock challan. After paying dock charges ‘Landing and Shipping Due

Office stamps on the application form itself with wordings like Dock charges

paid’ or it may issue a separate receipt called Post Trust Dues Receipt.

iii.

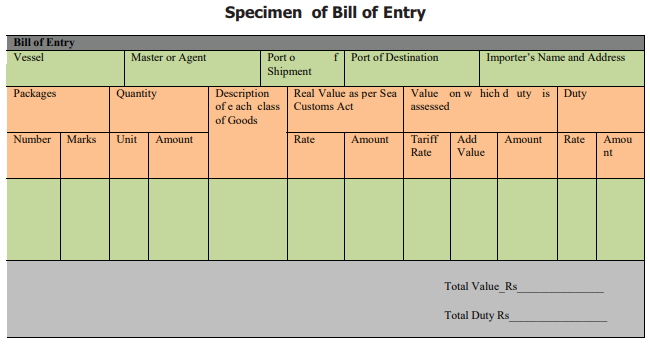

Preparation of Bill of Entry

Bill of Entry is prepared in triplicate

in order to pay custom duty. This document contains the details like name and

address of importer, the name of the ship, full description of the goods,

number of packages, importer and exporter code (IEC) name of the exporting

country and custom duty payable. Bill of Entry is issued in three colours. The

black form is meant for non-dutiable goods while the blue form is meant for the

goods within the country and the violet is

intended for re-export. Import

duty is calculated on the basis of details given in the bill of entry by

customs authorities. Where the importer / clearing agent does not know

He would provide as much as details

possible about the goods imported to the extent of his memory and with specific

remark that he cannot give complete information about the goods imported. In

such a case , customs authorities will complete the statement and import duty

only after assessing the arrival of goods at the port of delivery.

iv.

Payment of Import Duty

The clearing agent / importer submits

the bill of entry and other required documents to the customs authorities. He

pays import duty in the case of dutiable goods to the customs authorities.

v.

Release Order From Dock

After payment of customs

duty, the bill of entry has to be marked by the dock.

Superintendent and an examiner are instructed to physically examine the goods.

He gives his report on the bill of entry. Then the bill is passed over to the

port authority. He would issue release order.

vi.

Getting Delivery From The Dock.

The clearing agent takes delivery of

goods from the dock after submitting the documents like, Port Trust Dues

Receipt, Bill of Entry and Bill of Lading. If the goods are imported for

re-export, the agent / importer will deposit them in a bonded warehouse and

receives Dock Warrant.

vii.

Dispatching Goods to the Importer

The agent despatches the goods to the

importer by the rail/ road. He gets Railway Receipt (R/R) or Lorry Receipt

(L/R) from the transporter.

viii.

Sending Advice to the Importer

Clearing agent informs the despatch of

goods to the importer and sends Railway Receipt / Lorry Receipt with the

statements of expenses incurred by him and the commission payable to him for

his service.

9. Taking Delivery of Goods

Importer takes delivery of goods

from the Railway /Carrier after

producing the Railway Receipt or Lorry Receipt.

10. Settlement of Import Bill

The importer settles the import bill in

the following ways.

a.

Importer collects shipping document

after payment

b.

Importer gets shipping documents after

payment of bills of exchange in the case of Documents against payments (D/P)

c.

Importer gets shipping documents after

giving acceptance on bills of exchange in the case of Documents against

Acceptance(D/A)

Documents

used in import trade

1.Import License (IEC)

2.Indent

3. Letter of Credit

Import

Documents

·

Import License

·

Indent

·

Letter of Credit

·

Bill of Entry

·

Bill of sight

·

Port Trust Dues Receipt

·

Bill Of Lading

·

Bill of Exchange

·

Advice Note

Intermediaries in Import Trade

1. Indent Houses/ Import Agent

This intermediary is specialized in a

particular trade. He charges fees for his service. Importer has to enter into

contract with indent house to avail himself of his service

Services

rendered by Indent Houses/ Import Agent

The services rendered include the

following

·

Helping the importer get orders from

foreign countries

·

Providing information about the

availability of goods of various types and arranging credit facilities to

importer

·

Maintaining regular contact with the

exporter and obtaining sample and transmitting it to the importer

2. Clearing Agent

Clearing Agent is specialised in

clearing the goods from the port of discharge destination and transport it over

to the importer. They fulfill the various custom formalities on behalf of the

importer and get the goods cleared from the port. They charge commission for

their service.

Related Topics