Economics - Difficulties in Measuring National Income | 12th Economics : Chapter 2 : National Income

Chapter: 12th Economics : Chapter 2 : National Income

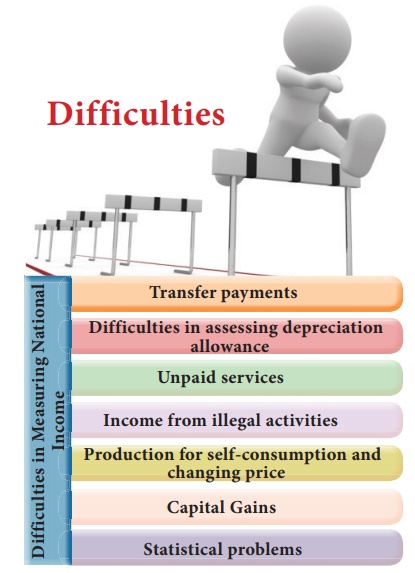

Difficulties in Measuring National Income

Difficulties in Measuring National Income

In India, a special conceptual problem is posed by the existence

of a large, unorganised and non-monetised subsistence sector where the barter

system still prevails for transacting goods and services. Here, a proper

valuation of output is very difficult.

1. Transfer payments

Government makes payments in the form of pensions, unemployment

allowance, subsidies, etc. These are government expenditure. But they are not

included in the national income. Because they are paid without adding anything

to the production processes.

During a year, Interest on national debt is also considered

transfer payments because it is paid by the government to individuals and firms

on their past savings without any productive work.

2. Difficulties in assessing depreciation allowance

The deduction of depreciation allowances, accidental damages,

repair and replacement charges from the national income is not an easy task. It

requires high degree of judgment to assess the depreciation allowance and other

charges.

3. Unpaid services

A housewife renders a number of useful services like preparation

of meals, serving, tailoring, mending, washing, cleaning, bringing up children,

etc. She is not paid for them and her services are not directly included in

national income. Such services performed by paid servants are included in

national income. The reason for the exclusion of her services from national

income is that the love and affection of a housewife in performing her domestic

work cannot be measured in monetary terms. Similarly, there are a number of

goods and services which are difficult to be assessed in money terms for the

reason stated above, such as rendering services to their friends, painting, singing,

dancing, etc.

4. Income from illegal activities

Income earned through illegal activities like gambling, smuggling,

illicit extraction of liquor, etc., is not included in national income. Such

activities have value and satisfy the wants of the people but they are not

considered as productive from the point of view of society.

5. Production for self-consumption and changing price

Farmers keep a large portion of food and other goods produced on

the farm for self consumption. The problem is whether that part of the produce

which is not sold in the market can be included in national income or not.

National income by product method is measured by the value of

final goods and services at current market prices. But prices do not remain

stable. They rise or fall. To solve this problem, economists calculate the real

national income at a constant price level by the consumer price index.

6. Capital Gains

The problem also arises with regard to capital gains. Capital

gains arise when a capital asset such as a house, other property, stocks or

shares, etc. is sold at higher price than was paid for it at the time of

purchase. Capital gains are excluded from national income.

7. Statistical problems

There are statistical problems, too. Great care is required to

avoid double counting. Statistical data may not be perfectly reliable, when

they are compiled from numerous sources. Skill and efficiency of the

statistical staff and cooperation of people at large are also equally important

in estimating national income.

The following are the some of the statistical problems:

1. Accurate and reliable data are not adequate, as farm output in

the subsistence sector is not completely informed. In animal husbandry, there

are no authentic production data available.

2. Different languages, customs, etc., also create problems in

computing estimates.

3. People in India are indifferent to the official inquiries. They

are in most cases non-cooperative also.

4. Most of the statistical staff are untrained and inefficient.

Therefore, national income estimates in our country are not very

accurate or adequate. There is at least 10 per cent margin of error, i.e.,

national income is overestimated or underestimated by at least 10 per cent.

That is why the GDP estimates for India varies from 2 trillion US dollar to 5

trillion US dollar.

Related Topics