Chapter: 11th Office Management and Secretaryship : Chapter 9 : Banking Services

Different Forms Used in Banks

Different

Forms Used in Banks:

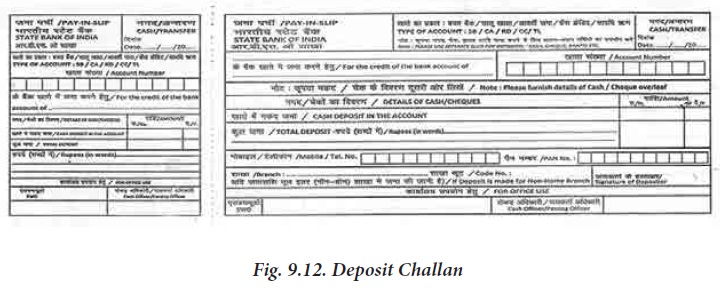

1. Deposit Challan

A

deposit slip or challan is a form supplied by a bank for a depositor to deposit

money in the bank.

Let

us understand the details to be filled up on the Bank Copy. Most of the same

information is filled up on the left side also.

Note: Since authorization is not required for depositing money, anybody can deposit money to any account.

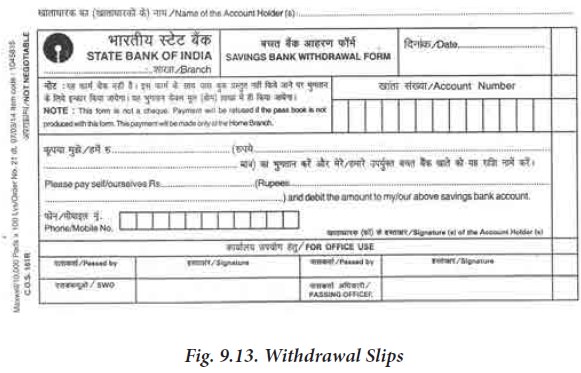

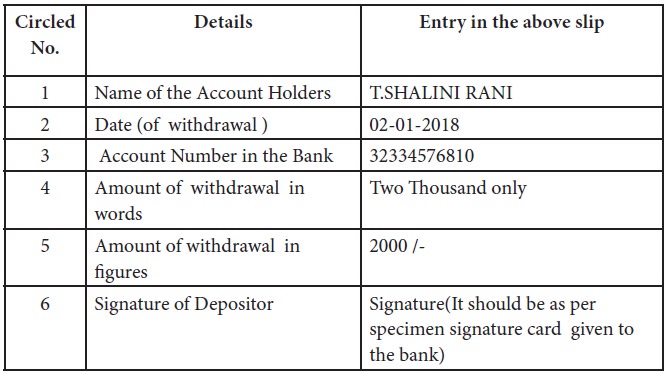

2. Withdrawal Slips

A

Withdrawal Slip is a written order to your bank instructing it to withdraw

funds from the account. Withdrawal slips vary from bank to bank.A customer can

withdraw cash using withdrawal silp only at their home branch.

There

are some restrictions on the use of withdrawal slip. They are:

1.

Only

the account holder can use this slip to withdraw the amount for himself.

2.

This

form cannot be used to make payment to others.

3.

Account

holder has to produce the pass book.

Since

withdrawal slip cannot be used to make payment to others, we use a form called

cheque.

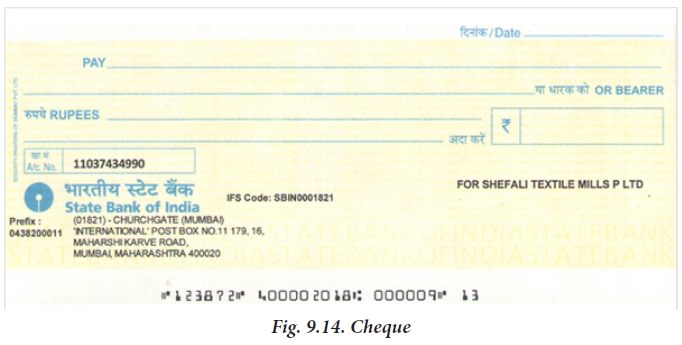

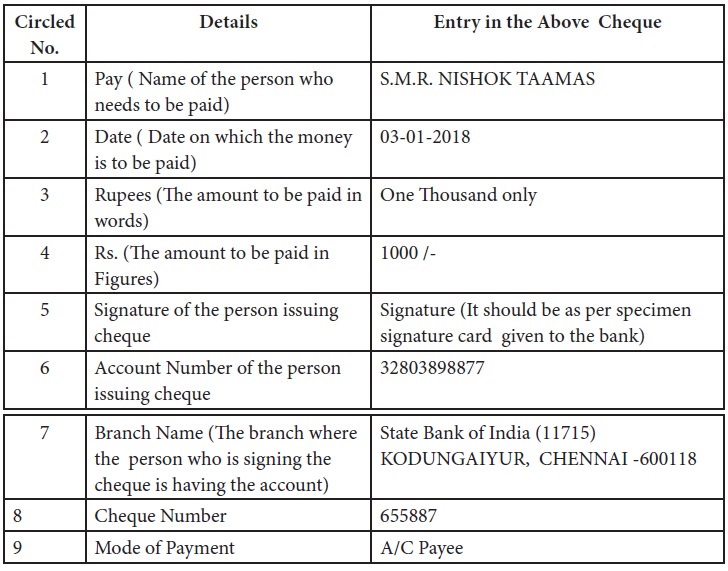

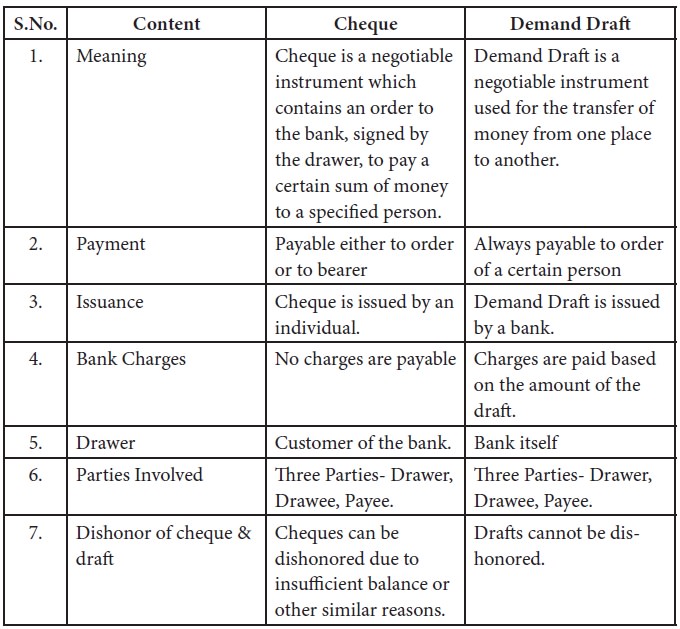

3. Cheque

The

cheque is a negotiable instrument containing an order to a bank to pay a stated

sum from the drawer’s account, written on a specially printed form. It is

signed by the drawer. It can be easily transferred through a mere hand

delivery. There are three parties to the cheque-Drawer (maker of the cheque),

Drawee (bank on which the cheque is drawn), Payee (to whom the amount of the

cheque is payable).

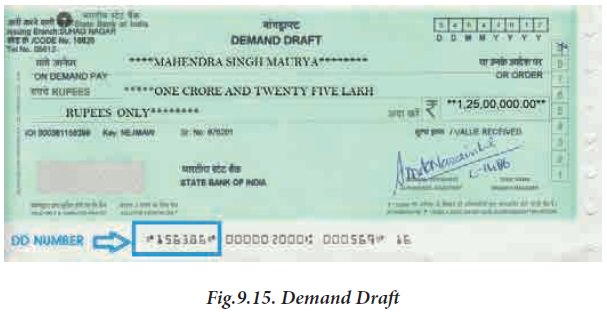

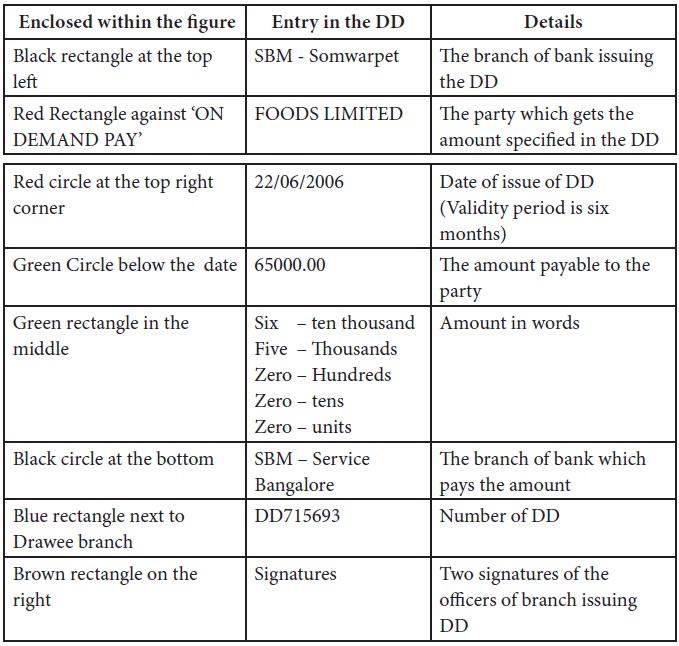

4. Demand Draft

Demand

Drafts is a pre-paid instrument, wherein bank by whom the DD has been made

undertakes responsibility to make full payment. DD is valid for 6 months.

Demand draft is accepted where the transfer of money is guaranteed. As most of

the individuals make payments through the RTGS, NEFT, IMPS mechanism demand

draft is losing it’s place. But still application for job, examinations,

admissions, services, high amount purchases etc. requires demand draft rather

than cheques.

5. Difference between Cheque and Demand Draft

Related Topics