Chapter: 11th Commerce : Chapter 26 : Export and Import Procedures

Export Trade Procedure

Export Trade Procedure

An exporter has to fulfill the formalities given below to export the goods out of the country

1. Receiving Trade Enquiry

Exporter receives trade enquiry (written request) from the importer / his agent who intends to buy the product. In the first place importer requests the exporter to supply the information given right below.

a. Specification about the goods like, size, design, quality and brand name.

b. Quantity of goods available.

c. Price per unit

d. Terms and conditions of shipment

e. Terms and conditions of payment

f. Probable delivery time

g. The period up to which his proposal to import is valid.

2. Receiving Indent and Sending Confirmation

After the scrutiny of quotation / proforma invoice, the buyer who intends to buy the goods sends an indent to exporter. The latter may either receive the order directly from the importer or through an agent who acts as an intermediary between the exporter and the importer. The agent receives commission for this intermediating service. An indent actually points to an order received from abroad for export of goods. i.e. sale of goods. The indent contains the details in the box.

Indent is prepared in duplicate. One copy of the indent is sent to the exporters and second one is retained by the importer and kept in his records. There are three types of indent, namely open indent, closed indent and confirmatory indent.

A. Open Indent

It gives complete freedom to exporter to choose type of goods, price, quality, method of packing etc.,

B. Closed Indent

It does not give any freedom to exporter. Importer specifies climates the type of goods, price, quality, packing method, and so on which should be strictly observed by the exporter.

C. Confirmatory Indent

An indent is to be confirmed by importer/ his agent and the final indent is sent by importer thereafter.

3. Arranging Letter of Credit

Under this stage exporter intends to satisfy himself/herself about the trust worthiness of the importer. In this case the exporter is requested to arrange a letter of credit in his favour.

Letter of Credit (LC) is an undertaking by its issuer(importer’s bank) thatbillsofexchange drawn by the foreign dealer on the importer will be honoured upon its presentation by exporter’s bank up to a specified amount. In other words it simply represents a guarantee given by the importer bank to the foreign dealer (exporter) that the amount in the bill will be honoured upon its presentation by the exporter /his agent. There are different types of letter of credit.

Letter of Credit is opened only for well- established and reputed importer. It is beneficial both to the exporter and importer. Exporter is assured of payment and need not bother about credit worthiness of importer. The letter of credit simply transfers the burden of settling the transactions to the bank

4. Obtaining Importer Exporter Code (IEC) and RBI code Number

Exporter has to apply in Ayaab Niryatt Form 2A(ANF2A) to the Regional Authority of the Director General of Foreign Trade (DGFT) in the region where the registered office of the company is located. Exporter has to mention the number in all the shipping documents. However IEC number is not required where the goods are exported/imported for the personal use of importer and not for trade/ manufacture or agriculture purpose.

5. Obtaining Registration cum Membership Certificate (RCMC) from Export Promotion Council /Commodity Board

An Exporter is required to obtain RCMC from Export Promotion Councils/ Commodity Board/Development Authority in order to avail himself/herself of export incentives, concessions, and other facilities offered by Government e g. cash compensatory support and benefit of promotional scheme from Government.

6. Manufacturing /Procuring Goods and Packing items

Exporters steps into manufacturing and procuring of goods required by the importer. Where the materials required for manufacturing of goods are subject to excise duty. the exporter has to apply to Export Commissioner for exemption from excise duty if the goods are meant for export along with the invoice AR4/AR5 and other documents. The Excise Commissioner would issue excise clearance certificate if he is satisfied with the documentation made by exporter. If the exporter has already paid excise duty, he can get refund from the Directorate of Drawback functioning under the Ministry of Finance.

The exporter proceeds to collect the goods from the factory or purchase it from the market. These goods have to be packed as per the specifications given by the importer. Where such instructions are not specifically given by the importer, the goods can be packed keeping in mind the safety and freight charges in respect of the consignment. The goods packed are marked distinctly to facilitate easy identification of goods of specific importer. The markings reveal the name of the importer, port of destination and weight of consignment.

7. Export Inspection Certificate

After the goods have been packed as per the specifications of importer, the exporter has to apply to the Export Inspection Agency (EIA) or other designated agency in this connection The agency sends an inspector

If the inspector is satisfied with the packing he/she issues certificate mentioning that goods exported adhere to specification made by the exporter. This certificate is termed as Export Inspection Certificate. It is required by the customs authorities for the shipment of goods.

8. Insurance of Goods

Exporter has to arrange for getting the goods insured to protect them against the various risks like deterioration, collision, immersion, fire, entry of sea water etc., as per the instructions of importer if any.

9. Certificate of Origin.

Import regulation of foreign countries may require that all this import consignments must accompany a certificate of origin. This certificate certifies that goods which are exported have been manufactured in a particular country. In India, Chamber of Commerce, Trade Association, Export Promotion Council have been empowered to issue such certificate.

It will be sent to importer, This certificate helps the importer to get concessions on import duty on the goods imported based on the bilateral trade agreement between the countries.

10. Consular Invoice

Where the customs duties are charged on the basis of value of goods at import’s port(ad-valorem basis), the customs officers are empowered to open the consignment to calculate duties. In order to avoid this problem exporter obtains consular invoice and sends it over to the importer.

This document is signed by the consul of importer’s country stationed in exporter’s country. Hence customs officer at the port of destination will not open the consignment and simply access customs duty based on the value declared in the invoice. They simply accept the invoice as true statement of the content of the consignment.

11. Engagement of Forwarding Agent

After Export Inspection certificate is obtained, the exporter has to obtain clearance from customs authorities. Generally exporters engage Clearing Forwarding Agent to fulfill various custom formalities. The latter do it for fees.

12. Dispatch of Goods to Port and Sending the Receipt to Agent

The exporter will send the goods over to port town by rail or by truck and endorse the Railway Receipt (R/R) or Lorry Receipt(L/R) to forwarding agent’s favour with necessary instructions.

13. Fulfilment of Customs Formalities by Forwarding Agent

i. Taking the Delivery of Goods at Port Town

When the goods arrive at port town, the forwarding agent takes delivery from the rail or from the truck after the submission of railway receipt (R R) or lorry receipt (L R). Then the agent arranges for storage of the consignment in a warehouse.

ii. Obtaining Shipping Order

The clearing and forwarding agent approaches the shipping company or its agentto book space in the ship. Onbooking a space in ship, shipping company issues a document called Shipping Order. It contains instruction to the captain of the ship concerned to accept the consignment on board. Besides it provides information about the name of ship, nature of goods shipped, the date of shipping, weight of goods, port of destination, and freight paid.

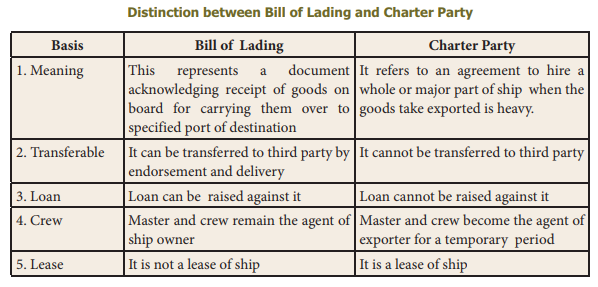

iii. Charter Party

A charter party is a formal agreement between ship owner and the exporter under which exporter hires an entire ship or a major part of ship either for a particular voyage or for a specific time period when the shipping is heavy. The hiring of ship for specific voyage is called voyage charter while this hiring of entire ship for a specific time period is called time charter. The content of charter party includes the following

1. Name of the ship 2. Place of loading

3. Port of destination 4. Name of exporter

5. Amount of freight

14. Customs Clearance

The exporter or his agent prepares three copies of shipping bill in printed form. The shipping bill contains the details like name and address of exporter, description of goods, value of goods, volume of goods, identification marks on the goods, port of destination and port of loading.

There are three types of shipping bills for three different categories of goods namely, dutiable goods, duty-free goods and duty draw-back goods Forwarding agent proceeds to pay of export duty calculated by customs officers in the case of dutiable goods.

i. Payment of Dock Dues

After the payment of export duty, the forwarding agent arranges for transporting the goods to docks. The agent fills two copies of challan and submits it to the dock authorities along with one copy of shipping bill. Then the agent pays dock charges. Dock authorities retain one copy of challan and return the second copy to the forwarding agent. This signed copy is called Dock Receipt or Port Trust Receipt.

ii. Obtaining Permission for Shipment

Theforwardingagentbringstheconsignment over to the dock. The Customs Preventive Officer stationed at the docks inspects the goods on the basis of declaration in the shipping bill. This officer gives permission to load the goods onto board by issuing Customs Export Pass or simply makes an endorsement with wordings ‘Let Ship’ on the duplicate copy of shipping bill.

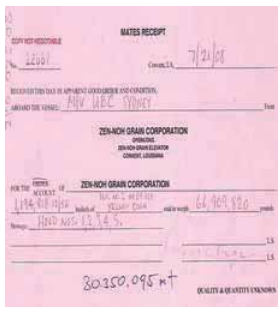

iii. Mate’s Receipt

Mate’s Receipt is the document issued by the captain of the ship acknowledging the receipt of goods on board by him to the port of specified destination. This contains details like quantity of goods shipped, number of packages condition for packing. etc., Where the Mate is satisfied with packing he/she issues clean receipt. If he/she is not satisfied with packing, he/she issues foul receipt. Forwarding agent should seek to get clean receipt. Otherwise insurance company will not bear liability for loss in case of foul receipt.

iv. Bill of Lading

Bill of Lading, refers to a document signed by ship owner or to his agent mentioning that goods specified have been received and it would be delivered to the importer or his agent at the port of destination if good condition subject to terms and conditions mentioned therein.

15. Preparation of Commercial Invoice and Submitting Documents to Bank

The exporter prepares a commercial invoice in respect of the goods shipped in triplicate according to the terms and conditions agreed between the exporter and the importer. Then the exporter submits all related documents like commercial invoice, insurance policy, certificate of origin, consular invoice, etc., to his bank for onward transmission to importer’s bank with the instruction that there documents should be delivered to importer only when he accepts the bills enclosed.

16. Securing Payment

i. Bills of Exchange

Bills of exchange of can be two types

a. Document against payment (D/P)

b. Document against acceptance(D/A)

Document against Payment (D/P)

In this case documents are handed over to the importer only against payment of bill by importers bank

Document Against Acceptance (D/A)

In this case documents are released to the importer immediately after he accepts the bills of exchange sent along with the

The exporter’s bank makes payment through importer’s bank either immediately or at maturity date in the case of usance bill. This amount is, then credited to the exporter’s account.

ii. Bank Certificate of Payment

After receiving payment for exports, the exporter has to get a certificate from his bank mentioning that the documents relating to export have been presented to the importer for payment and the payment has been received from the importer as per exchange control regulation.

Related Topics