Chapter: 11th Office Management and Secretaryship : Chapter 9 : Banking Services

Modern Banking Services

Modern

Banking Services:

After

Libera-lization, Privatization and Globalization, there was a huge development

taken place in the Indian banking scenario. All Indian banks were forced to

compete with world banks that were permitted to open their branches in India.

As a result, all banking customers were offered multiple and model banking products

which are different from traditional and conventional banking system in India

and these banking functions or mostly based on information technology.

Such

modern banking services include new products such as Core Banking Solutions; No

frills account; Demat accounts; Net Banking/ E-Banking; Mobile banking; Debit

Card/ Credit cards; Automated Teller Machines (ATM); Insurance etc.

1. Core Banking Solution (CBS):

Core

Banking Solution (CBS) is networking of branches, which enablesCustomers to

operate their accounts, and avail banking services from any branch of the Bank

on CBS network, regardless of where he maintains his account. The customer is

no more the customer of a Branch. He becomes the Bank’s Customer. Under this

system all CBS branches are inter-connected with each other. Therefore,

Customers of CBS branches can avail various banking facilities from any other

CBS branch located anywhere in the world. This CBS helps the customers

·

To

make enquiries about the balance or debit or credit entries in the account.

·

To

obtain cash payment out of his account by tendering a cheque.

·

To

deposit a cheque for credit into his account.

·

To

deposit cash into the account.

·

To

deposit cheques/cash into account of some other person who has account in a CBS

branch.

·

To

get the statement of account.

·

To

transfer funds from his account to some other account – his own or of third

party, provided both accounts are in CBS branches.

·

To

obtain Demand Drafts or Banker’s Cheques from any branch on CBS – amount shall

be online debited to his account.

·

Customers

can continue to use ATMs and other Delivery Channels, which are also interfaced

with CBS platform.

2. No Frills Accounts:

These accounts are opened mostly in rural

areas as a part of financial inclusion project encouraged by Reserve Bank of

India. These accounts are opened by banks without the condition of maintaining

minimum balance. No charge will be levied for non-operation/activation of

inoperative basic savings bank accounts. No frill accounts are mainly aimed to

take the banking facilities to the poor people in the unbanked rural areas and

semi-urban areas.

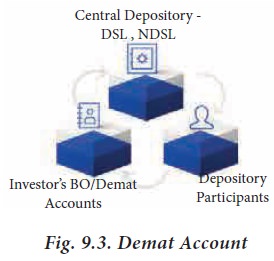

3. Demat Accounts:

These are maintained by banks for high value

transactions which are maintained in electronic forms for dealing in shares and

securities of the customers mostly dealing in Government Bonds.

4. Net Banking:

This is the easy way of doing banking from the convenient place of the customer and avoids

queue or delay. We can also check balance,transfer funds, pay bills, open fixed

and recurring deposits etc. Each customer is given a unique user ID and

password for the purpose of accessing internet banking. Electronic Banking is

also known as Electronic fund Transfer. Electronic means to transfer funds from

one account to other account by ways of NEFT, RTGS or IMPS.

NEFT-

National Electronic Fund Transfer

RTGS-

Real Time Gross Settlement

IMPS-Immediate

Payment Service

5. Mobile Banking:

Mobile Banking is a service provided by

banks or other financial institution that allow their customers to do financial

transaction using mobiles like smart phone or tablet. It is quick and simple

way of banking. Mobile banking app helps to check the account balance, transfer

funds, pay in bills etc.

6. Debit Card / Credit Card:

A debit card is a plastic

payment card that can be used instead of cash when making purchases. It is

similar to a creditcard, but unlike a credit card, the money depited directly

from the user’s bank account when performing a transaction. It is also known as

a bank card, plastic card or check card.

In

credit card, in the customer can perform the transaction upto a predefined

limit, and pay them to the bank before a specified date.

7. ATM (Automatic Teller Machine):

This is an electronic device which helps the customers for

withdrawal, deposits money, transfer fund etc, round the clock. For Availing

the services of an ATM the customer need ATM card with PIN number (Personal

identification number). It provides 24 x7 and 365 days a year service.

8. Insurance:

Insurance is a means of protection from

financial loss. It is an arrangement by which the company undertakes to provide

a guarantee of compensation for specified loss, damages, illness, or death in

return for payment of specified premium. The largest insurance company in India

is owned by government.

9. Lock-Box and Night Safe Services:

These services are provided by some banks. Lock-box helps the

customers particularly the traders, to keep cheques and other remittances in a

box for next day collection and certain entries should be passed. Nightsafe service is useful to the

traders who receive large amount of money after the banking hours and who feel

insecured at their premises.

Related Topics